Building for Growth and Scale: Takeaways from our Tech Talk

Modern Treasury recently hosted a Tech Talk on how growth companies can leverage embedded payments for growth, and build scalable payment operations. This journal shares key insights from in-house experts.

Modern Treasury’s payment operations platform combines a suite of APIs and dashboards to help companies manage money movement. To better understand how growth companies can set up their payments infrastructure for scale while taking advantage of innovative solutions such as embedded payments, we hosted a tech talk last week with Ani Narayan, Product Manager, and Omkar Moghe, Payments Engineer, moderated by Danielle Berger, our Head of Commercial Sales. Below is an edited excerpt of the conversation.

Embedded Payments Opportunity

Danielle: Let’s talk about the opportunity for startups in embedded payments. But first, Ani, can you help define what embedded payments are, and why early stage companies should consider them as they’re building out their product?

Ani: Embedded payments refers to the integration of payment processing capabilities directly into a software platform or application, rather than redirecting users to external payment services.

This can be valuable many reasons, but I’ll highlight a few:

- Unlocking new use cases deepen customer engagement and provide a better user experience.

- Unlocking new revenue streams and driving margins by adding payments and financial services to your products.

- Gathering deeper insights into your customers’ preferences and behaviors via payments data.

A good example is Procore, a construction SaaS company that recently added a new product called Procore Pay to help general contractors and subcontractors manage payments.

So as a founder or product manager, you might say, “This sounds great; where do I begin?” But there are some considerations:

- How you move money - what payment providers or banks should you work with, what payment rails will you use, and how to build that into your product experience.

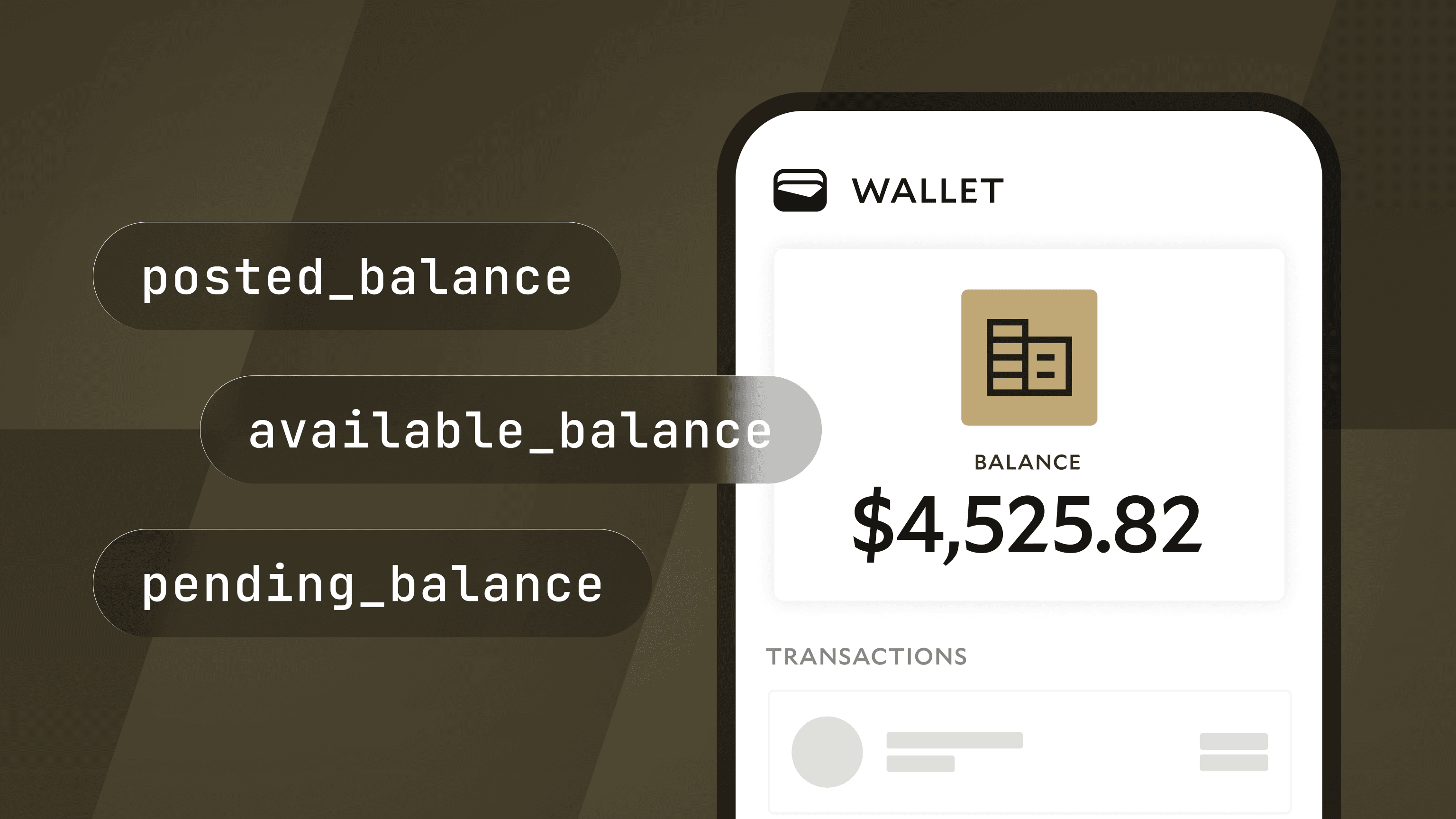

- How you track payments information - how will your ledger be architected, how will it interact with payment flows, and will it scale to handle the volumes and use cases you need.

- How you reconcile transactions - how do you ensure you know exactly what each payment was for and will you have that in a timely enough manner to close your books on time, and how to automate all that without having to linearly scale your operations team.

- How you stay compliant as you do all of this and ensure you’re honoring the commitments made to bank partners, payments providers, and regulators.

And it’s really important to think about all this from the start, because these decisions are fundamental to the long term success of my product and company.

Danielle: We’ve touched on embedded payments at a high level, but not yet the options companies have to facilitate those payments.

Companies generally have two options for doing so: either they can partner directly with a bank and sit in the flow of funds themselves, or use third-party processors that sit in the flow of funds on behalf of companies for which they move money.

Ani, can you share about the pros and cons of sitting in the flow themselves versus outsourcing to a third party?

Ani: This thought process will differ when you’re in the early stages of building your company versus when you have established traction and some level of scale.

For a very early stage company that just wants to get off the ground, a third-party processor can be a great tool for a couple reasons:

- You can defer compliance and regulatory requirements to them rather than manage in house. This can otherwise take time and resources to do yourself.

- You can increase speed to market since you’ve outsourced some requirements, and you’ll have fewer things to do to get the initial product in the hands of customers.

But a third-party processor can also slow down operations and limit transparency as your payments are going through another party, so that is a tradeoff you’ll have to make.

On the other hand, being in the flow of funds has benefits that make the compliance burden worth it.

- Faster payments. Because you streamline parties that the payment has to go through, your payment will move faster, which allows for a better user experience and could be essential to your use case.

- Wider access to different payment rails, both locally and internationally, because you’re not dependent on a third-party’s capabilities.

- Deeper visibility into a payment and the ability to handle complex use cases.

- A new revenue stream. You can make money on the float held in your bank account.

- Lower foreign exchange fees.

- Owning the relationship with your bank, which comes with other benefits like access to cheaper credit.

Danielle: Omkar, can you share some examples of customers you’ve worked with that have seen success with embedded payments?

Omkar: Yeah, one example that comes to mind is our customer . As a business, they provide APIs to help their partners—marketplaces, vertical SaaS tools, and payment processors—manage loans to small businesses on their platform. They’ve seen success with embedded payments through a deep integration with our payments product, using multiple payment rails like ACH and RTP to control speed and cost.

They control every aspect of payments through their system:

- How payments appear on the recipient’s bank statements

- When payments process by understanding ACH batch timing

- Payment status tracking + reporting/analytics

- Account verification via our API

Another example is Masterworks, a platform for buying and selling shares that represent fractional investments in iconic works of art. They’ve seen success from the seamless integration of many embedded payments products, such as payment origination, inbound payments and reconciliation, and virtual accounts.

Building a Bank Relationship

Danielle: We touched on the value of embedding payments and the benefit to companies when they choose to sit in the flow of funds themselves. But building a direct bank relationship is also not a straightforward affair.

Omkar, at a technical level, what makes integrating with a bank challenging?

Omkar: This is your standard build versus buy problem. But what it comes down to is: Is this really your core competency? For many core companies, it’s not. It’s crucial—it’s core to the business but it’s not their core business. And when it comes to integrating with a bank, there are many concepts that your team needs to understand:

- Integration. You need to know the variety of file formats. There are many standards, and some are bank- or rail-specific, and each bank has its own “quirks” like changes to standards or specific APIs that compound complexity the more banks and rails you integrate with.

- Reconciliation. You need to build reconciliation between your business and customers’ actions, like a customer clicking withdraw, and line items on your bank statement. Again, bank statement information varies by institution, and your customer data—things like invoice information—varies as well.

- Failure/edge cases. You need to be able to handle:

- Returns and return codes (the reason for payment failure)

- Returns being returned

- Notifications of Change (NOC) returns (i.e., a payment was successful but changes to the payment information are needed)

- Payments held for compliance

- Reversals

And you’ll want to build-in monitoring around all of this data like payment metrics, NACHA return rates, things like that. At Modern Treasury, our monitoring is so advanced, that we’ve actually notified customers of bank outages or payment delays before the bank itself.

Now think about doing all of this long-tail, for every bank, for every rail you have to integrate with, and this isn’t inclusive of version upgrades and maintenance, which happens for files, too. There’s a lot to keep up with, and it requires some level of expertise.

Danielle: Can you talk more about situations where you saw issues before the bank did?

Omkar: Yeah, I can share a few examples. There was a time where we noticed payment status delays on our systems. These status delays uncovered processing delays at the bank (meaning no status updates within an expected time frame).

Another time, we noticed reconciliation delays, which uncovered reporting delays at the bank and issues with their transaction posting systems.

Modern Treasury’s Offerings

Danielle: How does Modern Treasury differ from processors like Stripe or BaaS providers?

Ani: Third-party payment senders have a bank account mediating the flow of funds, which can delay payment timings, limit rail availability (e.g., no access to RTP), and minimize maximum transaction sizes—this might not be a problem if the company optimizes for card and consumer payments.

Modern Treasury is an operating system that might be a better fit for customers who need workflows built for finance and treasury teams like approval and reconciliation, faster settlement times, and want to work directly with their bank partner as much as possible.

Omkar: BaaS providers also won’t let you build to your own bank; you have to build to one of their partner banks, similar to third-party senders. Limits on transaction volume and rails could be imposed, and they don’t provide reconciliation or operational tools like approval workflows or audit logs.

Danielle: Will Modern Treasury assist with the compliance side of the business? What areas would Modern Treasury be directly involved with, and what would be required from their customers?

Ani: It’s no secret that compliance is hard, especially with payments. The regulatory environment is changing, and it expects more from companies that move money.

There are many elements of a healthy compliance program; some key ones are:

- Understanding money transmission laws in your state and country, and determining requirements to get set up with the right bank account.

- Investing in robust KYC/KYB and Transaction Monitoring

- Tracking customer balances and activity accurately to report to the bank and regulators

- Operational compliance, meaning robust internal controls and regular auditing

Modern Treasury can either directly or indirectly help with these. Customer requirements will vary based on what types of compliance their bank and partners require.

Thinking About the Future

Danielle: Let’s take this back to the current state of the world—high interest rates, a dearth in funding in fintech, recent bank runs, and a large regulation crackdown on banks and the types of businesses that they support, impacting BaaS providers.

What final advice would you give to growing companies—who may be facing headwinds from these recent events—in optimizing for float or risk management, to ensure they're thinking about stability and scale?

Ani: Capital is scarce. But scarcity breeds quality, and I’m optimistic that high quality products and business models will thrive. We’re already seeing this with the recent bounce in public fintech stocks like Adyen, Block, and recently Affirm, with success from Black Friday.

My advice would be to find partners to help you navigate the changing regulatory landscape, and trustworthy advisors who will give you honest feedback so you can deliver high quality services and products that compete in the scarce environment.

Omkar: From a technical perspective, I think the best thing you can do is build redundancy into your business. Have a multi-bank, multi-rail strategy that can work as a fail-over if ever there’s a system outage or other unforeseen event. Having a backup plan to keep your business running is key. This ties into your uptime, reliability, and brand trust.

Next Steps

The full tech talk will be available on our Resources page soon.

Modern Treasury enables companies to automate payments from end-to-end, including reconciliation, payment orchestration, and ledgering. If you are interested in learning more, .