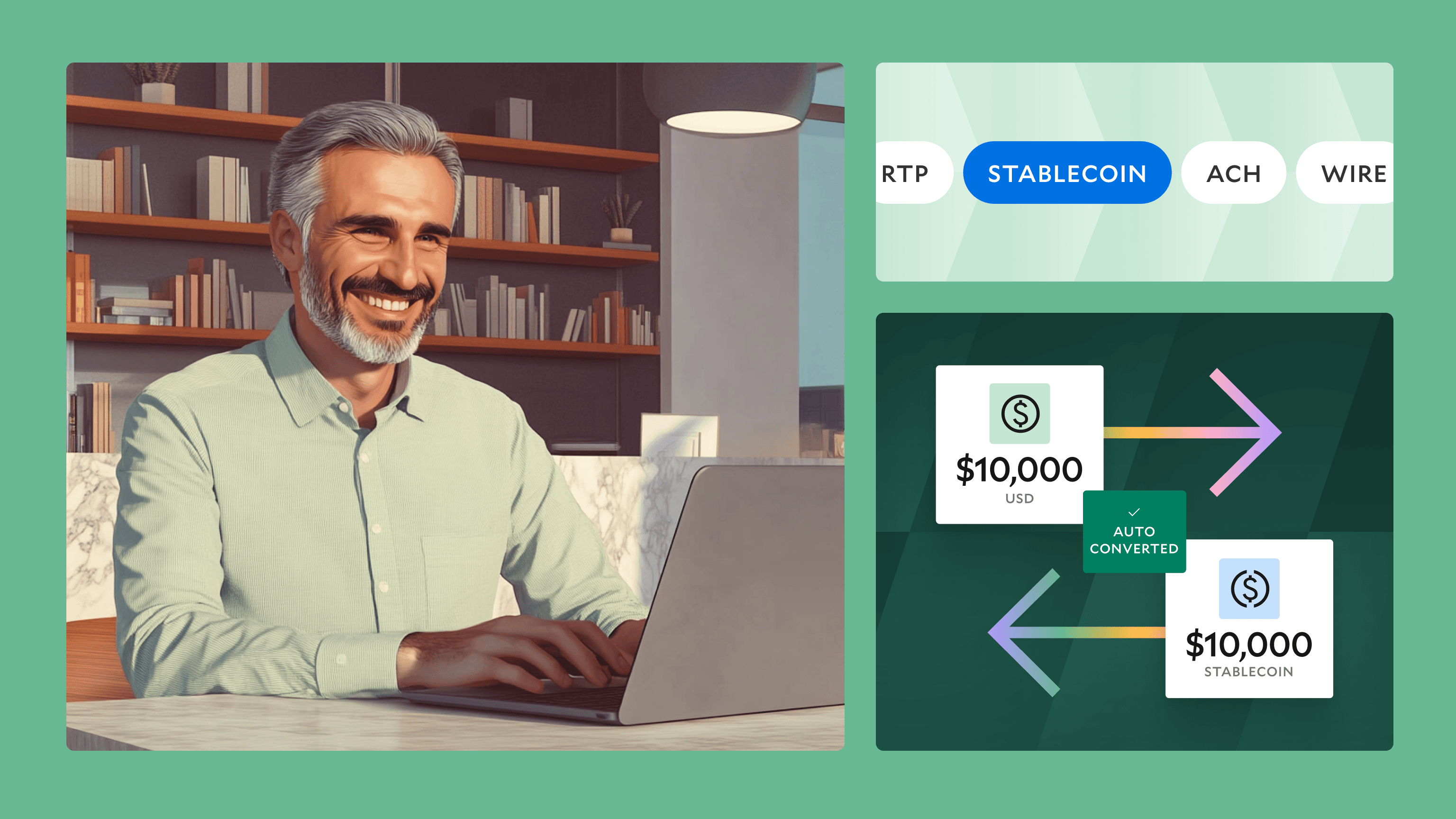

Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

September/October Changelog

In September and October, our product and engineering team shipped several new features including updates to payment initiation, invoicing, ledgers, UI & UX updates, Bulk APIs, and more.

In September and October, our product and engineering team shipped several new features including updates to payment initiation, invoicing, ledgers, UI & UX updates, Bulk APIs, and more.

Payments

Reconciliation: BAI2 File Imports

Modern Treasury now allows customers to import BAI2 files directly into Modern Treasury for the purposes of reconciliation. This can be a helpful alternative for customers who have limited ability to use one of our managed bank integrations, or customers who prefer BAI2 imports as a way to complement manual workflows. For more information, read our guide here.

Invoicing: Backdating Due Dates

Modern Treasury now supports invoices with backdated due dates. This is helpful for companies who need to retroactively account for invoices after the fact.

Invoicing: Linking Virtual Accounts with Invoices

Users now can associate a virtual account with an invoice. When the invoice is paid, the associated funds will be deposited in the linked virtual account. When a virtual account is associated with an invoice, the invoice displays banking information from the virtual account. This is helpful for customers who need to ensure that funds associated with invoice payments of a certain type are always deposited in a given virtual account.

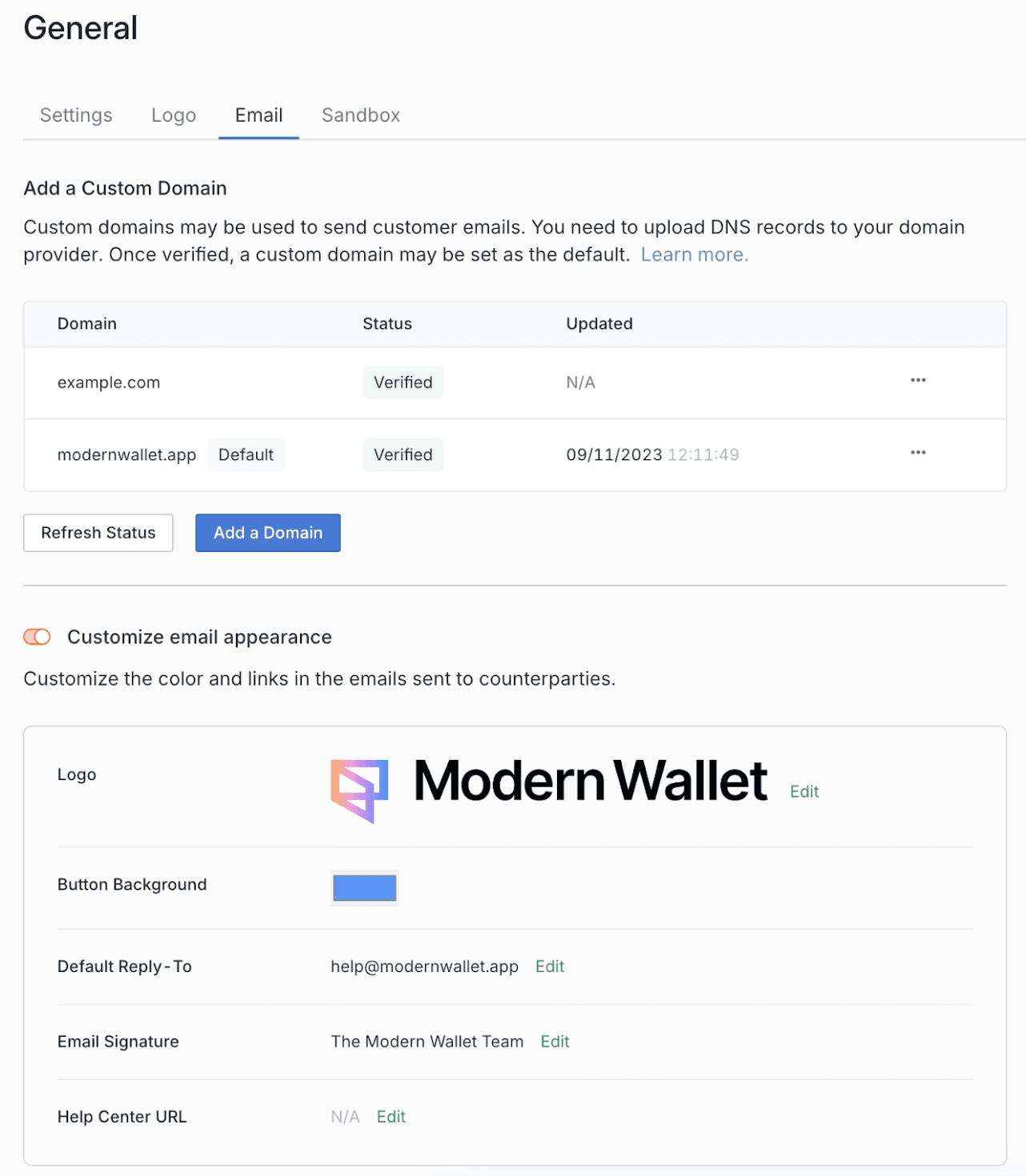

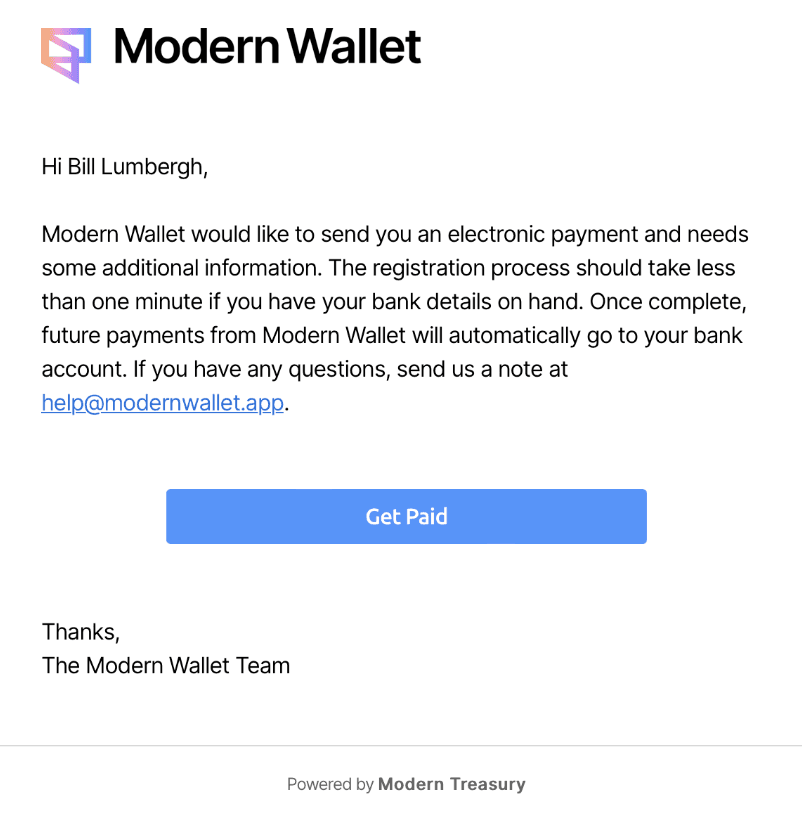

Invoicing: Custom Emails & CSV Attachments

When users send an invoice via Modern Treasury, the system sends the counterparty an email notifying them of the invoice. Customers can now customize the logo, email reply-to, email signature, CTA button color, and footer help center link in such emails. To use custom emails users must setup and a default and verified custom domain. For additional information, you can read our docs here.

In addition, users can now attach CSV files to invoices sent via the Modern Treasury UI. This is helpful for customers who need to transmit data to counterparties alongside invoices. Emails sent via Modern Treasury that are tied to invoices also include PDF files.

Global Payments: Global ACH

We have added support for Global ACH to our connections with JP Morgan, Citi Bank, Goldman Sachs, and Silicon Valley Bank. Customers can now leverage cheaper cross-border payments across 20+ currencies, with more coming soon.

Global Payments: Expanded Local Payment Rails

We have expanded Local payment rails support in UK, Australia, Europe, Canada, to our connections at JP Morgan, BMO, and Citi Bank. Customers can now establish local banking relationships in these regions, and transact over local payment rails.

Bank Integration: Added support at UMB Bank

We have added support for Reporting at UMB Bank to provide real time visibility and reconciliation of balance and transactions.

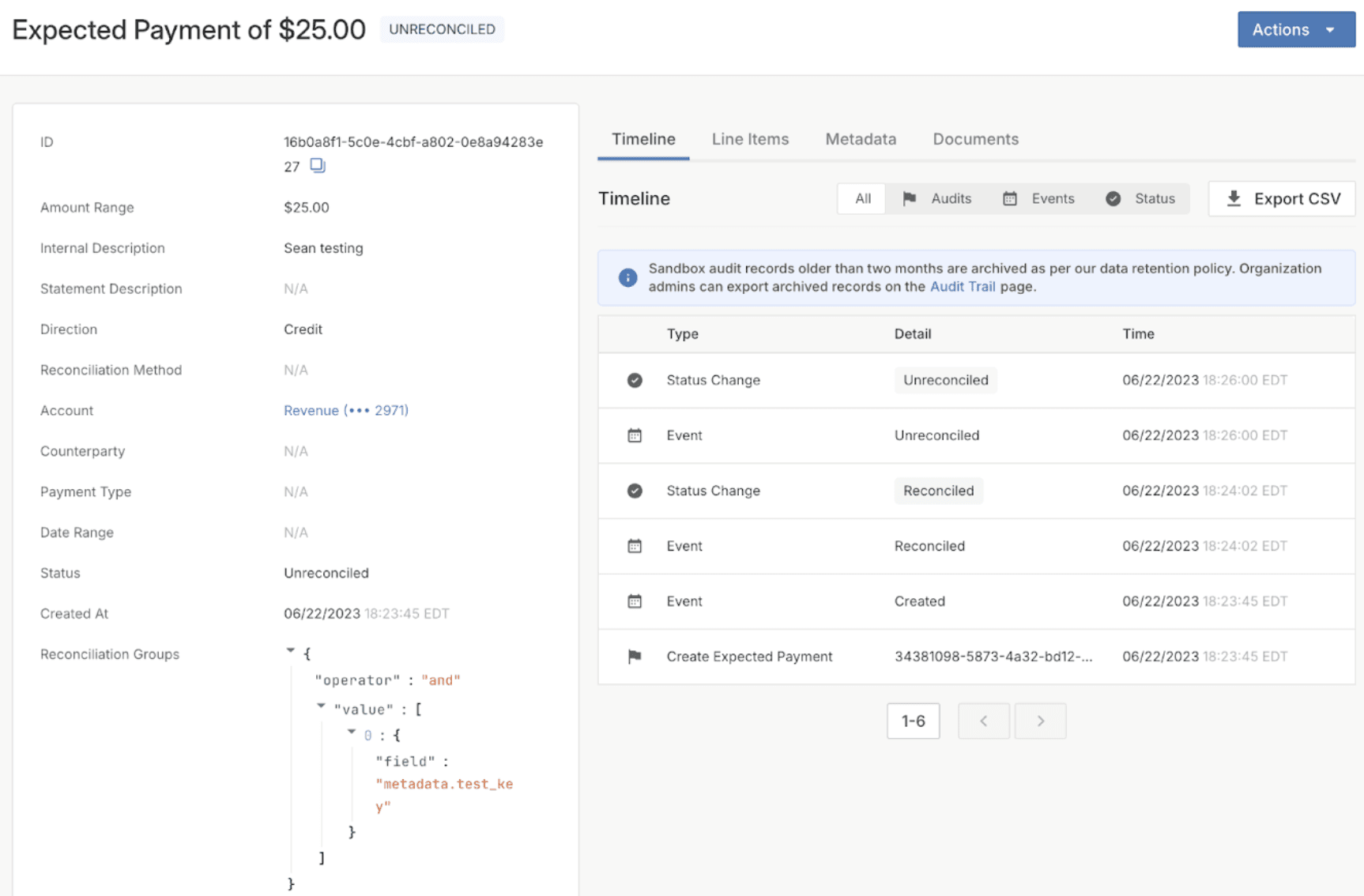

Expected Payments: Timeline

Expected Payments now contain a timeline field, similar to Payment Orders. This lets users easily track Expected Payment status changes, events, and audit trails in one view.

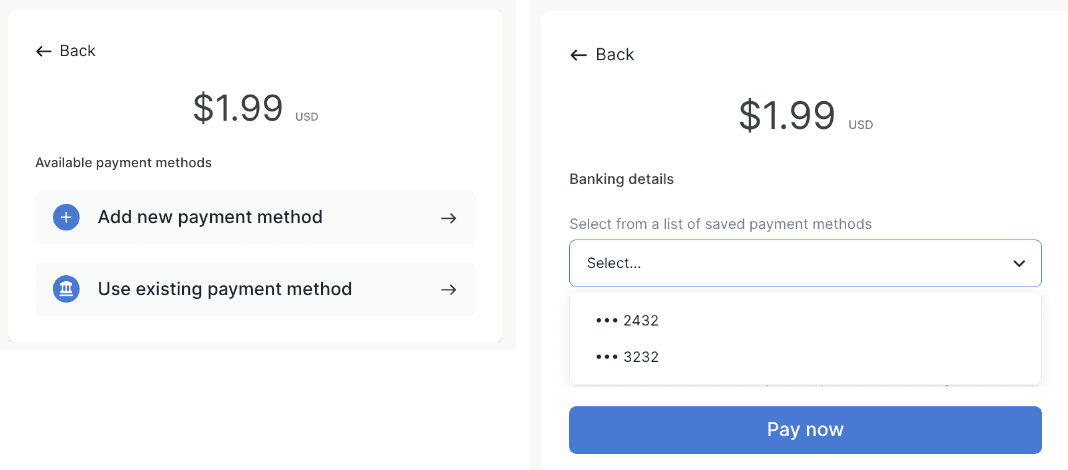

Payment Flows: Saved External Accounts

Our Payment Flow Pre-Built UI allows customers to embed a UI in their application to charge a counterparty. Historically, Modern Treasury required the counterparty to input their bank account each time they were making a payment. With this update, if the counterparty wants to make another payment, they can select from their saved bank accounts.

When adding a new payment method, a counterparty can also choose to save it for future uses. Customers can also choose to filter this list by verified bank accounts (e.g., via Plaid or microdeposits). For additional details, read our documentation here.

Ledgers

Embedded Ledger Transaction Forms

Customer can now create a ledger transaction directly from the Payment Order and Expected Payment fields in the UI. This allows customers to record the ledger impact of manually created payments.

Customers must have active ledgers to see this feature. When creating a payment object, a section in the UI will allow ledger entries to be specified. The resulting ledger transaction will be posted when the associated payment is reconciled.

Ledger Event Handlers

Customers can now configure common ledgering patterns as templates called ledger event handlers. When transactions occur, they can be ledgered by simply triggering these templates, without having to specify the underlying double-entry transactions.

The Ledgerable Event represents a simple business event (such as interest accrual, billing customers, etc.) and includes all the context needed to create a ledger transaction. The minimum required fields are the name of the event, and the amount.

The Ledger Event Handler orchestrates the interpretation of the event into a double entry ledger transaction. Constants or fields from the ledgerable event may be pulled into the ledger transaction creation.

Ledger Balance Alerts

Customers can now create configurable webhooks to fire when ledger account balances go out of a given range.

This is helpful for customers who need to trigger actions based on account balances dipping below a minimum or rising above a maximum. For example, I may want to know that I have an abnormally high outstanding balance for a given user, that a given asset balance is abnormally low, or that a user balance has gone negative. For more information, read our guide here.

Platform

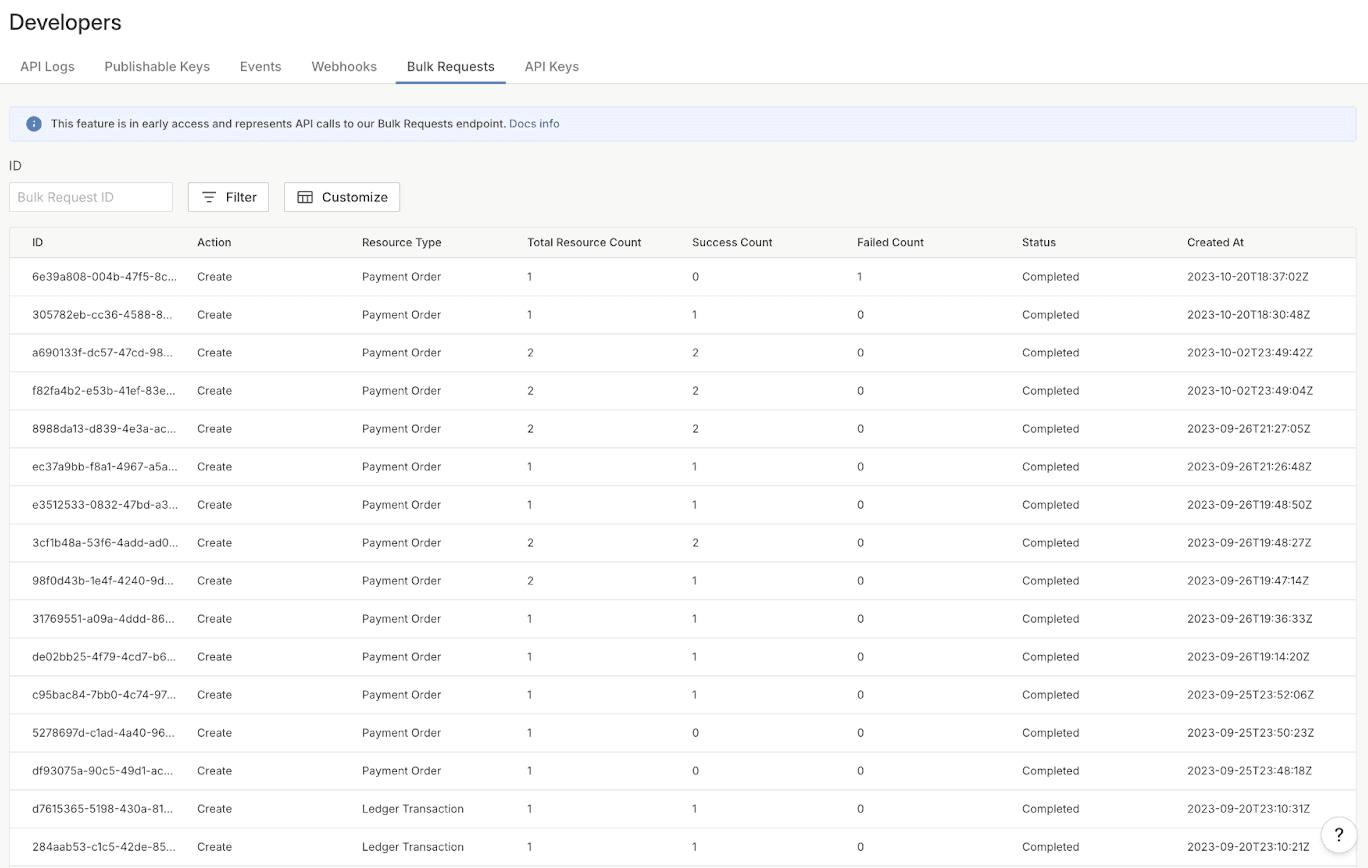

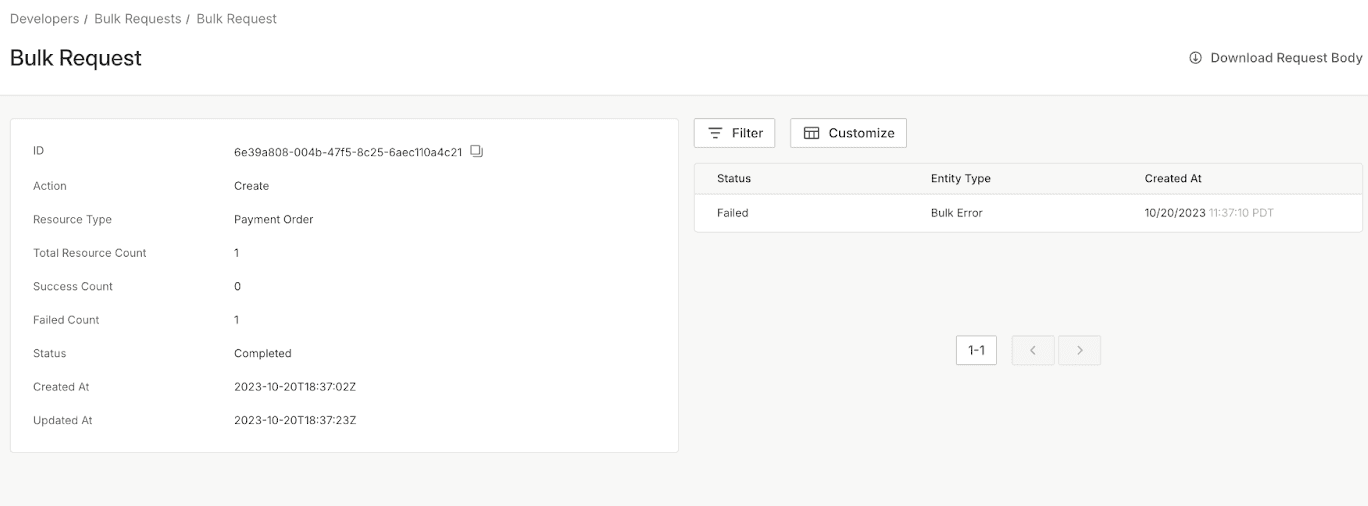

Bulk APIs (Invite Only)

We added support for bulk operations in the API, allowing customers to generate a high number of API resources with a single call. Resources supported at launch include Payment Orders, Counterparties, Ledger Transactions, and Expected Payments. This is particularly helpful for customers operating at a very high scale, as they are likely to hit rate limits using the API.

Resources can be created via API or UI. Past bulk operations can be seen under the developer section of the app. You can read our API reference for bulk operations here.

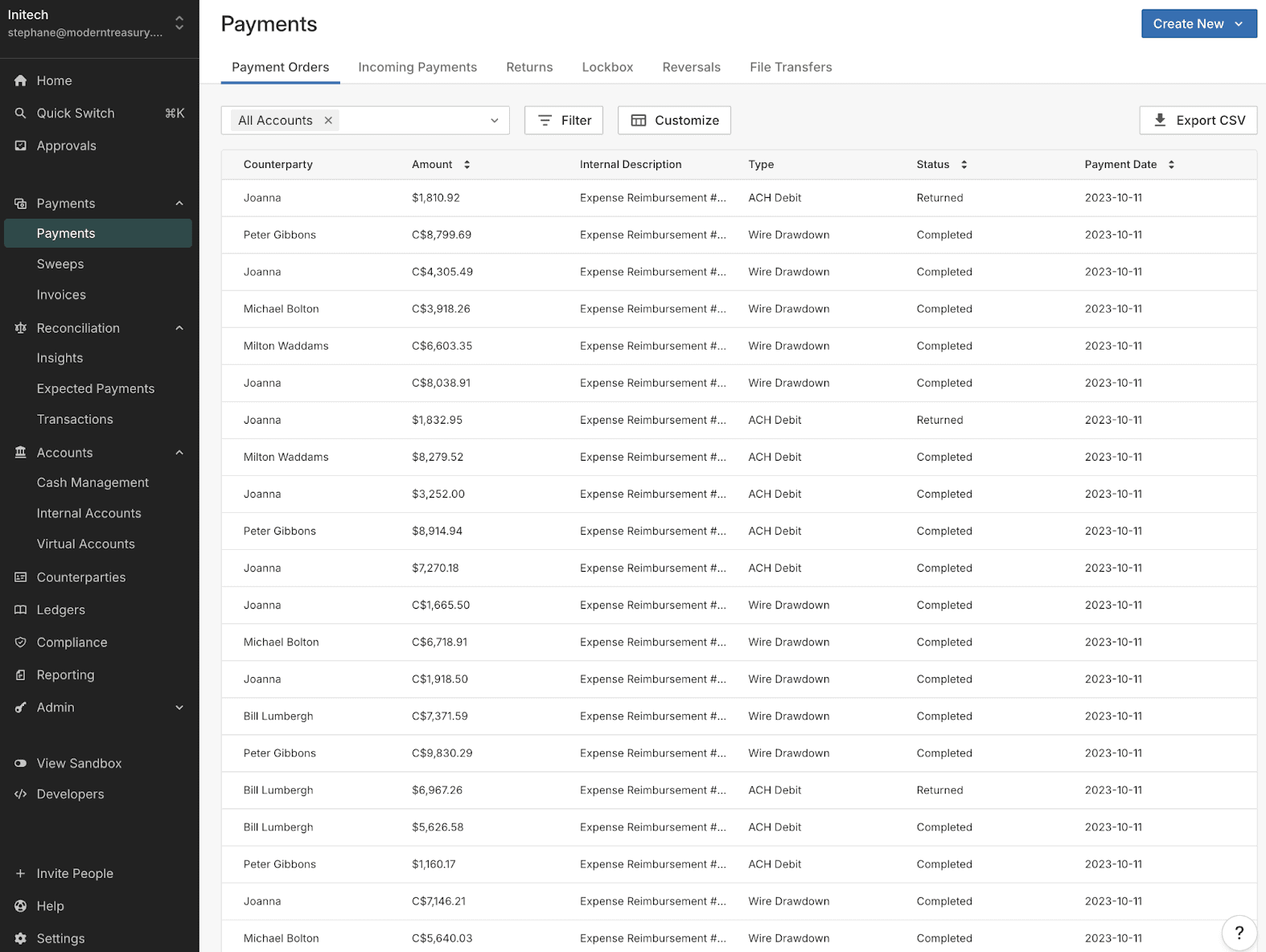

UI Refresh: New Nav & Table Sorting

The majority of our application has been refreshed with new visuals, including dark side navigation, new page headers, updated 404 pages, new colors, a new side nav with updated groupings (Payments, Reconciliation, and Accounts), as well as approvals as a primary link. We have also added the ability for customers to sort columns across the entire application.

Changes in Data Retention Policy

As an investment in continued security and performance at scale, Modern Treasury has updated the data retention policy for the following resources:

- Audit Records

- Request Logs

- Events

- Webhook Delivery Attempts

These resources can be retrieved via the UI or API for up to four months for live records and two months for sandbox records. Audit Records, Request Logs, and Events created before these cutoff dates can still be retrieved via a CSV export. Webhook Delivery Attempts can also be viewed up to six weeks after creation, but cannot be exported after this time period. Read more about this change and our overall data retention policy here.

Push to Warehouse Status Page

Our Push to Warehouse feature has been added to our status page.

Next Steps

If you have any questions or feedback about any of these updates, or if you’re interested in learning more about Modern Treasury, get in touch.