Join us at Transfer 2025 to hear how industry leaders are building payments infrastructure for a real-time world.Register Today →

How Companies Launching Card Programs Use Modern Treasury

When starting a card program for your business, there are a lot of factors to consider. This journal digs into how Modern Treasury streamlines the process.

Introduction

Embedded fintech products are having a moment, with even non-tech companies leaning into the future of finance. The same is true for card programs: more companies are issuing cards—for employees or users or both—regardless of whether or not cards have traditionally been a part of their business model.

Below, we’ll dive deeper into how companies creating a card program can leverage Modern Treasury to streamline payments, track data in ledgers, and make compliance straightforward.

Launching A Card Program

When starting a card program for your business, there are a lot of factors to consider. Should you utilize physical or virtual cards? How will you track significant financial and user data? How will you monitor and prevent fraud? How quickly can you launch your program?

You’ll also need to consider the concrete steps towards launching your program: finding a bank partner, choosing a card issuer or connecting with a card network, establishing underwriting and compliance, setting up a processor integration, working on design and marketing, and more. Regardless of how you choose to create your card program, you will still need high-performing and accurate payment operations software to keep track of all the moving pieces that come with a card program.

At the core of a card program is a card issuing API partner. Providers like Marqeta, Galileo, and Lithic simplify the process of launching and operating a card program with an API.

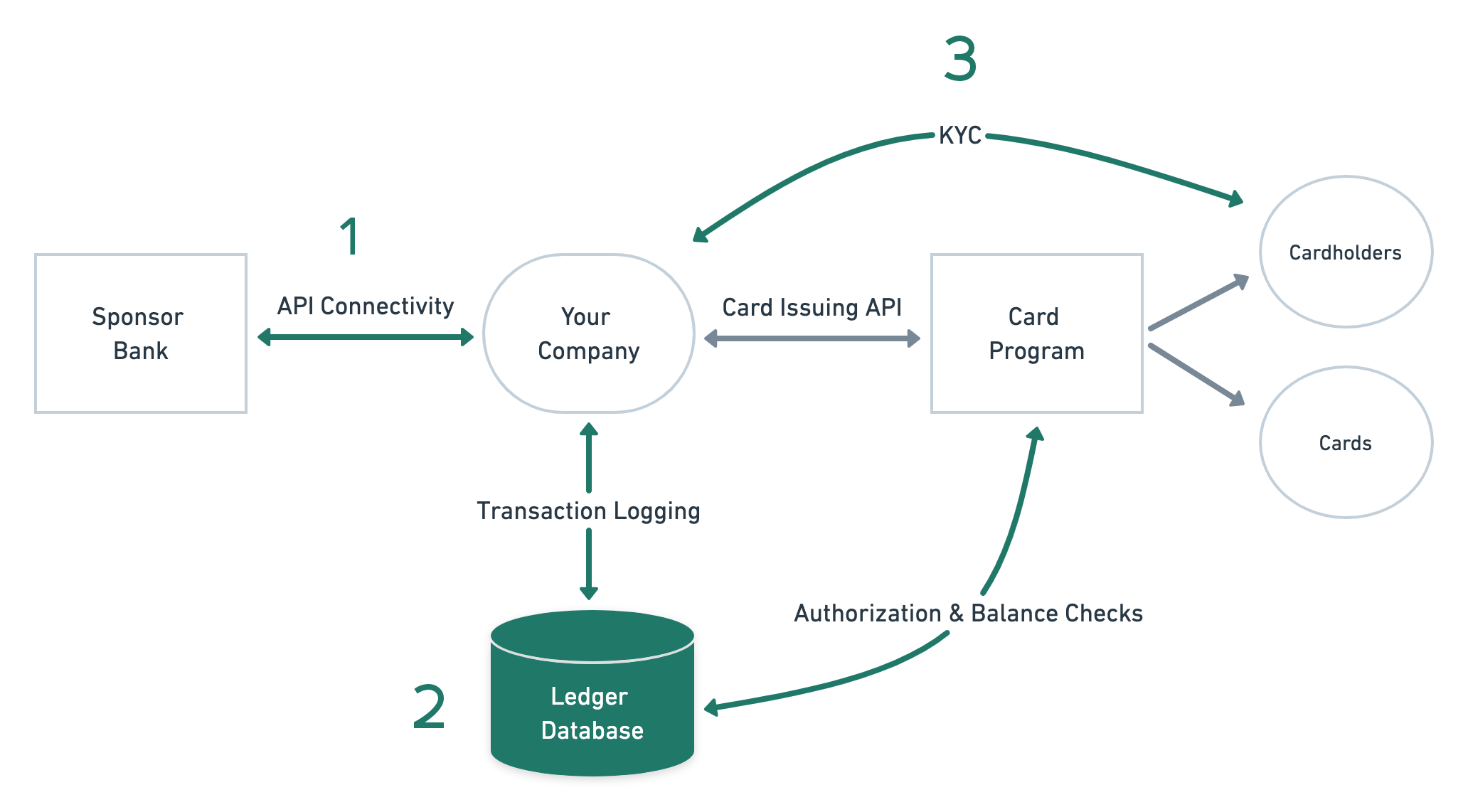

Modern Treasury complements the work done by card issuing APIs in three essential ways:

- Program Funding

- Ledgering and Balance Tracking

- Compliance and Fraud Prevention

Connecting With A Sponsor Bank Using Payments

In the case of many card issuers, you can set up your card program and be up and running right away without the need to set up a separate relationship with a partner bank. This can be advantageous for those looking to get to market as fast as possible, but comes with an increased price tag.

But what if you already have a business relationship with your bank or are looking to create your card program with a potentially lower overhead cost? An alternative would be to utilize Modern Treasury in conjunction with a card issuer.

Working with a card issuer like Lithic, for example, would allow you to create your card program while utilizing your existing banking relationships (or creating a new one, independent of your card issuer, if needed). With your sponsor bank, you’ll need to create a set of account structures to manage program funding with FBO accounts or virtual accounts. It is important to note that this setup can vary depending on which sponsor bank you use.

From there, Modern Treasury’s Payments API can easily integrate with your sponsor bank to handle payment initiation and reconciliation flows for the wire, RTP, and ACH payments and returns associated with your card program.

Keeping A Central Log Of All Transactions With Ledgers

You’ll then need to build or buy a ledgering solution that can act as a central source of truth for the balances and transactions happening within your program. While data on transactions and balances often sits on multiple services and different tables in your system, a central ledger helps make that data queryable and auditable.

For a card program, reliably tracking balances and transactions is a non-negotiable when it comes to being successful or not. Without a reliable ledger, you open yourself up to the potential for things to go wrong, including mismanaging account funding balances, or introducing disparities between user balances held in your internal ledger and information coming from partner APIs.

Many issuing APIs don’t offer a central ledger database, but it can be useful to have a central source of truth independent of partner issuing APIs in order to consolidate transactions and balances across systems. Ideally, that database is easy to configure and maintain, architected flexibly, and provides a host of features—idempotency, concurrency controls, and immutability—that fintech developers have come to appreciate as best practices over the years.

Modern Treasury's Ledgers works as a straightforward, customizable ledger database that can reliably track and deliver data while being built to scale along with a company—from a handful of transactions to hundreds of thousands and beyond. Ledgers can also automatically keep a large number of balances up to date and power instant queries, which is helpful for authorization flows and balance checks. Additionally, customers can use Ledgers to track points or credits to help build custom reward programs on top of their card products.

Working in conjunction with your card issuing partner, we can easily pipe transaction data into your hosted ledger and run real-time balance checks to provide you with a high level of visibility and control over your transaction data.

Handling KYC And Transaction Monitoring With Compliance

A significant part of starting a card program involves compliance. In order to establish a well-running (and law-abiding) program, you need to ensure that you are correctly and thoroughly establishing KYC identity verification.

For many companies, compliance and fraud are not core competencies, making implementing and managing these programs at scale a challenge. For card programs, a compliance program is doubly important because of the inherent risk for fraud: you have to know who you are giving cards to and what they’ll be using that card for.

Some customers starting card programs opt to build their own KYC programs. It is important for any business considering a card program to think about where they want their business to fall on the spectrum of risk: some businesses (and business owners) are naturally more risk-tolerant than others. Depending on your risk tolerance you may want to control more of your compliance program. While outsourcing a KYC program can be faster, you can achieve greater control by setting up a program internally based on your own risk tolerance.

If you want to learn more about how Modern Treasury can help you build the infrastructure for a successful card program, reach out to us.

Try Modern Treasury

See how smooth payment operations can be.