Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

Title & Escrow's Paper Problems

Here, we look closer at opportunities to update the historical methods used in title and escrow transactions and how the future of payment operations can take this well-established industry into the future.

The title and escrow industry, a cornerstone of real estate transactions, has a rich history, with many firms having been established over a century ago. Today, this industry is robust and well-consolidated, with the top four title insurance groups—First American, Fidelity National, Old Republic, and Stewart Title—accounting for 81% of net premiums written in 2022. The industry is now at a pivotal moment where it can leverage modern payments technology to enhance its operations, security and customer experience.

As interest rates fluctuate, the industry has shown resilience. Despite a 31% decrease from 2022, the industry generated $15.1 billion in title insurance premiums in 2023, proving this lucrative industry ripe for growth and opportunity. However, with significant financial activity still managed through traditional, paper-based processes, the industry stands to gain immensely from modernization. By embracing digital payments and advanced technologies, title and escrow firms can position themselves at the forefront of the Instant Economy.

Leading the Digital Transformation

One of the greatest opportunities for the title and escrow industry is transitioning from manual, paper-based processes to more efficient automated, digital systems. Real estate transactions involve many documents, from property deeds to title insurance, that have traditionally been managed and stored physically. While these paper records have served the industry well, the advent of digital documentation offers a path to greater efficiency and security.

Title insurance remains a critical component of real estate transactions, protecting against financial losses due to mistakes, fraud, or incomplete records. Traditionally, title insurance processes have been slow to change, with a preference for paper documents over digital files. However, modern technology offers solutions that streamline these processes, making them faster and more secure.

For instance, Stewart, a leader in the title industry, is actively working to reduce its reliance on manual processes by partnering with Modern Treasury. Stewart processes over 1 million paper checks annually, but they are leveraging new payment technologies like Instant Payments to reduce their reliance on older methods like paper checks and wires. Brian Glaze, Chief Accounting Officer at Stewart, emphasized the benefits of this shift, stating, “The whole cost structure of new payment rails is so economical compared to wire transfers or cutting checks. We are excited about this.”

By embracing digital transformation, Stewart is taking the lead in this new era of real estate transactions and gaining a competitive advantage. The industry’s future lies in its ability to adapt to modern technology, and those who take the lead—much like Stewart has already done—will define the standards for years to come.

Enhancing Security and Efficiency with Digital Payments

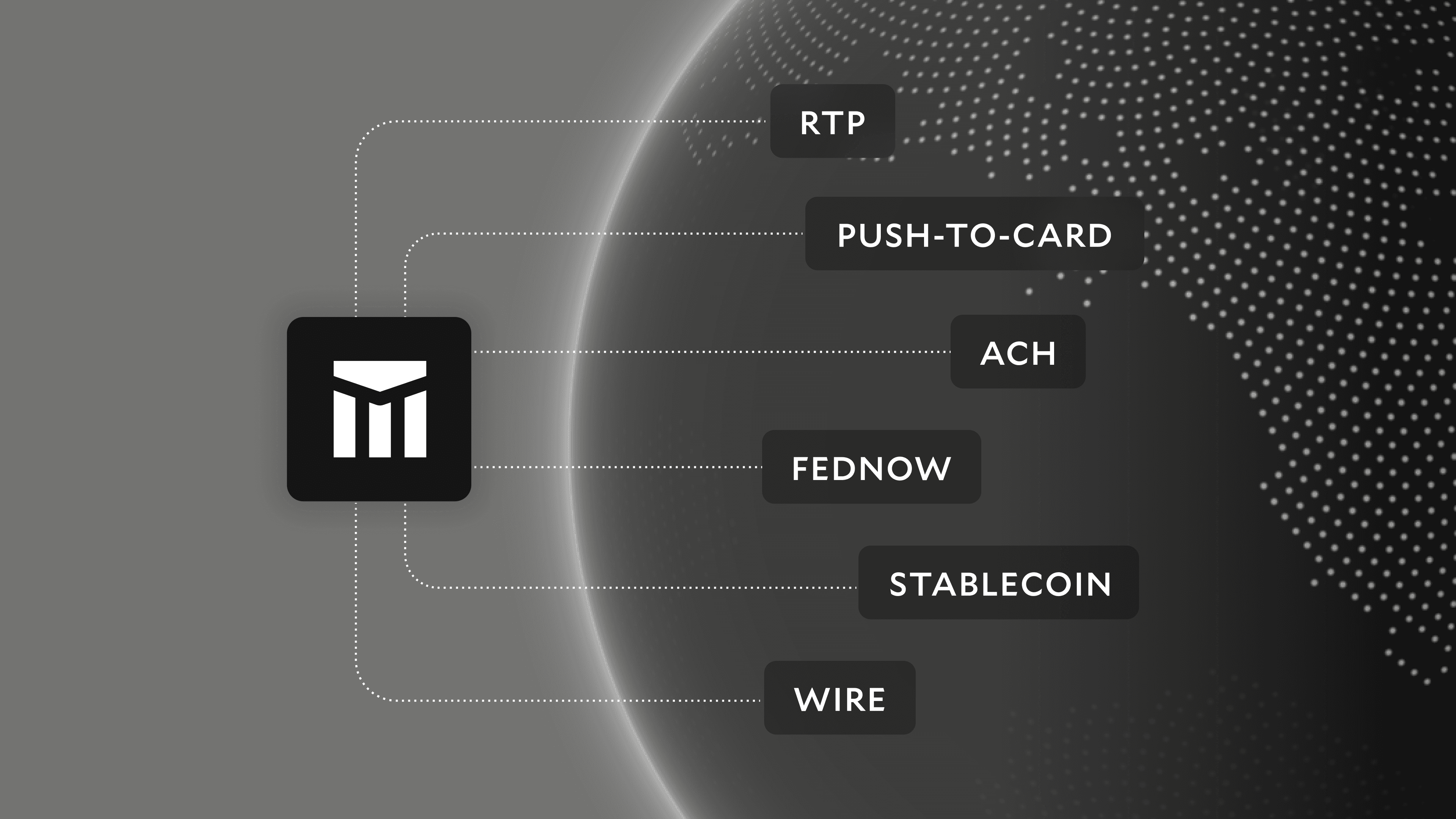

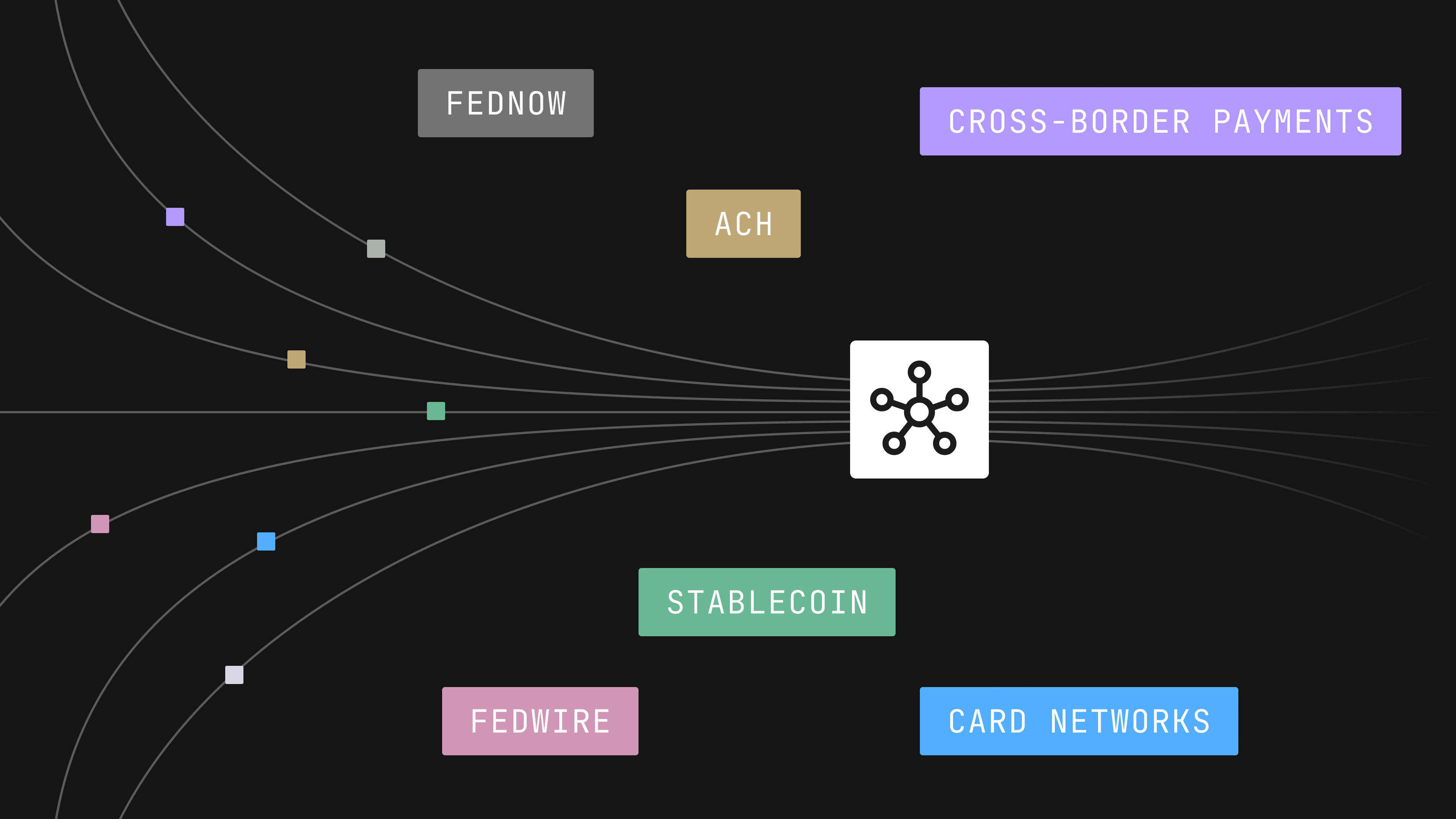

Security is paramount in the title and escrow industry, particularly regarding wire and check fraud. Traditionally, manual verification processes have been the norm, but advancements in payment technology now offer safer, faster alternatives. Payment rails like FedNow and Real-Time Payments (RTP) provide higher levels of security with push-only capabilities and features like Request-for-Payment (RFP). These innovations can streamline the title process, enhancing speed and security, and effectively addressing the challenges of wire and check fraud.

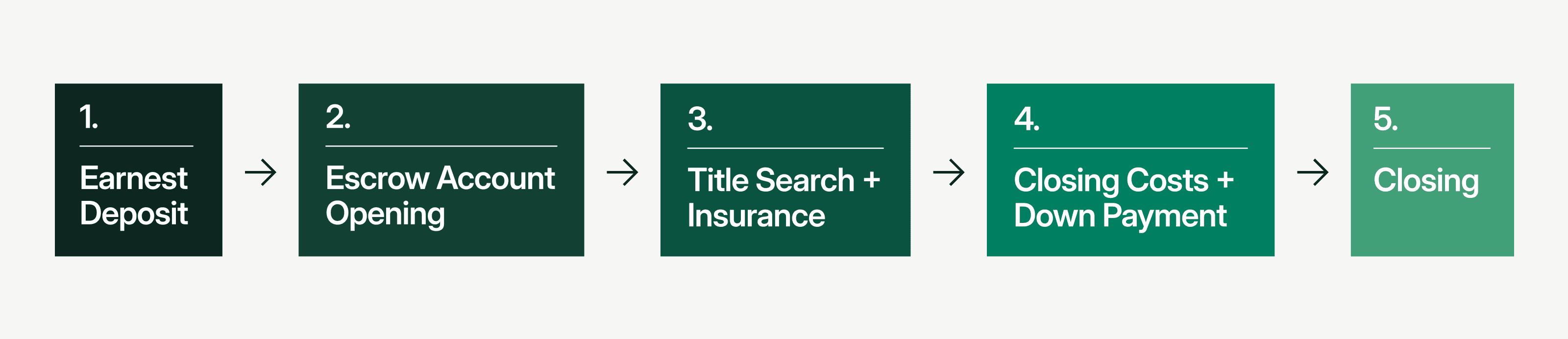

Adopting digital payments also presents a significant opportunity to reduce the time and cost of real estate transactions. Currently, closing on a home can take 30-40 days, largely due to the reliance on paper checks and wire transfers.

The steps include:

- Earnest Deposit: When making an offer on a property, a buyer usually provides a “good faith deposit” called an earnest deposit. Earnest deposits are almost always paid by personal check, certified check, or wire transfer.

- Escrow Account Opening: Once an offer is accepted, an escrow account is opened to serve as a neutral third-party intermediary, holding funds and documents.

- Title Search and Title Insurance: The title company conducts a title search to ensure there are no outstanding liens or claims on the property's title, and insurance can be purchased to protect against any unforeseen issues.

- Closing Costs and Down Payment: The buyer provides funds for closing costs, which are, again, typically paid via cashier's check or wire transfer

- Closing Paperwork Signing and Fund Disbursement: Paperwork is signed by all relevant parties, after which the escrow agent disburses funds to the seller.

- Recording and Transfer of Title: The title company records the transfer of title.

- Closing Statements: The escrow agent provides closing statements detailing the distribution of funds and any remaining balances in the escrow account.

- Good Funds: The funds are now available for immediate withdrawal or use by the relevant parties.

The prevalence of paper checks in title transactions cannot be understated. Despite advances in financial technology, most real estate transactions still occur via cashier's or standard checks and wire transfers. By moving to digital payment systems, the industry can shorten this timeline significantly, bringing it closer to the instant transactions that consumers have come to expect in other sectors.

What’s Next?

The title and escrow industry stands at a crossroads, with a clear path toward modernization through digital documentation and faster payment systems. Companies that embrace this transformation early will improve their operations and set a new standard for the industry.

The benefits of such a shift are substantial. Digitizing documentation and payments will reduce transaction times, lower costs, and enhance customer experience. In a world where consumers are increasingly accustomed to the convenience and speed of digital transactions, the title and escrow industry has the opportunity to align itself with these expectations and lead the way into the future.

Modern Treasury is a payment operations platform built for the digital age—supercharging money movement with faster payment rails, intelligent workflows, and real-time visibility, effectively modernizing outdated financial infrastructure. If you’re ready to switch to real-time operations, reach out to us.