Join us at Transfer 2025 to hear how industry leaders are building payments infrastructure for a real-time world.Register Today →

Real-Time Payments, A Generational Shift

RTP has launched, and FedNow is on the horizon; faster payments in the US are becoming a reality and changing the way we think about money movement.

Introduction

Since the launch of RTP in 2017, and the imminence of FedNow, there’s been a lot of talk in recent years about how real-time payments will change the future of money movement. And with the Federal Reserve updating the launch timing for the new real-time payment rail, there’s now a definitive timeline for when faster payments will be more widely accessible. Our co-founder and CTO, Sam Aarons, said recently that FedNow is the “closest thing we’ve seen so far to have ubiquitous real-time payments in the United States.”

With such a sea change comes the need to prepare. More than three-quarters of US money movement takes place over ACH and wire transfers. According to the Fed, in 2021, an estimated $992T moved over wires alone. Imagine that transaction volume occurring in a system where each payment is processed individually and settles instantly, 24/7/365. It’s hard to fathom. That’s because we first need to change our mindsets around what payments can be.

A (Very) Brief History of US Payments

US payments, at least in recent history, have not dealt with real-time transaction or settlement. Ever since the exchange of cash was replaced with checks and credit cards, we’ve understood that a payment lifecycle would be extended, accounting for time taken at clearing houses or for credit repayment. Banks incorporated cash float to compensate. Businesses hired accountants to reconcile payments to a general ledger because the payment date and settlement date are disparate. We’ve normalized waiting.

Each iteration of payment innovation, we’ve tried to get closer to a system that fits what our Head of Engineering, Shruthi Murthy, calls “the three Fs”: fast, low-fee, and fraud-free. And if we think about it, each iteration has been a proxy for the “real-time” exchange of cash.

Cash transactions are fast: you hand over the money for the good or service and it’s done. They’re low-fee: in fact, no-fee. And they’re (usually) fraud-free: in person, you know who you’re handing your money to, and it’s hard to pull it back. Paper checks, credit cards, and even wire transfers are all attempts to mimic that exchange. And RTP and FedNow might be the closest we get to doing so.

Real-Time Payments are Not New

It’s important to note that other countries have already adopted or are adopting faster payments. FIS reported that nearly 60 countries have faster payments systems, almost four times as many countries as in 2014.

The UK’s Faster Payments service network is over a decade old, and Sweden’s Swish payments launched in 2012. In 2014, Singapore launched Fast and Secure Transfers (FAST), and in 2016, India piloted their United Payments Interface (UPI) platform. China has two closed loop systems, one through digital wallets and the other through Quick Response (QR) codes. In 2018, Australia launched its New Payments Platform (NPP). And we’re just scratching the surface.

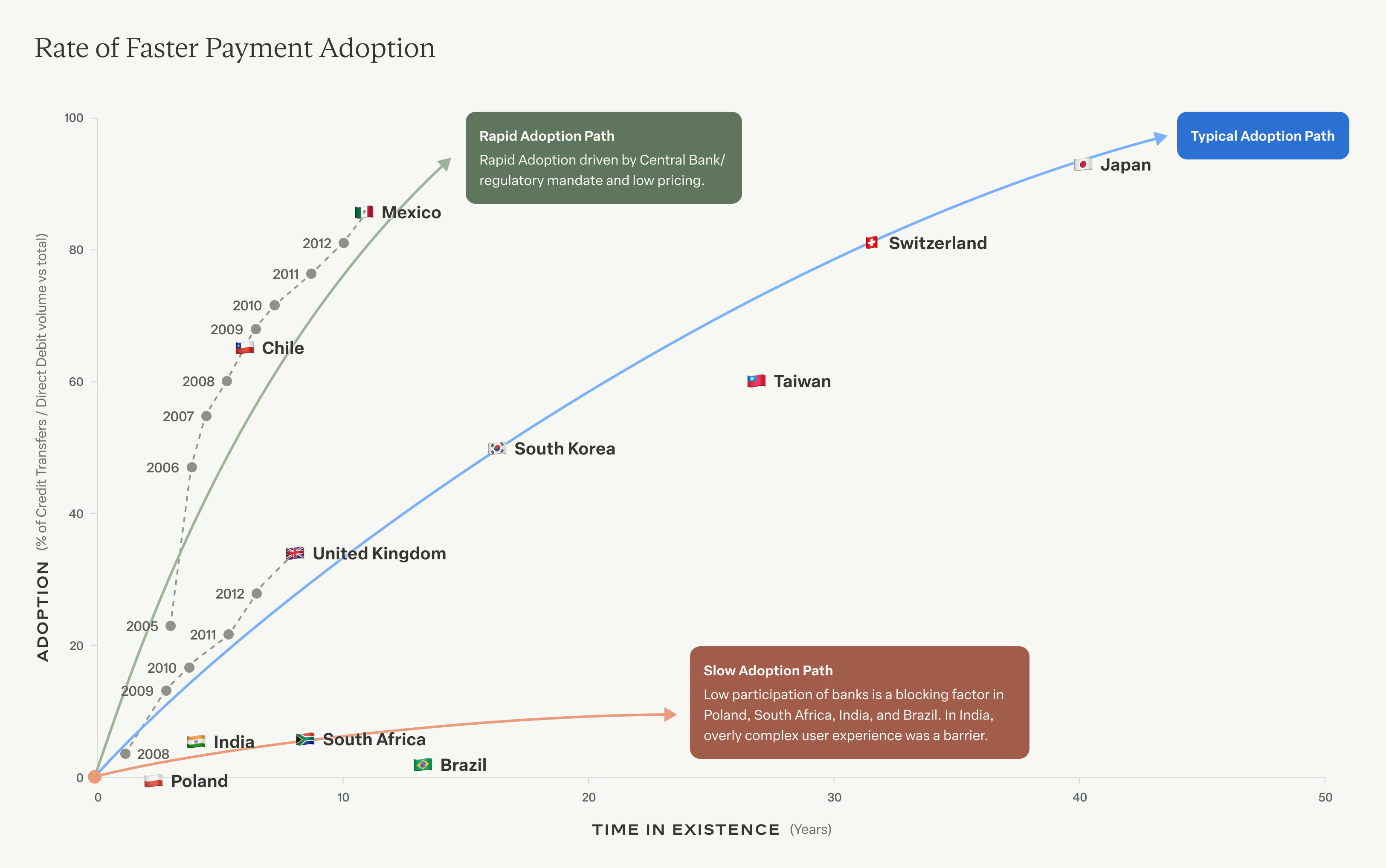

Still, the rate of adoption amongst countries with faster rails has been mixed. The best data we could find on adoption comes from this SWIFT report from 2015, and shows three curves of adoption:

A lot of these countries have a unified central banking system, so it was easier to standardize faster payments. Additionally, many of these countries are not as reliant on credit cards as the US, which makes adoption easier. But the desire for speed and convenience has fueled excitement for faster payments opportunities here, too.

Moving from Batch to Real-Time

The real pivot point for adoption begins with a mindset shift: from analog to digital, batch to streaming. We can’t just lift and shift our ACH batch system and make it move at a per-transaction rate. And we don’t need to. There’s a place for batch processing: it’s cost-effective to batch high-volume transactions that are not time-sensitive.

But for payments that are time-sensitive, real-time 24/7 settling is a game-changer—getting us closer to the future where all payments begin and end in software. Since its launch in 2017, RTP has had steady rolling adoption across banks, and FedNow will open the door to even more financial institutions. This wide coverage at a nominal charge—$0.045 per transaction—will help drive adoption, and give the US a real shot at real-time payments.

The adoption of real-time payments opens the door to even more exciting opportunities: fast, secure, low-cost cross-border payments. In a recent webinar we sponsored on Modernizing Payments, Jim Colassano of The Clearing House, called these “the holy grail” of payments. Already countries are working on ways to do this effectively. In the Eurozone, TARGET Instant Payment Settlement (TIPS) was launched in 2018 for cross-border payments in Euros, and this year, is expanding to Swedish Krona as well.

What’s Next

As Modern Treasury Co-founder and CEO, Dimitri Dadiomov, said in his fireside chat with Protocol last month, it’s the most exciting time in payments since the 1970s. And it’s more important than ever to have a modern payment operations solution that can meet the speed and efficiency of new payment innovations. If you want to learn more about faster payments and payment operations, reach out to us.

Try Modern Treasury

See how smooth payment operations can be.