The State of Payment Operations 2025

Our fourth annual State of Payment Operations report holds a wealth of data from product and finance leaders about the present and future of finance.

Note: This post contains insights gathered from a public online survey of over 500 US financial decision-makers from companies ranging from 500–9,999. The survey was conducted between August 14th – 28th, 2024 by The Harris Poll.

The fundamental business challenge of payment operations is the reason our founders went through Y Combinator seven years ago. Across businesses and industries, they were seeing the same problems across the payments lifecycle: indecipherable bank statements, missing or delayed expected payments, no clear picture of cash position across bank accounts. In many ways, our company was created to address this significant lack of infrastructure.

The great thing about annual surveys such as this, is that it can validate our raison d’etre as we assess the results of this year and look back at trending data. The tough thing about payment operations is that they are often so hairy, complicated, and sprawling, that trends in innovation often come slowly.

Our fourth annual State of Payment Operations Report reveals that though business leaders are eager to improve their payment operations, many companies are still relying on legacy systems and manual processes, creating operational slog and systemic inefficiencies that can result in higher costs, missed opportunities, and a diminished ability to meet customer expectations. For B2B companies, efficient, real-time, and scalable payment operations are essential. As transaction volumes grow, investing in modern payments infrastructure is no longer optional.

Here, we’ll take a closer look into these key takeaways from our 2025 State of Payment Operations report and look forward into how businesses can upgrade their payment operations to meet the speed and demand of the Instant Economy.

Outdated Systems Are Holding Companies Back

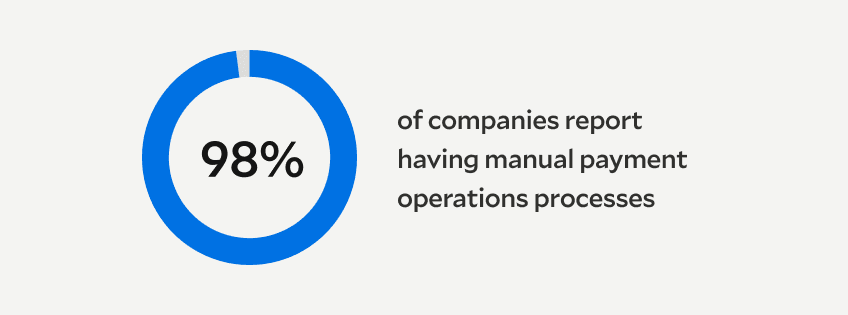

Despite the pace of innovation, for many businesses payment operations remain rooted in the past, with 98% having to perform some payment operations processes manually.

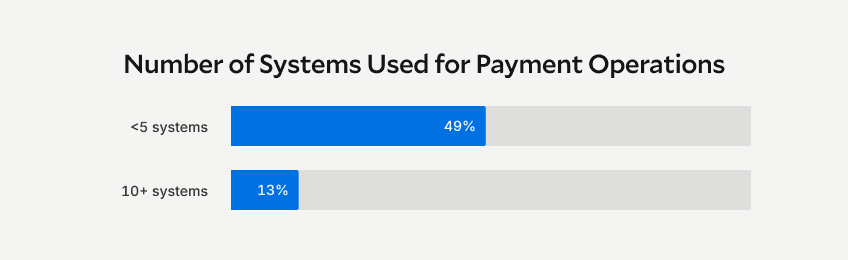

Adding to the complexity, 49% of companies use five or more systems to manage payments, and 13% have operations spread across ten or more systems.

These fragmented and manual workflows make it difficult to achieve the seamless, real-time visibility into payments required in the instant economy. Errors stemming from these issues create complicated payment workflows at best; at worst, they lead to critical disruptions or damaging headlines.

Instant Payments Gain Traction, But Challenges Persist

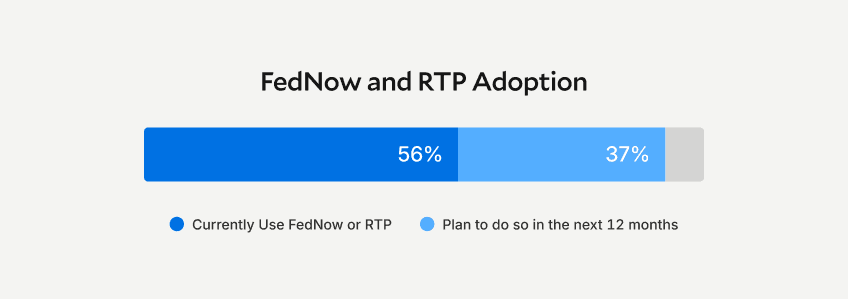

One key takeaway from this year’s report is that there’s a clear push toward modernization via investment in instant payment rails—even if many companies haven’t yet gotten rid of all their legacy processes. More than half of companies (56%) already use RTP or FedNow, and another 37% plan to do so in the next year. These systems promise faster transactions and better customer experiences.

Yet, instant payments are just one piece of the puzzle. While instant payments help companies better manage liquidity and respond faster to market needs while also delivering better customer experiences, a business’ back office still needs to be able to keep up to maximize the positive impacts. Without serious improvements to infrastructure, businesses risk losing the very efficiency gains instant payments were meant to deliver.

AI and Automation Will Continue to Redefine Payment Operations

To stay competitive, businesses are looking to the future and automation remains the way forward, with many companies investing in AI and automation now to stay competitive and efficient going forward. In the last 12-18 months, 76% of software-focused companies made significant investments in payment automation.

The rise in AI across a variety of industries seems to give financial decision-makers more confidence in deploying it for products that move money. 94% of financial leaders expressed excitement about the potential of AI-assisted workflows.

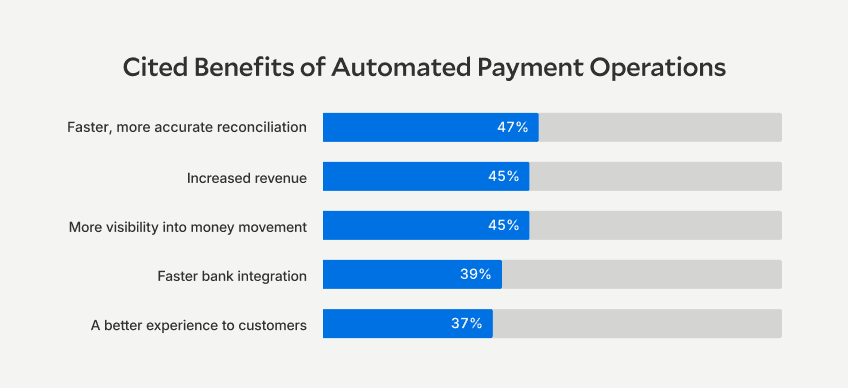

AI and automation advancements bring precision and efficiency to payment operations with greater accuracy, improved transparency, and reduced costs.

Moving Forward with Modern Treasury

Our platform exists to help companies move money confidently in the instant economy. We believe your business’ payment operations should be as fast and seamless as the real-time transactions the world is moving toward.

This year’s report delivers additional insights you’ll want to explore—download your copy here.

If you're ready to learn more about how to future-proof your payment operations for the Instant Economy, reach out to us.