Join us at Transfer 2025 to hear how industry leaders are building payments infrastructure for a real-time world.Register Today →

Journal

Archive

Subscribe

Get email updates→

Introducing the Modern Treasury Model Context Protocol (MCP) server, enabling new ways of interacting with our API using natural language.

Read more→

Modern Treasury now enables secure, instant global payouts via stablecoins—24/7 payments, lower costs, and seamless compliance—powered by Brale’s blockchain infrastructure.

Read more→

Stablecoins can drive cost-effective, real-time payments across global markets—featuring enterprise use cases, adoption data, and strategic implications for modern businesses.

Read more→

Modern Treasury is mandating Multi-Factor Authentication (MFA) to bolster security, protecting against credential theft and unauthorized access.

Read more→

Today, we're excited to announce our partnership with Brico, helping innovative companies accelerate the shift to embedded payments.

Read more→

Here, we cover how businesses can navigate the complexities of money transmitter licensing while building scalable payment operations.

Read more→

Hear from two of our software engineers about how the team's build reliability was improved through reducing integration tests.

Read more→

In last week's webinar, Modern Treasury's COO Rachel Pike and Bain's Expert Partner Erin McCune discussed our latest payment operations report and current trends like real-time payments and AI.

Read more→

Here, one of our software engineers looks at the challenges investing platforms face and explores how designing a ledger can better address them.

Read more→

Stewart Title is a leading title insurance and real estate services company. They partnered with Modern Treasury to help modernize their payment systems and processes.

Read more→

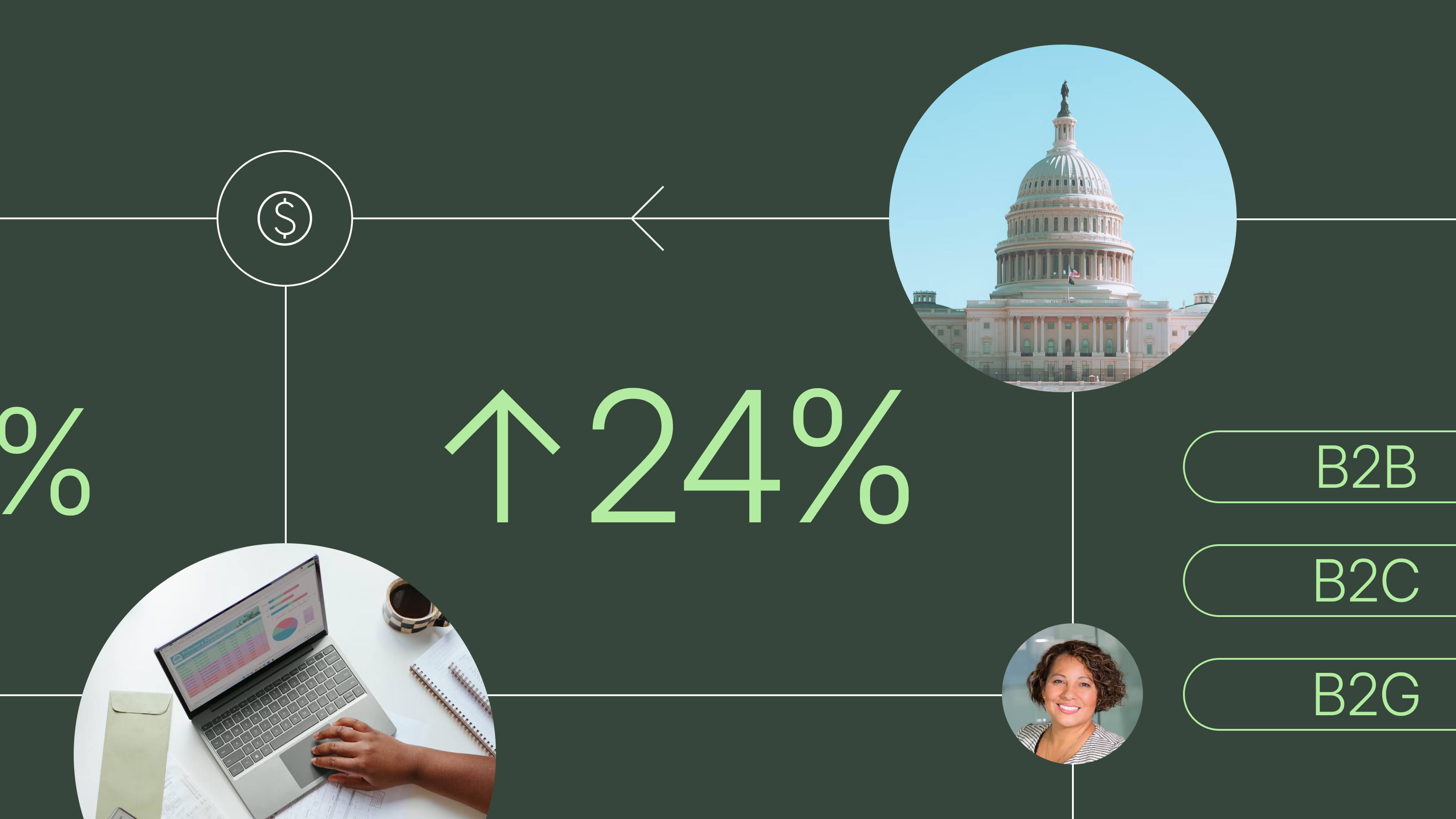

Our fourth annual State of Payment Operations report holds a wealth of data from product and finance leaders about the present and future of finance.

Read more→

Our Ledgers product lead shares best practices for maintaining a ledger.

Read more→

Modern Treasury CEO and Co-Founder, Dimitri Dadiomov, shares his thoughts on why and how third-party ledgers should improve.

Read more→

In this journal, we explore two use cases that require strong payment operations infrastructure: launching a card product and embedding payments within a platform.

Read more→

In this Journal, we explore how AI-driven automation is reshaping payroll.

Read more→

Alegeus and Sana Benefits are leading the way when it comes to payments transformation, we recently hosted a webinar discussing their payments journey and predictions for the future. Here are the top takeaways.

Read more→

AvidXchange is a leader in providing automated accounts payable solutions. They work with Modern Treasury to manage multiple bank integrations and support over 8,000 buyer customers and 1.2 million supplier customers.

Read more→

In July and August, our team launched new features and updates to expand banks and instant payments support, improve auto-reconciliation rates, and enhance the user experience across the Modern Treasury app.

Read more→

Here, we’ll look closer at opportunities to update the historical methods used in title and escrow transactions and how the future of payment operations can take this well-established industry into the future.

Read more→

Here, we delve into the insights from our recent webinar on how faster payments can transform the future of financial operations.

Read more→

This journal clarifies the role of AI and LLMs for finance—specifically, we’ll demystify important concepts and offer suggestions for thoughtful implementation.

Read more→

Here, we explore the benefits of FedNow and how Cross River and Modern Treasury partner to help mutual customers make the most of it.

Read more→

Here, we’ll explore how AI can revolutionize reconciliation for benefits administration, by streamlining operations, and enhancing accuracy and trust.

Read more→

In May and June, our team launched new product features and updates, including new features for reconciliation rules, overdue invoice emails, and more.

Read more→

M&A has major implications for benefits administrators—and payments infrastructure shouldn’t be an afterthought.

Read more→

Alegeus is a leading provider in the health benefits management sector. They work with Modern Treasury to streamline their complex reconciliation processes.

Read more→

Discover key points from our recent tech talk focused on the power of AI to reimagine core financial workflows.

Read more→

Modern Treasury recently welcomed our new Head of Artificial Intelligence (AI), Patrick Harrington. Here, he shares his journey to Modern Treasury and what he thinks the future of AI in payments looks like.

Read more→

FedNow and RTP are an opportunity for the US to achieve parity with other countries when it comes to faster payments. Today, we’re sharing our 3 I's framework as a way to drive ubiquitous adoption and standardization of these faster payments rails.

Read more→

On May 15th, Modern Treasury hosted Transfer 2024: Beyond Payments at The Midway in San Francisco.

Read more→

Modern Treasury is proud to release new features to help companies transform reconciliation.

Read more→

In April, our team launched new product features and updates, including Bulk Invoice Creation, Reconciliation Rules Previews, Sequential Approvers, and more.

Read more→

FedNow and RTP allow pull payments via RFP, or “Request For Payment.” Learn about the significance of RFPs and discover three exciting advantages—funding digital wallets, RFPS as an alternative to wire draw downs, and fraud reduction.

Read more→

Explore the significance of APIs, especially for those in finance roles seeking to innovate workflows and transform their business.

Read more→

In February and March, our team launched a host of new product features and updates, including our Professional Services offering, updated invoice flows for ledgers, new filters, and more.

Read more→

We're excited to introduce our Foreign Exchange Platform to help customers access optimal FX rates for global payments directly through their banking partner.

Read more→

We’re excited to share our launch of Professional Services. Learn about the origins of this new offering and how enterprises stand to gain efficiency, unlock revenue, and curtail risk as a result.

Read more→

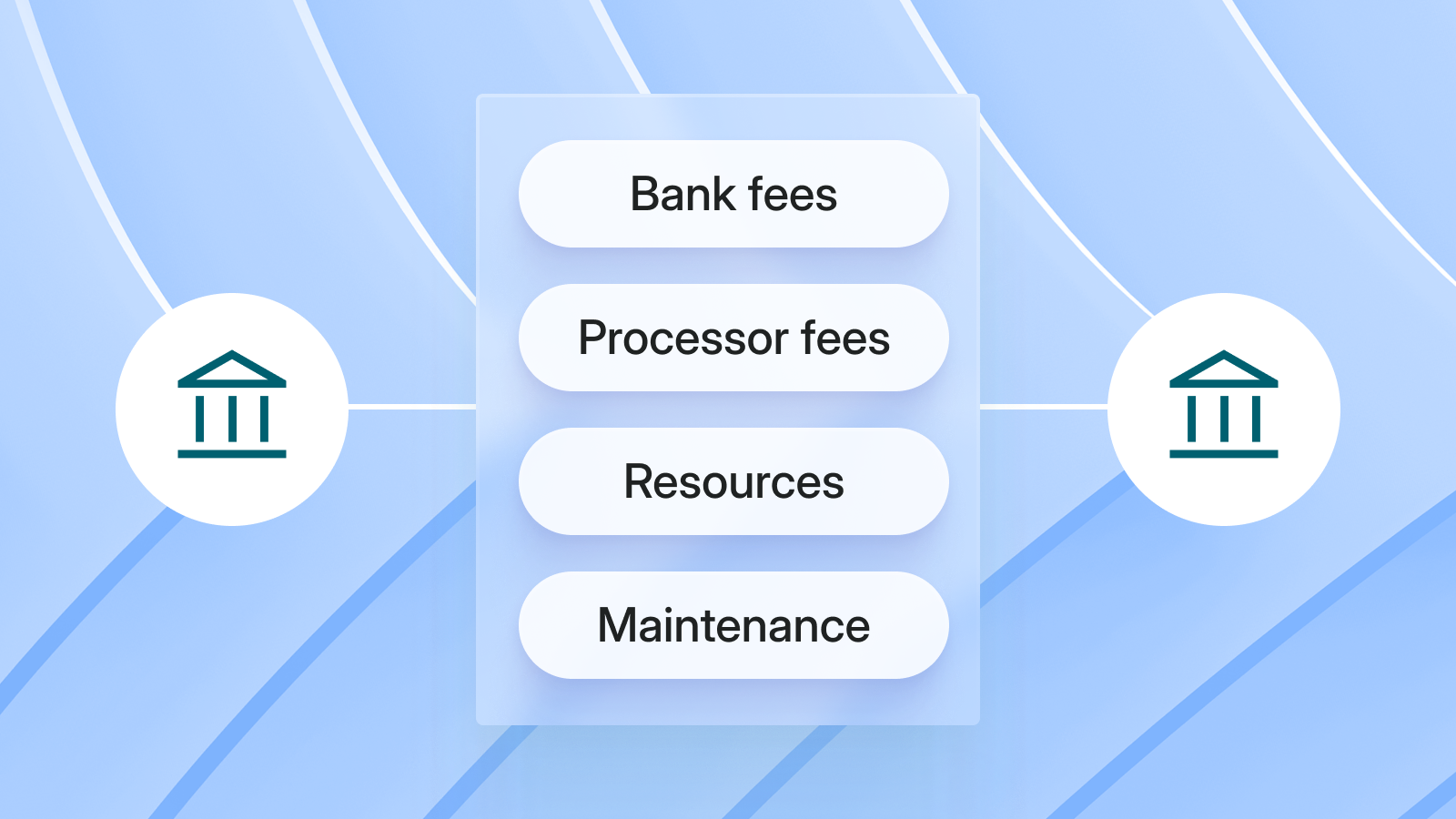

Building sustainable companies takes work. For companies with high-volume, complex payment workflows, Modern Treasury believes the key to longevity is owning your banking relationship. Here, we dig into the costs and benefits of doing so.

Read more→

We recently held a Tech Talk focused on how Modern Treasury ensures reliability at scale. Here, we take a deep dive into the discussion and the insights shared by members of our engineering team.

Read more→

Get the inside take on why and how we updated Modern Treasury’s UI.

Read more→

Here, we take an in-depth look at how Modern Treasury supports our enterprise customers.

Read more→

Modern Treasury recently hosted a webinar in conjunction with Nacha, to chat about innovation and how companies can better take advantage of the ACH network. This journal covers the key takeaways from the discussion.

Read more→

Today, we are announcing new features dedicated to helping companies move, track, and reconcile a high volume of payments at scale.

Read more→

Companies need a proactive solution for handling ACH returns. Learn why ACH returns matter, what the potential business impacts are, and how companies can prevent and manage returns at scale.

Read more→

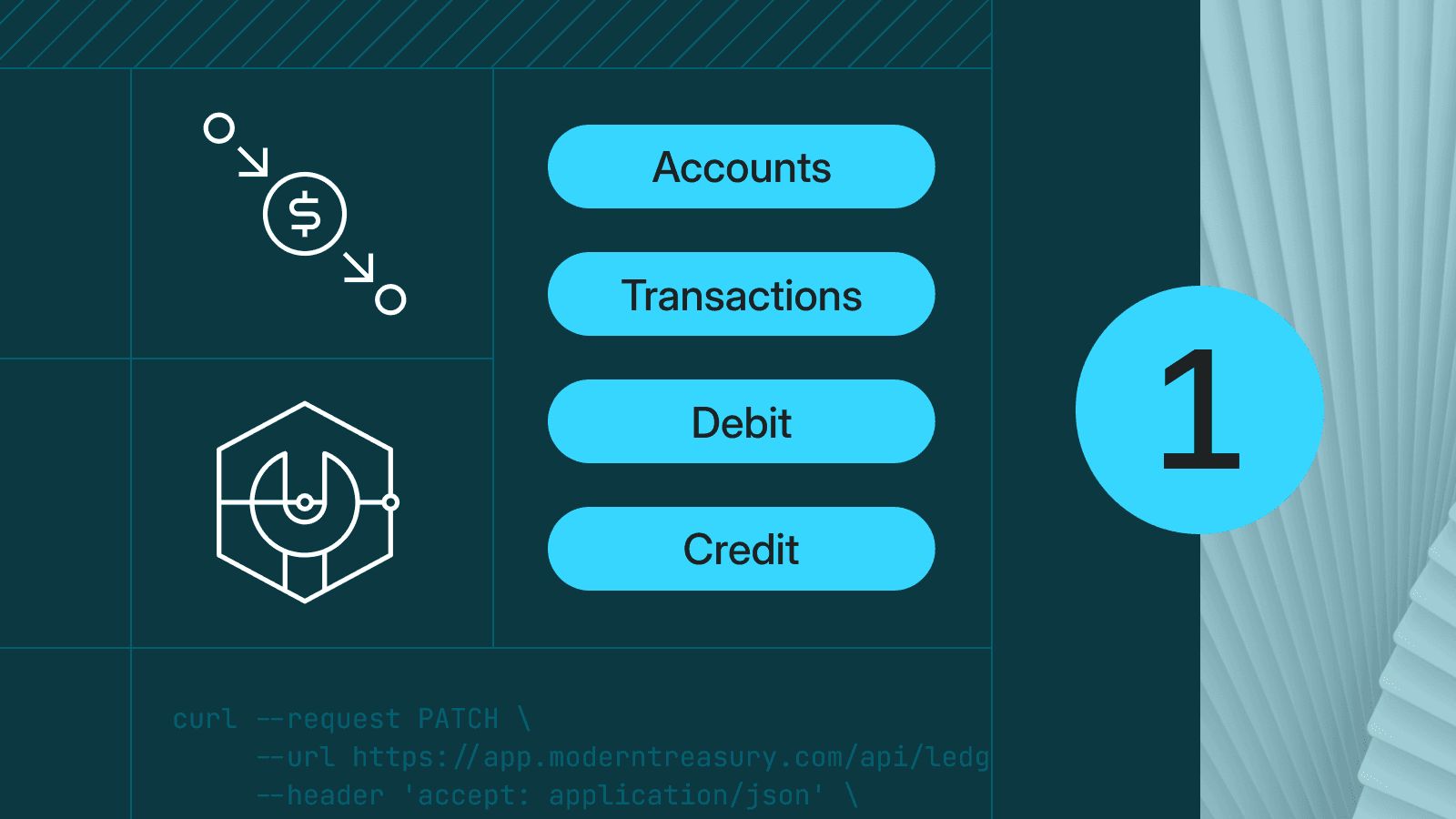

A high-throughput ledger database is essential infrastructure for companies moving money at scale. Learn how Modern Treasury built our Ledgers product for enterprises that track payments at volume and velocity.

Read more→

This article examines key considerations for CFOs when it comes to money movement. A three-part framework can help finance leaders address challenges and identify opportunities for payments innovation.

Read more→

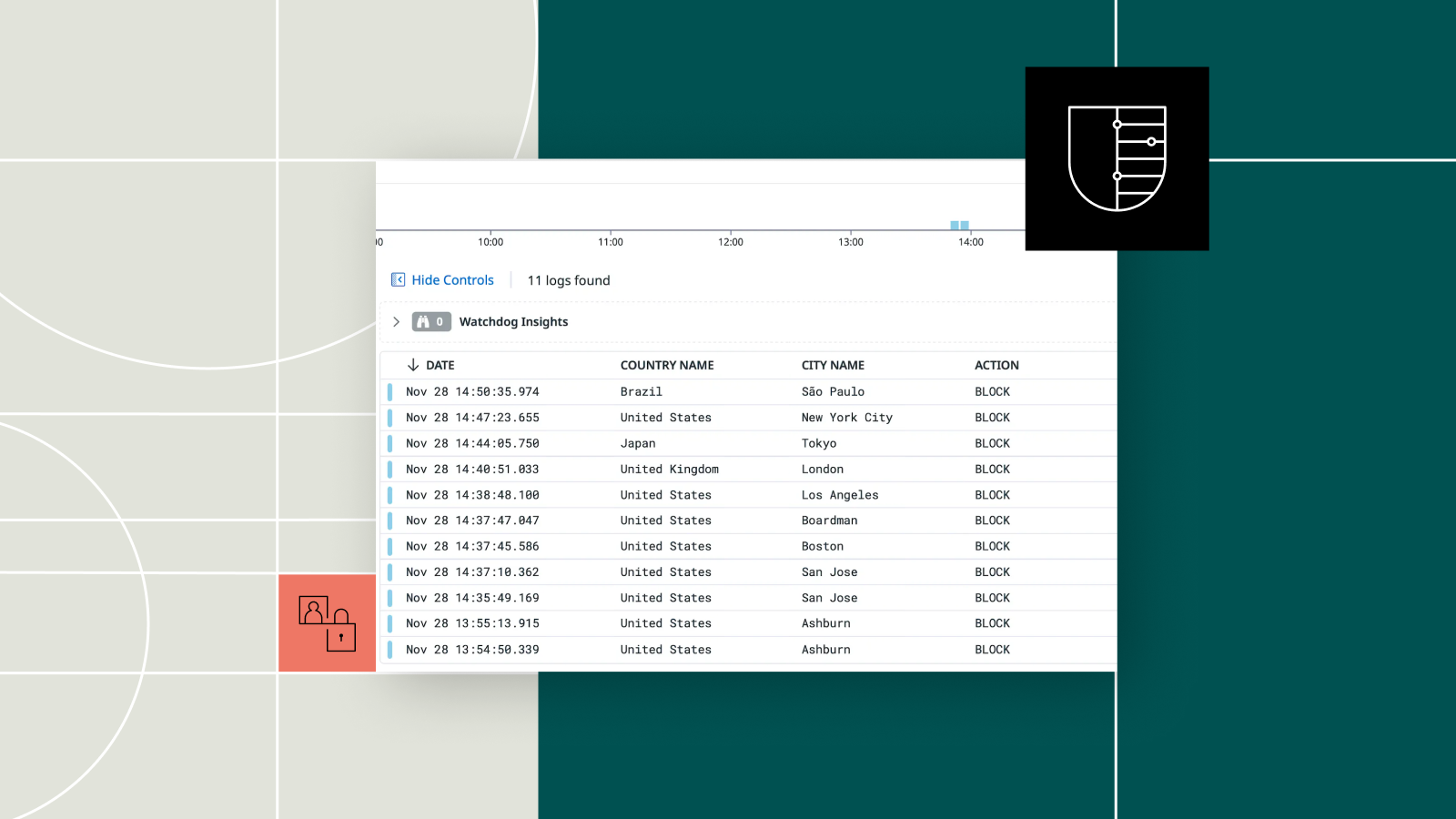

Security is the foundation for Modern Treasury operations and software. This article explores what we’ve implemented over the years to help enterprises move, track, and reconcile money securely.

Read more→

In November and December, our product and engineering team shipped several new features including updates to reconciliation, ledgers, UI/UX, and more.

Read more→

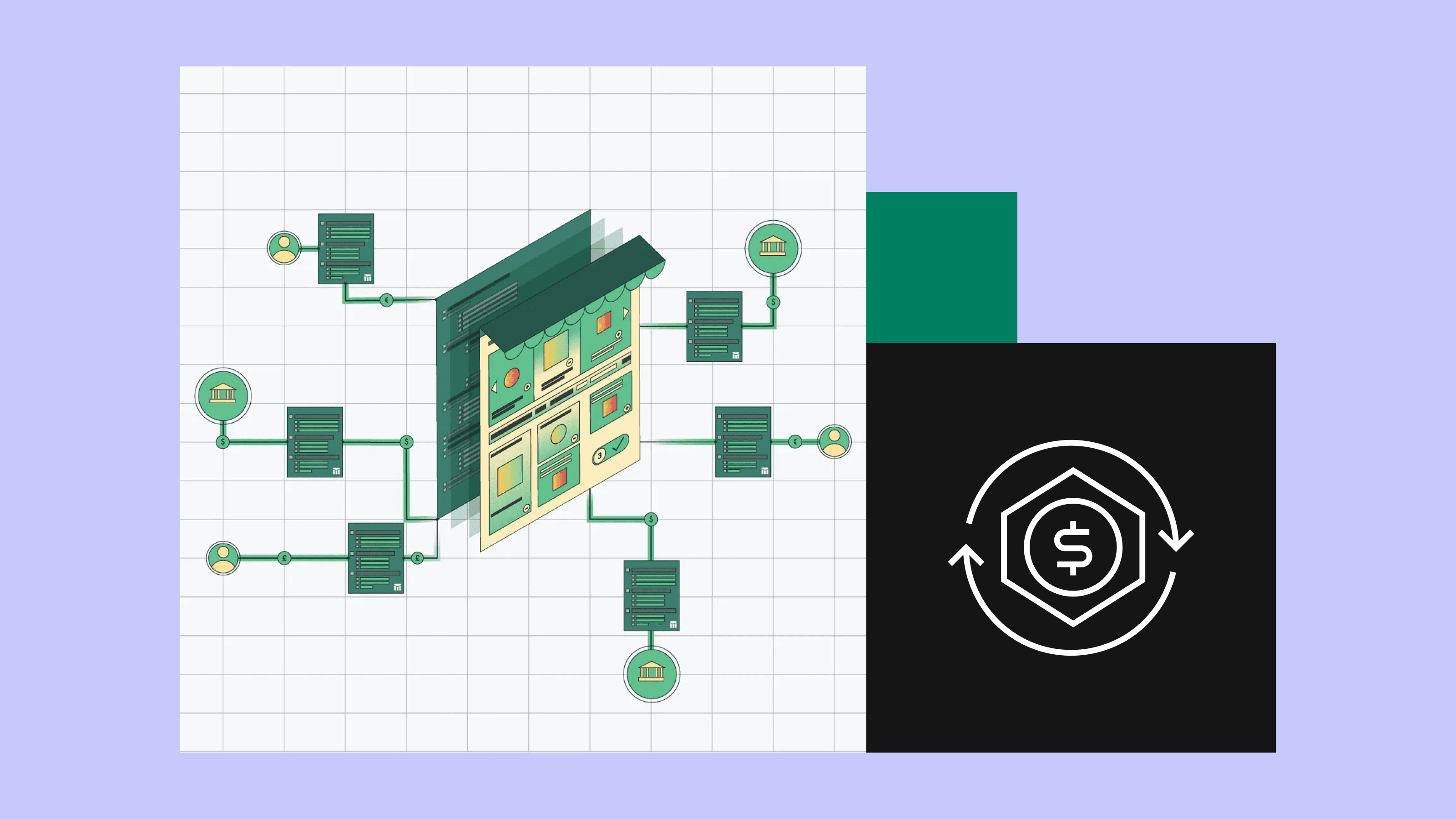

Modern investing platforms need robust payment infrastructure to power complex workflows. Learn how Modern Treasury supports these businesses, improving speed, efficiency, and investor experience.

Read more→

Today we’re announcing a host of features designed to help enterprises automate and configure complex reconciliation processes.

Read more→

This article will explore the payments infrastructure modern lending companies need, across models. We’ll also dig into three real-world examples where an operating system for money movement proved essential.

Read more→

Explore how healthcare companies can benefit from a modern operating system for payments.

Read more→

Modern Treasury recently hosted a Tech Talk on how growth companies can leverage embedded payments for growth, and build scalable payment operations. This journal shares key insights from in-house experts.

Read more→

We're happy to announce that we have taken a step in supporting card rails by becoming PCI DSS 4.0 compliant.

Read more→

Customers now can interact with Modern Treasury’s financial database using business logic and pre-defined templates.

Read more→

In this journal, we take a deep dive into how fintech and traditional finance leaders view their payment operations based on data from our third annual State of Payment Operations Report.

Read more→

Today, we're excited to announce instant microdeposits. Leveraging the FedNow and RTP networks, we're verifying accounts instantly, enhancing customer experiences and improving cash flow.

Read more→

Cards have long been the default option for online and in-app payments, but recently there's been a shift toward bank payments. In this journal, we dig into why and what's needed to offer bank payments successfully.

Read more→

In September and October, our product and engineering team shipped several new features including updates to payment initiation, invoicing, ledgers, UI & UX updates, Bulk APIs, and more.

Read more→

In this Behind the Scenes journal, we look back on our time at Money20/20 USA last week.

Read more→

Yesterday, we announced adding AI to our recon engine. Today, we're underscoring how reconciliation is a pain point by delving into the math.

Read more→

Today, for the first time, we're sharing some AI work we've been doing at Modern Treasury—namely, how we use AI to augment our reconciliation engine.

Read more→

Learn how marketplace payments happen today—the practices and issues, associated losses, and what leaders want for the future.

Read more→

Modern Treasury recently hosted a Tech Talk on driving digital transformation through modular upgrades to payment infrastructure. This journal shares key insights from in-house experts.

Read more→

In this journal, we take a deep dive into how product and finance leaders view their payment operations based on data from our third annual State of Payment Operations Report.

Read more→

Explore key insights from our third annual State of Payment Operations Report.

Read more→Modern Treasury recently hosted a coffee chat with Nacha to discuss straight-through processing and reconciliation. This journal digs into some of the key takeaways from our discussion.

Read more→In this journal, we take a closer look at stored-value digital wallets, including how some major companies are already using them successfully and how they can help unlock cash flow, increase customer retention, and improve margins for companies with established customer bases.

Read more→

In July and August, our product and engineering team shipped several new features including Automatic Invoice Email Notifications, Pre-built UI Updates, and more.

Read more→This journal digs into what payment hubs are, how they function, what teams building them should know, and how scaling businesses can benefit.

Read more→ Modern Treasury recently hosted a Tech Talk on building a central ledger. This journal shares key insights from in-house experts.

Read more→The differences between closed-loop payment systems and digital wallets are nuanced and can be challenging to understand. In this journal, we delve into these two products, how they work, and what they look like in practice.

Read more→In this journal, we’ll take a deeper dive into some of the variants of reconciliation, how they work, why they’re necessary, and how Modern Treasury can help your business better manage them.

Read more→It's official—FedNow has launched. Here’s a roundup of key resources to help companies get up to speed.

Read more→

Real estate is responsible for a considerable portion of US bank payments. In this article, you’ll learn how real estate companies of all sizes can use Modern Treasury to modernize payment operations.

Read more→

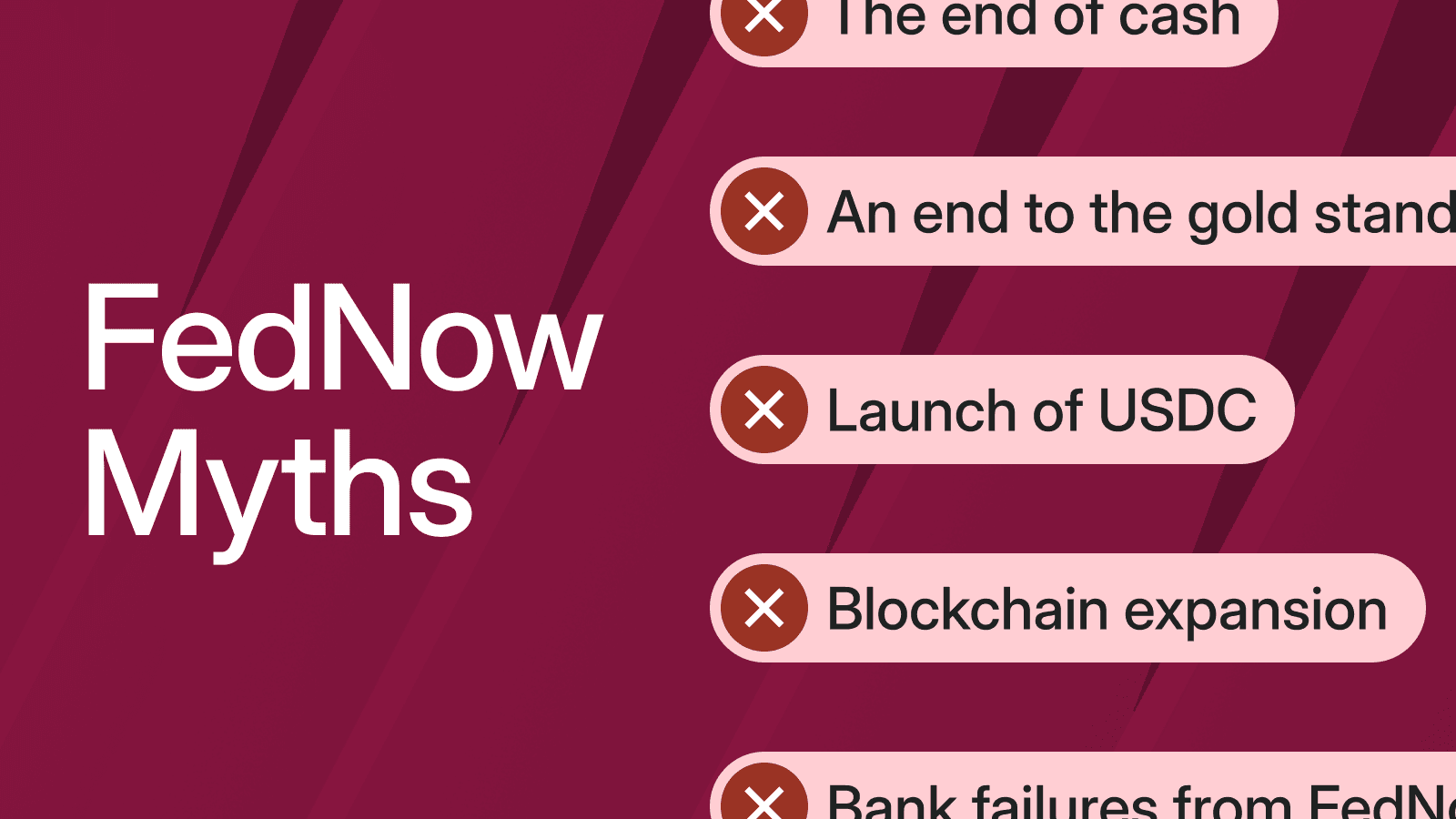

Learn the truth behind six popular social media myths about FedNow, the newest US payment rail set to launch in July.

Read more→

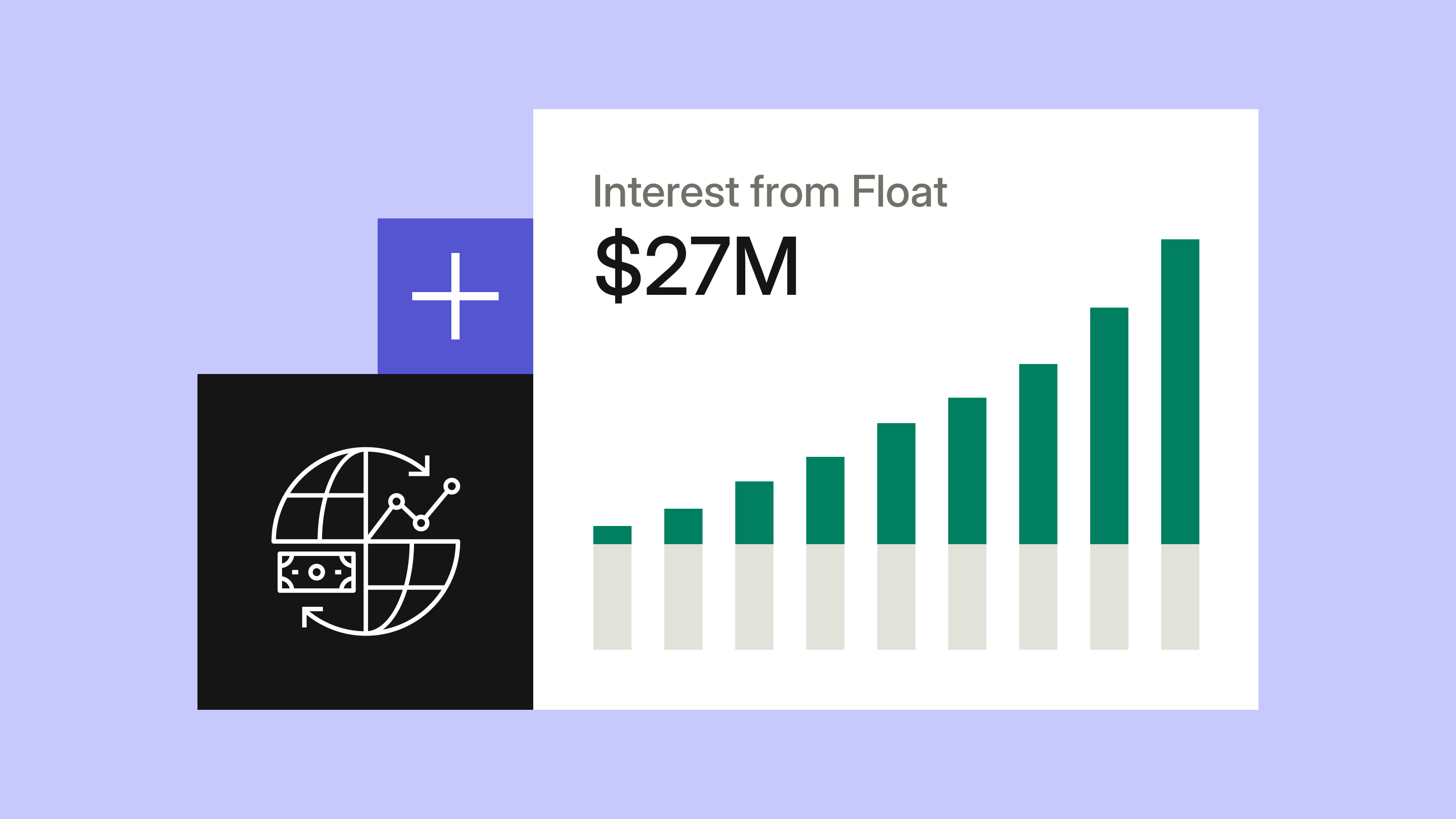

In this journal, we discuss float and several of the ways it can be used to help generate extra interest revenue for businesses.

Read more→

In June, our product and engineering team shipped several new features including updates to our invoicing features, transaction monitoring on incoming payments, and more.

Read more→

Modern Treasury is pleased to share new capabilities that support finance and treasury teams, including Automated Sweeps, Account Groups, and Enhanced Account Views.

Read more→ In April and May, our product and engineering team shipped several new features including Enhanced Account Views, Pre-Built UIs, Invoicing, and more.

Read more→On June 1, Modern Treasury hosted Transfer at The Midway in San Francisco. Read up on key learnings from the event.

Read more→On Modern Treasury’s fifth birthday, our CEO shares five learnings from the journey so far.

Read more→Modern Treasury’s Reconciliation Engine provides customers with real-time, automated cash reconciliation across any payment method and processing partner—here's how it works.

Read more→Developers now have a set of example integrations to help build pre-built UIs into Node.js or Python web applications.

Read more→Learn how digital payment platforms like Sana Benefits are transforming payment operations.

Read more→Finance and operations teams can now use Modern Treasury to create invoices with built-in payment flows, allowing invoices to be easily sent, tracked, and reconciled.

Read more→In a conversation with Modern Treasury, Slope CFO Ashish Jain discusses why diversification, people, and partners matter when it comes to building organizational resilience.

Read more→Using Pre-Built UIs, companies can now create custom payment experiences to improve efficiency with minimal engineering and IT involvement.

Read more→Rahul Hampole, Head of Risk Products at Plaid, cautions leaders not to wait until fraud shows up at your door.

Read more→In this journal, Dr. Elizabeth McQuerry of Glenbrook Partners shares her perspective on innovations happening in cross-border payments and how Global ACH fits in.

Read more→

In this journal, we look at how businesses stand to benefit by embracing FedNow.

Read more→In this journal, we discuss why we built our new Reconciliation Engine and how it can help drive efficiency, reduce financial risks, and provide real-time data for businesses.

Read more→ In February and March, our product and engineering team shipped a wide variety of new features across our platform including support for Global ACH, updated account views, custom email domains, and more.

Read more→Payments expert Cici Northup explains the reasons why the Real-Time Payments network is here to stay.

Read more→Modern Treasury is excited to announce our support for real-time payments (RTP) with Increase.

Read more→Building upon our robust SOC 2 compliance program, we’ve implemented additional controls resulting in a SOC 1 Type II Report without exception.

Read more→

Colin Anderson, Palantir’s former CFO, argues now is the time to modernize payment operations.

Read more→In this journal, we recap the main takeaways from our recent webinar on Building Resilient Payment Operations and answer some key questions about the future of payments.

Read more→The fourth part of our Recon Diaries series digs into the factors that make reconciliation tricky, as well as how a modern solution can help.

Read more→Given recent events, many companies are thinking about improving the resilience of their payment systems via a multi-bank strategy. This journal digs into three primary considerations for shoring up fund flows right away.

Read more→A message from Modern Treasury CEO Dimitri Dadiomov regarding recent events involving Silicon Valley Bank.

Read more→Modern Treasury customer Capchase offers flexible, non-dilutive funding for global B2B subscription-based and SaaS companies. They partnered with Modern Treasury to scale their financing platform using ACH, Same-Day ACH, and wire transfers.

Read more→We built Modern Treasury to be the operating system for global money movement. Today, we announce a wealth of new features to help customers launch global products and streamline global processes that move money.

Read more→In this journal, find out how banking APIs are powering the future of fintech, and how companies can use them to embed financial services into their products and unlock new growth.

Read more→In this second article in our series about Global ACH we detail how finance and operations teams can use this new rail to drive efficiency in global payment operations.

Read more→Global ACH is the newest option for product managers and developers building products that move money internationally. In this article, you’ll learn why integrating with Global ACH is a superior choice for cross-border payment flows.

Read more→In this journal, we’ll take a detailed look at RTP and how developers can implement it for building products and processes that move money.

Read more→Customers can now receive webhook notifications when a Payment Reference is added to their payment order, which can help in tracking the status of a payment through its lifecycle.

Read more→In January, we shipped features including ledger account payouts, block and allow lists, and more.

Read more→We are expanding our Push to Data Warehouse capability to help provide full data visibility into payment operations. In this journal, we explain more about this expansion and detail how customers rely on us as a single source of truth.

Read more→Last week, along with Goldman Sachs TxB, we hosted Geoff Lewis, VP of Product at Procore, for an evening event in New York City. In this journal, we recap some themes of the night and look at how the Modern Treasury and Goldman Sachs partnership is enabling Procore to embed financial services.

Read more→In this journal, Craig Nile traces his journey to becoming Chief Revenue Officer at Modern Treasury and shares his vision for the future.

Read more→Positive Pay is a fraud detection tool for business accounts. This journal digs into how it works and how Modern Treasury can help automate Positive Pay reporting to help mitigate check fraud.

Read more→In today’s market—and well into the future—embedded finance can unlock huge business potential. Learn why and how in this journal.

Read more→In this journal, we'll discuss two of the fastest options for making cross-border payments from US-domiciled bank accounts and take a detailed look at how they work.

Read more→In the third part of our Recon Diaries series, we take a close look at check reconciliation and discuss why it matters.

Read more→In this journal, we take a detailed look at what to expect as FedNow prepares for its launch later this year.

Read more→In the final part of our series, we explore advanced ledger functions that all global, scalable ledgers need.

Read more→In November and December, we shipped features including scheduled reports, security notifications, international counterparty invites, and more.

Read more→In the fifth part of our series, we examine ledger guarantees, like immutability and double-entry, and how the API can provide them.

Read more→In this journal, we cover RFP, its differences from RTP, and the potential it has to influence faster payments adoption in the US.

Read more→

In the second part of our Recon Diaries series, we dive into the process of reconciliation and how it's similar to cryptography.

Read more→

In this journal, we’ll take a closer look at several use cases for faster payments and their applications for businesses, consumers, and government agencies.

Read more→In the fourth part of this series, we'll look at how a ledger fits into a modern money movement system.

Read more→

In the first part of this series, we walk through a cash reconciliation example to show best practices and why it matters for the health of a business.

Read more→Widespread faster payment adoption hinges on a few key developments. This journal digs into three important drivers for the usage of rails like RTP and FedNow, as well as potential barriers to success.

Read more→In the third part of this series, we'll look at how Transaction models enable atomic money movement and enforce double-entry.

Read more→Compliance is a tricky, but vital part of launching a fintech product. This journal covers key takeaways from our webinar on building a culture of compliance.

Read more→

The possibilities that faster payments open up are exciting not just for business leaders, but fraudsters as well. In this journal, you’ll learn what makes faster payments fraud tricky and how companies can minimize their risk.

Read more→The payments landscape continues to shift towards speedier, more convenient options. In this journal, we explore how faster payments work in the US.

Read more→In this second part of the series, we'll look at what it means for a ledger to be immutable and double-entry at the source of financial events.

Read more→RTP and FedNow have a lot in common, but they are not the same payment rail. In this journal, we discuss how the two systems can achieve interoperability.

Read more→In this guide, we walk through how to verify prior ledger states by finding the historical changes to a ledger.

Read more→

In the first part of this series, we’re looking at why any company that moves money at scale should have a ledger database as a single source of truth.

Read more→If only the preparation for instant payments were as delightful as the end-user experience. Alas, readiness for faster payments requires more than a click or two. This journal shares four facets of good planning for real-time payment rails like RTP and FedNow.

Read more→Modern Treasury supports extended functionality for virtual accounts. For each virtual account, you can now track balances, retrieve a list of transactions, and originate payments directly.

Read more→In this article, we discuss the benefits and drawbacks of using an external ledger service.

Read more→

Faster payment rails like RTP and FedNow are about to remake domestic money movement. This journal explores how faster payments are different and what the near future could look like.

Read more→Managing fund flows and ledgers for card programs can be tricky. Here are four takeaways from a recent webinar with Lithic focused on the fundamentals.

Read more→In this follow-up to our accounting for developers series, we explore the ins and outs of building a ledger to power a lending marketplace product.

Read more→In this journal, we look at best practices for managing payment operations, namely, building a payments ecosystem to enable transactions and building out the back office to manage the complexities of high volume payments.

Read more→Payment operations are central to an efficient, modern fintech stack. Read more about the business challenges and opportunities money movement technology presents.

Read more→This summer, Laura Levy, our new Head of Growth, joined the team. In this Behind the Scenes journal, she shares the career journey that led her to Modern Treasury.

Read more→Our second annual payment operations report is overflowing with notable data about the state of money movement. Read on for key takeaways and a peek at the numbers for 2022.

Read more→When starting a card program for your business, there are a lot of factors to consider. This journal digs into how Modern Treasury streamlines the process.

Read more→

RTP has launched, and FedNow is on the horizon; faster payments in the US are becoming a reality and changing the way we think about money movement.

Read more→What is the cost of payment operations and why do the right investments matter? Read on to learn more.

Read more→Today, we're launching Intra-Bank Payments, allowing customers to process payments without using interbank payment networks when they bank at the same financial institution.

Read more→Every business has some sort of payment operations workflow in place. As more businesses embed payments into their products, the need for better, automated payment operations is growing beyond fintech.

Read more→Our Co-founder and CTO, Sam Aarons, was on a FedNow steering committee. In our conversation, he shares why its launch next year is so significant and why he’s excited about it.

Read more→

Today we’re excited to announce Modern Treasury’s partnership with Goldman Sachs Transaction Banking (TxB).

Read more→Payment operations are the workflows surrounding money movement. This journal digs into the nuances and evolving significance of effective payments technology.

Read more→

Ledgers can now hold accounts with multiple currencies, and a single ledger transaction can span many currencies.

Read more→The history of ledgers is more intriguing than you might think. This journal traces notable moments in the evolution of immutable, double-entry, and scalable ledgering.

Read more→In August, we shipped several new updates including a new payment order create experience, a payment order timeline, ledger account categories, and more.

Read more→

Building a compliance program can be tricky. This journal covers seven important questions related to financial compliance and fraud prevention.

Read more→

Companies that move money at scale need a ledgering system that can flex with them, and often homegrown ledgers cannot keep up with the needs of scaling. This journal looks at why, and the alternative solutions for fixing a "broken" ledger.

Read more→In this second part of our two-part series, we build a ledger for a Venmo clone by applying the accounting principles we learned in Part I.

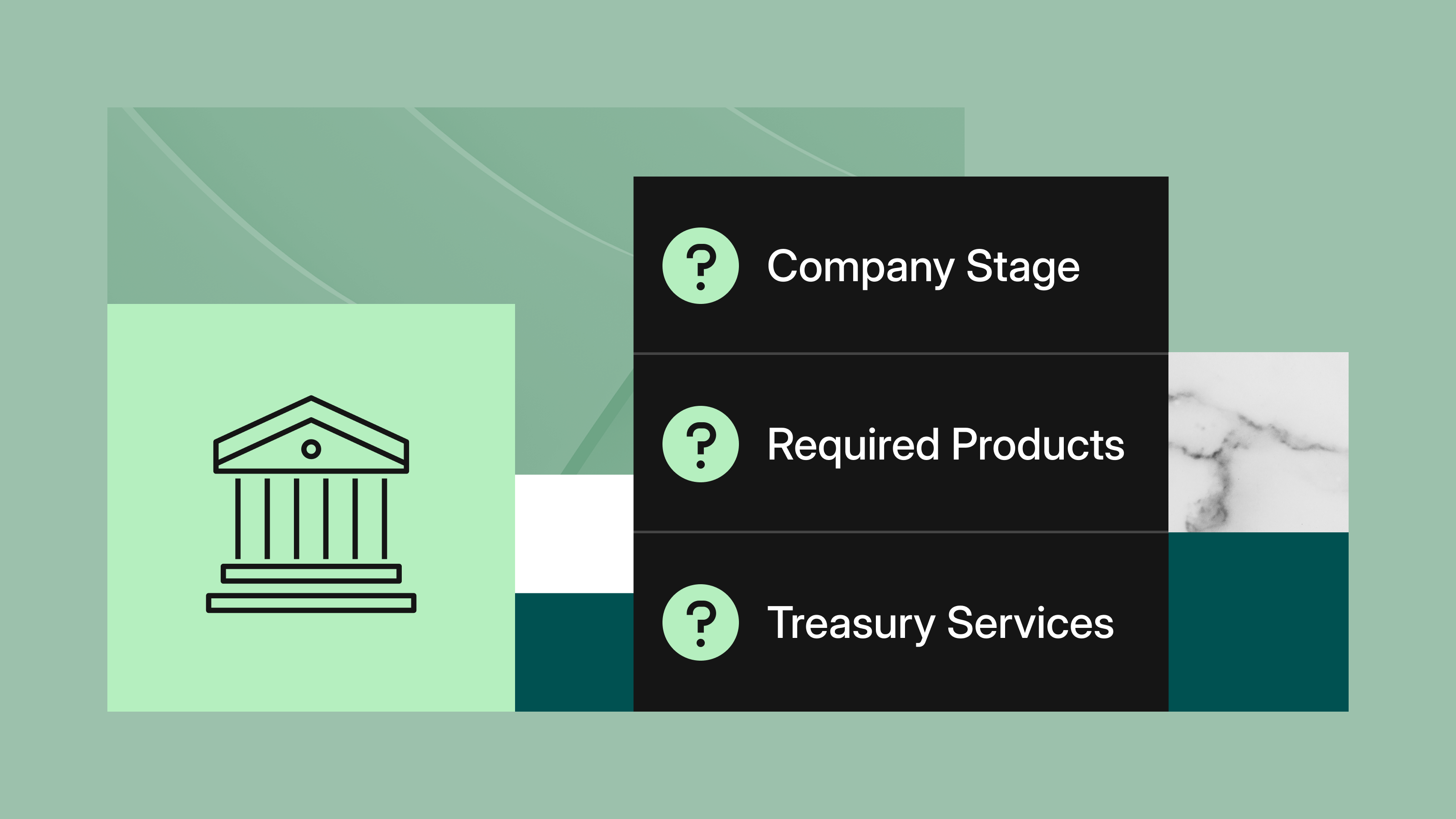

Read more→Any company that wants to work directly with a bank must successfully complete the bank due diligence process. This Journal provides an actionable checklist for companies preparing for this process with a bank partner.

Read more→Understanding the differences between ACH and card payments is a strategic necessity for businesses looking to scale. This journal digs into key distinctions and selection criteria for making the best choice.

Read more→

In this first part of a two-part series, we walk through basic accounting principles for anyone building products that move and track money.

Read more→We recently shipped three new features that let you build a better Ledger faster: Available Balances, Balance Aggregation, and Ledger Accounting Categories. This journal details the benefits of each.

Read more→Earlier this month, we migrated from offset pagination to cursor-based pagination for our API. In this journal, we walk through the basics of these methods of pagination and why we’re making this switch.

Read more→

Modern Treasury customer, Manufactured, is streamlining manufacturing solutions for consumer brands. They partnered with Modern Treasury—integrated with JPMorgan Chase Bank—to build their scalable, cross-border payments solution.

Read more→

As more companies are embedding payments into their products, payment flows are changing. More than traditional accounts payable and receivable, or first-party payments, there are now third-party payments, where businesses move money on behalf of customers. This post looks at these two payment flows and why they matter.

Read more→As fintech continues to create value through expanded access to financial services, banks have the opportunity to partner to provide better product support and customer experiences.

Read more→We now support customers of Cross River to send and reconcile ACH transactions, with support for additional payment rails.

Read more→We're excited to expand our partnership with BankProv to include support for their payments and banking APIs.

Read more→

In this guide, we outline key considerations for customers who are thinking about partnering with a bank, including whether to sit in the flow of funds, how to select a bank partner, and what goes into establishing a banking relationship.

Read more→On Thursday, along with Rutter, we hosted a discussion to learn about alternatives financing. Here are three key learnings from our panel.

Read more→To prevent a double-spend situation, your ledger needs to be able to record transactions that are conditional on the state of an account balance or account. The Ledgers API now supports account balance locking to make it even easier to handle concurrency in your ledger.

Read more→In June and July, we shipped features such as historical balance reports, a banking holiday banner on the web app, and more.

Read more→With the internet providing increasingly new ways to distribute and interact with financial products, the banking industry is losing ground to new fintech entrants. Modern Treasury can provide the software to help banks compete. In this journal, we take a look at the opportunity that exists for us to work better together.

Read more→Software-integrated payments are fast-becoming the new normal. In this journal, we look at how software infiltrated the payments space, how it enables better experiences, and why this matters.

Read more→

Whether a business chooses to sit in the flow of funds depends on a number of factors. This journal looks at the cost implications of being inside or outside the flow of funds.

Read more→When Modern Treasury onboards a new bank partner, we are building a relationship—with both the people and the software—to the financial institution used by our customers. This journal looks at the consideration and work that goes into establishing a bank partnership.

Read more→When building a marketplace solution, there are many considerations for how to structure payments to streamline operations. This journal looks at four questions to keep in mind when designing marketplace payment flows.

Read more→Bank partnerships are a core part of our offering. This journal looks at the mutual benefits of the partnership between banks and Modern Treasury.

Read more→

Payment operations is complicated. Technical challenges can arise for myriad reasons. This journal details one edge case that we dealt with recently, how we responded, and what we're doing to ensure it doesn't happen again.

Read more→Earlier this month, we sponsored and attended Nacha's Smarter Faster Payments conference in Nashville. This journal takes a retrospective look at our time at the event and highlights our key takeaways.

Read more→When a business sits “in” the flow of funds, it means that money will, at some point, pass through the business’ bank account. This primer digs into funds flow models and the risks and benefits associated with sitting in the flow of funds.

Read more→Modern marketplaces need to consider how to design payment flows to move money between buyers and sellers. In this journal, we outline why it can be beneficial for the marketplace to be directly in the flow of funds.

Read more→Earlier this month, we co-hosted a panel with Nacha about how to mitigate fraud on the ACH network. This journal details some of the key findings from that conversation.

Read more→In April and May, in addition to our new Compliance product, we shipped several new updates including ledger dashboard improvements, exporting payment approval queues and bulk imports, and more.

Read more→

Today, Modern Treasury customer, C2FO, announced their new CashFlow+ Card. They chose to manage the payment operations of their new card with Modern Treasury's Payments and Ledgers products.

Read more→Modern Treasury uses a field called "Effective Date" to represent the date of a payment. This journal takes a look at payment timelines and why the Effective Date does not mean date of transmission.

Read more→Nacha has over 80 codes for ACH returns. In this primer, we look at the ACH return that happens if you debit a blocked account and other common ACH return codes.

Read more→Today we're launching early access to our Push to Data Warehouse feature: connect your data warehouse, and receive up-to-date Modern Treasury data as fast as every 15 minutes.

Read more→Last month, Nacha released their top 50 ACH Originators, which included some surprisingly small financial institutions. In this By The Numbers journal, we dig into how tech forward banks are pursuing new strategies for revenue growth, enabling them to compete with bigger banks.

Read more→

Sending money internationally can be complicated. This post explains how to use ACH rails to send money abroad, using the International ACH Transaction (IAT) specification and the FedGlobal ACH program.

Read more→We now support customers of Bank of Montreal moving money via US and Canadian payment methods.

Read more→In this Behind the Scenes, Julie Mullins, our new head of marketing, discusses her experience in category creation and shares what brought her to Modern Treasury.

Read more→Frank Chimero, our new Head of Brand, shares his thoughts about the changing nature of money and how that brought him to Modern Treasury.

Read more→Core banking systems revolutionized the way we manage money. In this Payments Primer, we dig into how they work and how they compare to modern day payment solutions.

Read more→

In this Guide, we discuss how companies that facilitate payments of any kind can use a ledgering database to track balances and transactions at scale.

Read more→Cryptocurrency is rising in popularity and becoming more mainstream. In this post, we dig into the differences between cryptocurrency and fiat money.

Read more→A look at how you can use an application ledger to keep track of balances and transactions on your platform and build programmatic, instant payouts.

Read more→

Businesses seeking to optimize their payments operation strategy need a robust approvals system. This guide walks through what to consider when creating one.

Read more→This March, we shipped several new updates including added support for customers at Wintrust Bank, custom table columns, bulk import views, and more.

Read more→President & CEO of Ancestry, Deb Liu revolutionized e-commerce. In our Coffee Break discussion, Deb offers a framework for strengthening your payment operations.

Read more→Despite all the digital payment options, many businesses still rely heavily on paper checks. In this post, we walk you through what check processing is and how it works.

Read more→Today, we’re excited to announce the $50M second close of our Series C and welcome Salesforce Ventures and SVB Capital to the growing Modern Treasury family.

Read more→We have tools to make managing your financial transactions simple and straightforward. One of those tools is our notification of the details of an incoming payment.

Read more→Recently, we hosted a Coffee Break with Indeed’s VP of Client Success for the Americas region. Here's 5 lessons in leadership she shared with us during our conversation.

Read more→

Settlement and clearing systems are an important component of modern payment operations. In this post, we walk you through the important distinction between the two.

Read more→In April, Visa and Mastercard will raise interchange fees – the fees set by the networks to determine how much merchants must pay to accept consumer cards.

Read more→Security is a priority for our customers and key feature of our products. Here are recent examples of our continuing approach to delivering on hardened network security.

Read more→We have now added support for Virtual Accounts for Wires at BankProv. We have also added support for ProvXchange at BankProv.

Read more→This February, we worked on several projects to create more features and enhance our product offerings. Here is what shipped in the last month.

Read more→Most consumers are familiar with chargebacks as they happen with credit cards. This post will help you understand chargebacks across different payment rails.

Read more→SWIFT is making headlines due to the ongoing Russia-Ukraine conflict. This post explains what SWIFT is and what changes are currently taking place.

Read more→Modern Treasury’s selection to join NACHA’s Preferred Partner Program endorses our endeavors to support the ACH network and continue as the leader of payment operations.

Read more→In this post, we explore how interbank settlements work, why they are used, and what happens to transactions at cutoff or if there is a system outage.

Read more→

It can be difficult to understand the difference between ACH returns and reversals. This post digs into similarities and differences between each.

Read more→In this By the Numbers Journal, we provide a definition of cutoff times, explain why they’re crucial, and explore how they might affect business money movement.

Read more→

Startups depend on the function of money movement and how well it can scale up with the business. The process of setting up payments begins with a few key steps.

Read more→It can be challenging to differentiate between money that’s in flight and settled. Ledger transactions have a status field that can help with this.

Read more→Preet Narisetty joined the team as Head of Customer Success, and in this Behind the Scenes journal he shares his story and reasons for joining Modern Treasury.

Read more→Last month, Shruthi Murthy joined the team as Head of Engineering, and in this Behind the Scenes journal she describes what drew her to Modern Treasury.

Read more→Last month, Derek Schwede joined the team as Head of Legal, and in this Behind the Scenes journal he dives into what led him to Modern Treasury.

Read more→This month we shipped new updates including failed payment order notifications, duplicate payment order detection, and a dedicated dashboard for external accounts.

Read more→On September 30th, NACHA is instituting a new rule that will address third-party senders that are direct customers of other TPSs and provides requirements for when a TPS must conduct a risk assessment.

Read more→Managing payment flows within an insurance company can be difficult. In this article, we share how insurance companies can use Modern Treasury to help with three common payment operations challenges.

Read more→It can be hard to understand the difference between general ledger software and a financial ledger database. This post explains each system and when your company might need one or the other.

Read more→This month we shipped new updates including support for creating internal bank accounts in the sandbox, the ability to view incoming payment details and link reversals to ledger transactions.

Read more→Immutability is one of three core principles to adhere to good engineering and accounting principles.

Read more→For those considering using Ledgers to build a reliable transaction database, this journal discusses the 3 most common questions existing customers have asked.

Read more→This month we shipped new updates including improved bulk imports, support to filter by return type, and naming approval rules.

Read more→This September, we opened our San Francisco office, a milestone moment on the journey to building a company.

Read more→With SVB and Settle, we participated in a panel about Scaling Payment Operations. This journal digs into some key points from the discussion from what payment operations are to how to evaluate a payments solution.

Read more→This year, we conducted the first State of Payment Operations survey. This By The Numbers journal talks through some of the key survey points and the case for modernizing payment ops.

Read more→Last month, Modern Treasury unveiled our first brand video. This Behind the Scenes journal digs into how we made it, from pre-production to post.

Read more→

We recently announced Ledgers, our new product that helps businesses manage their books. Here's the story behind why we built it.

Read more→Modern Treasury has added wallet support to our Internal and External accounts to allow customers to view transactions, balances, and originate payments on the wallet’s network.

Read more→This month we shipped new updates including bulk imports for expected payments, a currency filter for payment orders, and linking ledger transactions to expected payments.

Read more→On Tuesday, we announced Virtual Accounts, our new product that helps automate payment attribution. Here's the story behind how we built it.

Read more→Today we're excited to announce the launch of Virtual Accounts, which helps businesses automate how payments are attributed and reconciled.

Read more→We’re excited to share that Modern Treasury is joining the Plaid Payment Partner Ecosystem.

Read more→Businesses that move money eventually need a solution for how to handle payouts for their products and services. In this guide, we’ll describe the key factors to consider when choosing a payments solution for automatic payouts at scale.

Read more→

Today, we’re excited to share that we’ve reached another milestone on the road to building an enduring and valuable company: we raised an $85M Series C. The new financing values the company at over $2B.

Read more→This month we shipped new updates including support for check processing in the sandbox, linking ledger transactions and incoming payment details, and a beta version of reporting.

Read more→

This is an overview of current laws for money transmission, the rationale behind them, and regulations and exemptions to needing a money transmitter license in the US.

Read more→This month we shipped new updates including support for testing failed payments in the sandbox, search capability for "other" payment types, and virtual accounts for Wells Fargo.

Read more→A virtual account doesn’t hold any funds, despite having a unique account number and can perform payments as physical accounts. They can be a popular solution for neobanks to scale payment operations and manage large transaction amounts.

Read more→Optimistic Locking is a control method that assumes multiple transactions can complete concurrently without conflict. We built our ledgers API with concurrency control semantics to better manage transaction volume.

Read more→Despite the availability of electronic payments, paper checks remain a popular payment method. This primer details why lockboxes remain a beneficial way of managing paper checks for businesses.

Read more→This month we shipped several new updates including permissioning updates for better risk control, RTP automatic payment retries, and sandbox testing for processing originated returns.

Read more→

Marketplaces are a growing industry, and their payment operations can get increasingly complex. This guide explores the ways Modern Treasury can help streamline processes for all types of marketplaces as they scale.

Read more→A few months ago we conducted a reverse interview with one of our favorite business podcasts: Acquired. Today, we’re excited to share it.

Read more→The bank onboarding process can be long and confusing. In this guide, we hope to demystify the process and help you go live with your bank faster.

Read more→In June, we shipped several new updates on our dashboard, such as notifications for approval rule changes, configuration options for NetSuite integration, in-dashboard support for international accounts, and more.

Read more→

An FBO account is a custodial account that lets a company manage funds on behalf of, or “for the benefit of” their users without assuming legal ownership of that account.

Read more→Today we're excited to announce the launch of Ledgers, an immutable double-entry product ledger that makes it easy for businesses to record financial transactions.

Read more→Modern Treasury has now added support for customers of Santander Bank.

Read more→

When moving money, you have options when it comes to making fast payments. In this payments primer, we explore the fastest ways to make a domestic payment in the United States.

Read more→Even though wire transfers are the most expensive payment type, they remain one of the most utilized payment methods. This primer explains what wire transfers are, wire payment timings, and what makes this method so costly.

Read more→In May, we shipped several new updates on our dashboard, such as our new organization switcher for businesses who manage more than one organization, a new billing page to track all aspects of your account, and support for virtual accounts at Increase.

Read more→The rise of newer and faster payment methods like RTP and FedNow will enable businesses to move and settle money more quickly, driving adoption. This journal explores whether the U.S. will see increased payment volumes as adoption grows across large and small financial institutions.

Read more→We are excited to announce our first formal bank partnership with Silicon Valley Bank.

Read more→We released a new feature that allows Modern Treasury customers to pause webhook endpoints while performing maintenance.

Read more→

Digital wallets are some of the most widely-used financial products today. This guide describes the bank and payments infrastructure underlying digital wallets and how you could build one using Modern Treasury.

Read more→Modern Treasury has now added support for customers of Bank of America.

Read more→Today, we are excited to announce that Modern Treasury reconciled over $1B in payments for our customers last month, a compound monthly growth rate of 37%.

Read more→We have added Global Payouts, enabling our customers to make multi-currency international payments through our API and web app.

Read more→We've released a new feature that allows customers to verify routing numbers using a new API endpoint.

Read more→On March 19, Nacha made effective a new rule which strengthens the requirements for originators of WEB debits. In an attempt to curtail fraud, the rule requires companies to validate new accounts. Though it won't be enforced for a year, it's important to know about the rule change so your company can remain compliant.

Read more→Modern Treasury now supports sending ACH prenotes as a way to validate account and routing information.

Read more→When maintaining your books, there are a number of accounting methods you can use to keep track of your company’s financial information. One of them is double-entry accounting. What is it, and when should it be used?

Read more→The Federal Reserve (“The Fed”) promotes the stability of the financial system, including playing an important role in maintaining the integrity of the US payments system. What happens when the FedACH, FedWire, and National Settlement Service are offline?

Read more→Modern Treasury has now added support for customers of Sutton Bank.

Read more→Today we’re happy to share that we’ve released a new ACH Reversals feature in our Payments product. ACH Reversals lets you reverse an ACH payment you initiated with the click of a button or an API call.

Read more→

Payment operations are the workflows that move money for companies, from payment initiation and processing approvals, to reconciliation and managing transaction issues.

Read more→A story about a $900 million mistake, bad software, and good people. This case goes to the heart of why we started Modern Treasury.

Read more→These past five months, I’ve had the opportunity to intern at Modern Treasury and wanted to reflect on my experience here.

Read more→

A regular source of frustration for startups who move money for customers is trying to understand the rules that banks impose on those clients they deem to be third party senders (TPS), or as banks call them, third party payment providers (TP3’s). A third party sender is a company that uses its own bank account to make or receive payments on behalf of its customers or users.

Read more→We released a new feature that allows Modern Treasury customers to add custom processing windows in addition to our default processing windows for all supported payment types.

Read more→Escrow is a payment setup where the payer sends funds to a third party rather than directly to the payee. If certain conditions are met, the third party routes the funds to the recipient; if not, the funds get returned to the sender. Escrow is particularly useful for high value payments because the payer can rely on the escrow provider as a responsible intermediary of the funds.

Read more→There are many important moments along the journey of never-ending work it takes to build an enduring and valuable company. Today we’re excited to share that we’ve reached another stepping stone on that path: we raised a $38M Series B financing led by Altimeter Capital.

Read more→2020 was a year like no other. To fill all that time at home, we consumed a lot of content. So what caught our eye in 2020? Here are our favorite posts from the year.

Read more→Last week, we announced support for self-serve sign up. When signing up, customers can now pick between three options for bank connection: Instant Bank Partners, Supported Bank Partners and Custom Bank Partners.

Read more→Yesterday, we announced self-serve sign up, an easy and secure way to start moving money within minutes. Here's how we built it.

Read more→At Modern Treasury we help companies manage payments at scale and build payment flows into their products. Done right, we believe this can turn payments and treasury into a strategic advantage and unlock incredible new products and customer experiences.

Read more→

The process of tying a payment to a transaction is called reconciliation and it is essential for a business to understand how completed and in-progress transactions add up to the cash balance in its bank account.

Read more→If you need to track the complete lifecycle of a payment from the time it is approved and sent to the bank, through completion, you need to reconcile it to a cash transaction. A bank statement is precisely what’s needed: a chronological list of credit and debit transactions with corresponding bank balances at any point in time.

Read more→In October, we shipped support for Signature Bank and added capabilities for collecting SSNs and EINs. We made a number of additional improvements to our platform that we are excited to share.

Read more→Modern Treasury has now added support for customers of Signature Bank.

Read more→

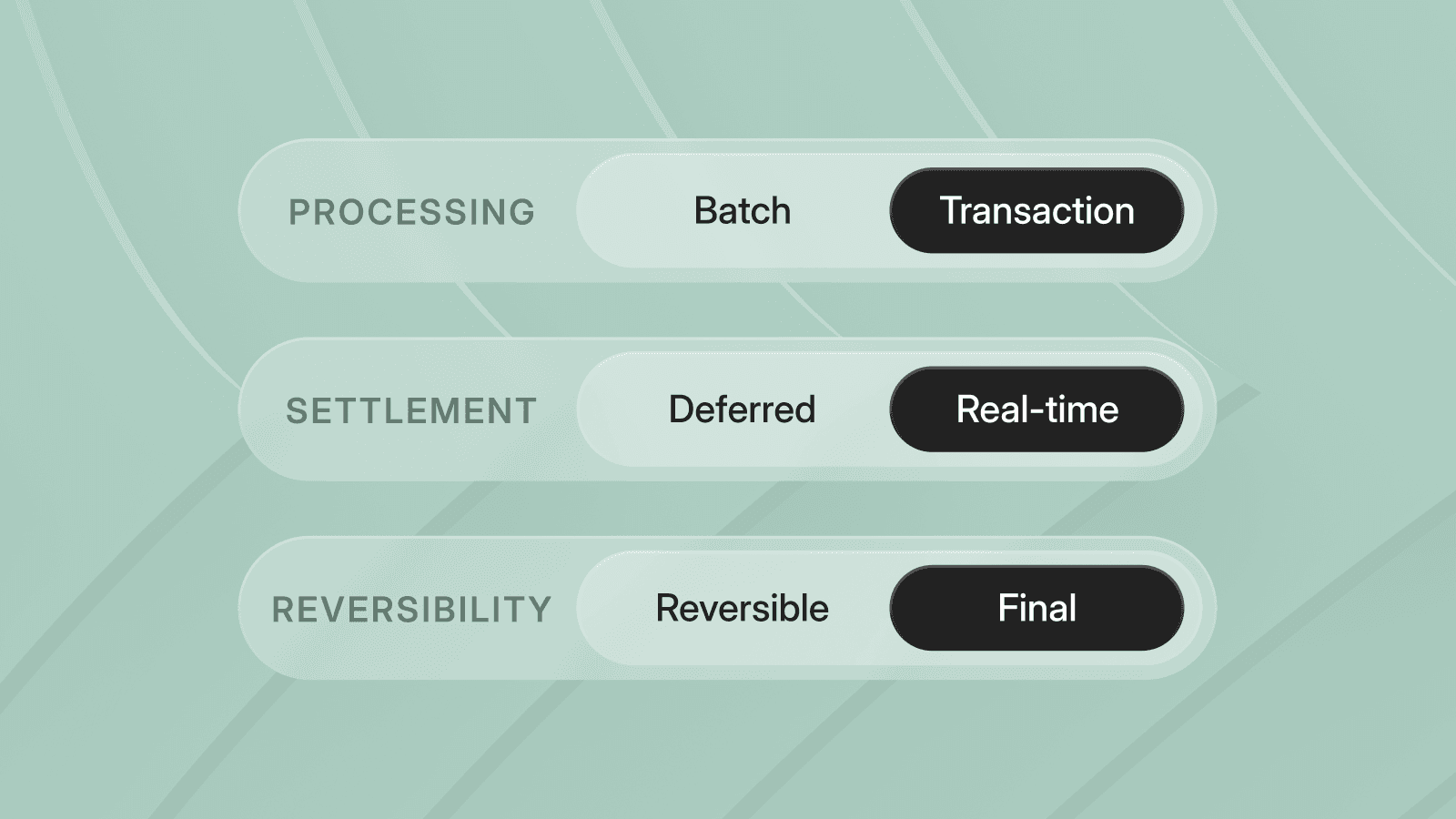

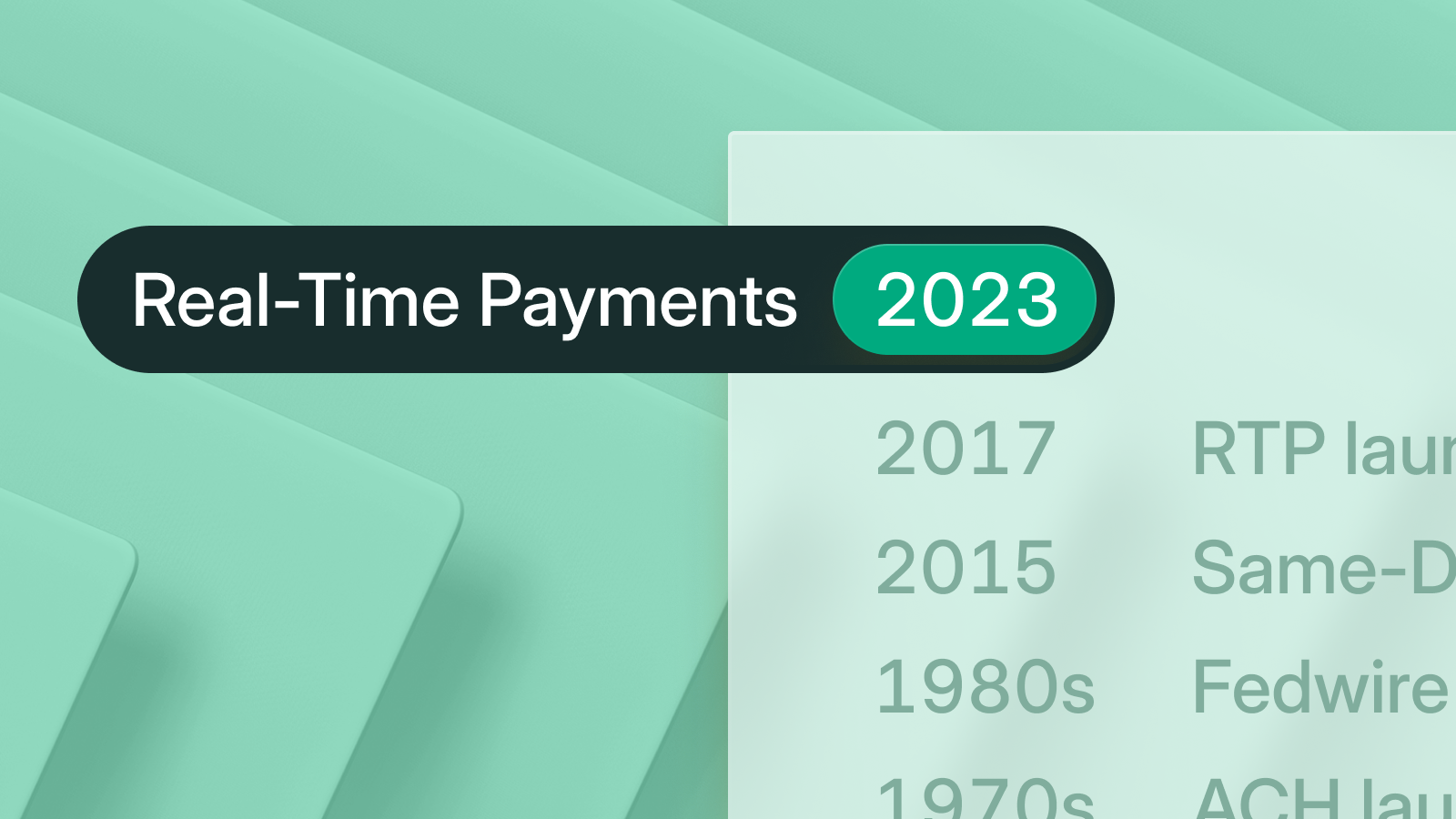

As a category, moving money instantly is often called “faster payments.” Faster payments are defined by three attributes: speed (instant), availability (24x7x365), and confirmation (available to both sender and receiver immediately). And though we think of the United States as a global leader in innovation, when it comes to faster payments, we are lagging way behind.

Read more→In order to pay many types of counterparties, businesses need to collect and track Social Security Numbers (SSN) or Employer Identification Numbers (EIN). This is required in cases where you need to file a tax document, such as a 1099, and can also support compliance and control processes inside your company.

Read more→We’re excited to share some of the features that shipped this month at Modern Treasury. In addition to the Events product we shared earlier this month, we have improvements across our platform that benefit the entire payment process.

Read more→This is where two goals can sometimes come in conflict: responding to customer requests as fast as possible, and managing the financial controls around payments. So we’ve built tools for a customer support team to get access to the information they need while creating flexible controls to ensure a business is safe and protected.

Read more→There’s a myth going around now that fintech is a new industry, poised to take over, and that now that it’s here, every company will be a fintech company. In reality, though, fintech is just as old as "tech." For as long as engineers and entrepreneurs have been coming up with new technology amongst the hills of Cupertino and the orange groves of Mountain View, there have been fintech entrepreneurs right amongst them. And in many instances, the two groups have utilized the same technology advances to push the world forward.

Read more→When evaluating options for payment processing, one option to consider is working directly with your bank. The term for this setup is called “direct transmission.”

Read more→Events are how we model important state changes within the Modern Treasury system. When a state change event occurs, we create an Event object.

Read more→Today, we are excited to announce that Modern Treasury reconciled over $100 million in payments for our customers last month. This milestone comes after compound monthly growth of 25% since January.

Read more→August has been another busy month for Modern Treasury. In addition to some of the bigger items we shipped like Permissioned API Keys, we’ve shipped a number of smaller features and improvements we’re excited to share.

Read more→This post is a guide to the operational, money movement aspects of private investing. While the specifics of the investments and the horizon for repayment might vary widely, we hope that this guide is useful in simplifying and demystifying how a fund might automate some of its internal operations.

Read more→Bank statements can be difficult to understand. We’ve previously written about bank statement descriptions and how they work. In this post, we will focus on a specific abbreviation, INDN, that you may see on your bank statement.

Read more→In November, we released functionality that allows Modern Treasury to connect with general ledger systems in real-time and introduced it as a class of features called Continuous Accounting.

Read more→You can now unmask and view account numbers on external accounts in Modern Treasury. Previously, it was impossible to view the account number for a counterparty’s external account. Our platform will automatically record an action on the audit trail every time an account number is viewed.

Read more→Credit card users today can transact online with peace of mind because card-accepting merchants are subject to Payment Card Industry Data Security Standard (PCI DSS). Security is also a concern for bank payments.

Read more→

Originally taking place over telegraph, the means of sending wire messages have been replaced: first by the telephone network, and then it in turn by the internet. Yet the core idea of how wire transfers work has remained the same.

Read more→Among the many improvements that Real-Time Payments brings to the money transfer ecosystem, one of the most overlooked is its adherence to the global standard ISO 20022.

Read more→Many more of us are working from home right now, which means in-person processes are being taken online. For finance and accounting teams, one common in-person workflow is managing paper checks. There are two sides to check transactions: sending and receiving. Both can be automated. Let’s take them one by one.

Read more→

At Modern Treasury, we place a strong emphasis on building systems that behave predictably and are resilient to failures. An important characteristic of these systems is that they are idempotent. In this article, we’ll explain what being idempotent means and why it is important for systems that handle payments like we do at Modern Treasury.

Read more→Modern Treasury integrates with NetSuite to support our Continuous Accounting product.

Read more→We now support PacWest Bank and our Continuous Accounting platform integrates with NetSuite. Here are a few additional changes that we released.

Read more→We are excited to announce our integration with NetSuite. Modern Treasury customers can now sync their data to NetSuite, making it even easier to automatically reconcile transactions for accounting.

Read more→Modern Treasury has added support for customers of Pacific Western Bank API.

Read more→In payments, there are two common setups: third-party sender and third-party service provider. For any company that needs to move money, it’s good to understand the differences.

Read more→Invoice factoring advances cash against invoices a company has issued, effectively prepaying the funds that a company’s customers have promised to pay in 30, 60, or 90 days.

Read more→Due to the asynchronous nature of payment operations, Modern Treasury has a robust webhooks API that sends out webhooks when objects such as payment orders change state. Many of our customers build against our webhooks API, and rely on webhooks to trigger state changes and start automated processes on their end.

Read more→So here it is: the top ten. It’s a subset of our full list of readings that’s focused on payments specifically.

Read more→Modern Treasury has added support for receiving Corporate Trade Exchange (CTX) records on incoming ACH payments.

Read more→LedgerSync is an open source Ruby library that allows developers to easily connect to and sync information to and from any ledger or accounting software such as QuickBooks Online, NetSuite, and more.

Read more→March was a busy month for us at Modern Treasury. We shared some changes we made to support customers in Canada through RBC, display API logs in the application, and enable users to reconcile expected payments manually in the dashboard. Here are a few additional changes that were released.

Read more→ACH money movement is a common payment method for money transfers or automated payments. It’s relatively easy and cheap, but timing can be confusing. Since we get so many questions around ACH timings, we wanted to clear up timing for companies utilizing ACH and what they can expect.

Read more→Modern Treasury has now added support for RBC Commercial Banking customers.

Read more→To improve the developer experience with Modern Treasury, we have introduced easily navigable API logs in the app.

Read more→

When we set out to build Modern Treasury, we knew that as a company that deals with financial data and stores data in the cloud, our customers will expect us to prove our commitment to security. This proof typically takes the form of a SOC 2 report.

Read more→We’ve released a new feature that allows Modern Treasury users to manually reconcile expected payments to transactions on their bank statement.

Read more→Modern Treasury is updating how users interact with the application’s permission system. After studying how users across organizations were grouping permissions together, we are introducing a simplified permission interface.

Read more→To better support customers who send physical checks, Modern Treasury has now added Lob as a supported check print provider.

Read more→

Choosing a bank is more than just a financial decision. At Modern Treasury, we work with many companies building out products that require banking support. This guide will help you ask the right questions from the outset, because running a company comes with enough curveballs, and your banking relationship should not be one of them.

Read more→Today we’re launching Audit Logs. We’ve always had an audit trail for Payment Orders. Now, all user and API actions will be logged and available throughout our app.

Read more→We have previously shared news of our partnership with Plaid, and our first Plaid integration which enables our mutual customers to instantly verify their counterparties through Plaid.

Read more→When we started Modern Treasury, we set out to build an enduring and valuable company. Today, we are excited to share that we’ve reached a significant milestone on that journey.

Read more→Modern Treasury now supports reconciling payment orders, expected payments, paper items, and returns (called “transactables” in this article) to pending transactions on a tentative basis.

Read more→Yesterday we announced our partnership with Plaid, which enables our mutual customers to use Plaid to authenticate and collect bank account details without touching sensitive data like bank account numbers.

Read more→Since the day I arrived at Modern Treasury, customers and prospects have asked us about Plaid and how to use our products together. Today we are excited to share our partnership, which offers businesses an improved, secure, and streamlined way to manage payment operations.

Read more→Modern Treasury has added support for customers of Bank of the West through the bank’s Integrated Solutions offering.

Read more→In this Journal Entry, we’re going to give a behind-the-scenes look into how we built this integration using LedgerSync, which is an open-source library for accounting systems.

Read more→This post explains how to use Modern Treasury’s Continuous Accounting product with QuickBooks. We will cover some QuickBooks basics, product decisions we made while building our integration, and how to setup QuickBooks with Modern Treasury.

Read more→We are excited to introduce Continuous Accounting to the Modern Treasury platform.

Read more→Regardless of specifics, however, the Income Sharing Agreement (ISA) structure is relatively consistent. To define it more explicitly, an Income Sharing Agreement funds a student’s tuition upfront in exchange for receiving a percentage of the student’s future earnings (hence “income-sharing”) based on a pre-defined formula. In this way, the funder can be thought of less as a debt investor and more as an equity investor, receiving “dividends” from the students future earnings.

Read more→We've released two new features to improve the experience of using the Modern Treasury API. To view these changes, visit your developer settings page.

Read more→In late 2017, banks started rolling out Real-Time Payments (RTP). You can learn more about the history and promise of RTP in our previous post about it. Rather than rehash that background or answer common questions, this post will offer a step by step guide to building an app using RTP and the customer delight moment that comes with.

Read more→It’s no surprise that everyone from major financial institutions to consumers would have questions about a brand new payment method: Real-Time Payments.

Read more→

In this By the Numbers post, we share the information we could find publicly available online about which banks are currently live with RTP send.

Read more→We’re excited to announce that Modern Treasury now supports sending payments through the Real Time Payments (RTP) network. RTP instantaneously delivers fund to your customers and vendors at any time: 24 hours a day, 7 days a week, 365 days a year. For more background on RTP, here’s a useful primer.

Read more→Modern Treasury now supports JP Morgan Chase commercial banking customers.

Read more→

The ACH network supports dozens of payment scenarios. These categories appear as a unique 3-character Standard Entry Class (SEC) code with every entry. The SEC code dictates which rules and regulations apply to a given payment, who can start them, and under which specific scenarios they can occur. This list is not exhaustive, but we have included descriptions for SEC codes companies are likely to receive or start themselves.

Read more→We’re excited to announce our status page where you can view Modern Treasury’s current condition and past incident details.

Read more→Lockboxes are a great solution for businesses who don't want to deal with the hassle of paper checks.

Read more→We've released two new features to help you manage your counterparty relationships in Modern Treasury.

Read more→When an ACH return occurs, the payment is reversed. This means that if you had paid someone, the money will come back to your account. Or if you had charged someone, you will lose the money you thought you received. But how does that reversal happen?

Read more→Modern Treasury has now added support for foreign exchange wires through Wells Fargo and Silicon Valley Bank.

Read more→This post lays out how money moves between companies, how that differs from consumer payments, and some surprising upcoming changes.

Read more→In the United States, moving money is big business. The ACH Network moves $51 trillion dollars in 23 billion electronic financial transactions per year. That’s almost 70 payments per person.

Read more→Ultimately, though, the mechanics are similar irrespective of what is being insured: an insurer first calculates the potential damage and the odds that damage might occur. Then, it charges a payment on a regular basis that, in aggregate across all those insured, is designed to make a profit for the insurance company itself. And finally, when and if the risky event comes to pass, the insurance company approves a payment to the customer that incurred the damage. That payout is called an insurance claim.

Read more→We released an update to help our customers process their webhooks more safely.

Read more→There are many setups that can complicate the system, including collecting and returning security refunds, splitting rent between roommates, handling one-off fees or refunds, and other unique cases. And there’s a lot to think through if you want to start a company that deals with property management.

Read more→

Whether it is a student loan, an auto loan, a personal loan, a small business loan, or even a government bond issue, it is possible to build a generally applicable set of mechanics that work for any lending business.

Read more→Increasingly, products are adding various forms of cash transfer beyond a simple credit card payment. In this post, we will walk through the building of a peer-to-peer money transfer app using the Modern Treasury API.

Read more→

This post discusses some of the common tactics businesses use to collect and verify bank account details. Ultimately it is up to each business to decide how they want to approach these tasks. The approaches outlined below can be done in tandem or independently.

Read more→You may have heard of Real Time Payments (RTP) and wondered what that is. We thought it would be helpful to create a post that could serve as an overview of RTP, a new payment method that is coming to the US in the next couple of years.

Read more→When we talk to companies, we’re often surprised by the misconceptions that exist around ACH.

Read more→An eCheck is a payment method that businesses use to charge an individual or another business. It utilizes the Automated Clearing House (ACH) system to move the money between bank accounts. eChecks support a diverse set of use cases, from rent and utilities to medical payments and business invoices.

Read more→

We've all seen them. Semi-cryptic entries on our bank statements. Where does that information come from? What do the random numbers and letters mean?

Read more→Today we're pushing an updated design for the Modern Treasury application. Our goal with this update is to make our user experience cleaner, more consistent, and more readable.

Read more→Modern Treasury has now added support for Wells Fargo commercial customers.

Read more→In March, NACHA released their listing of top ACH financial institutions. We always want to know as much as possible about how money moves in the United States, so we took a deep dive into the data they published.

Read more→Today we're releasing a new way to make it easier for Modern Treasury clients to onboard their counterparties.

Read more→ACH, or Automated Clearing House, is an electronic network used to communicate financial transactions.

Read more→Modern Treasury has added support for retrieving and creating Documents on associated records.

Read more→Modern Treasury has now added support for First Republic Bank corporate customers.

Read more→Modern Treasury has now added support for Silicon Valley Bank customers.

Read more→We’re excited to introduce Modern Treasury to the world, a startup a part of YC’s Summer 2018 batch that is simplifying and modernizing payments for businesses.

Read more→