Modern Treasury has acquired Beam.Build for what's next →

Expanding Support for Complex, High-Volume Reconciliation

Today we’re announcing a host of features designed to help enterprises automate and configure complex reconciliation processes.

Companies are sending an increasing volume of payments with software as money movement becomes an embedded part of more products and services. Reconciling these payments is complex, particularly when companies are handling high payment volumes or fragmented data sources.

If reconciliation is not managed well, closing the books becomes labor intensive; companies need to work through internal ledger and bank statement discrepancies, and exceptions that require manual resolution. Finance and Engineering teams wind up scrambling to figure out what happened while worrying about the accuracy of earnings or cash positions.

Our reconciliation engine is designed to support complex reconciliation, and we have the privilege of automating reconciliation for some of the most innovative financial services, fintechs, and marketplaces in the US.

Today Modern Treasury is announcing four new capabilities to support more enterprise—and therefore complex, high volume—reconciliation use cases:

- Reconciliation rules for automated matching

- Exception management workflows

- New data ingestion methods

- Account balance reconciliation

Reconciliation Rules

Reconciliation Rules enables users to customize Modern Treasury’s advanced reconciliation engine to fit their specific fund flows and data nuances. Previously, Modern Treasury automated payments originated within the application, and had a simple default policy for attempting to reconcile non-originated payments (e.g., inbound wire or ACH).

The reconciliation engine now supports more complex logic, and can handle common transaction reconciliation scenarios, for example one-to-one, many-to-one (e.g., multiple card swipes paid out in a single batch transaction each day), and one-to-many (e.g., a single invoice paid in multiple installments). The engine also supports both received payments and payments originated outside of Modern Treasury.

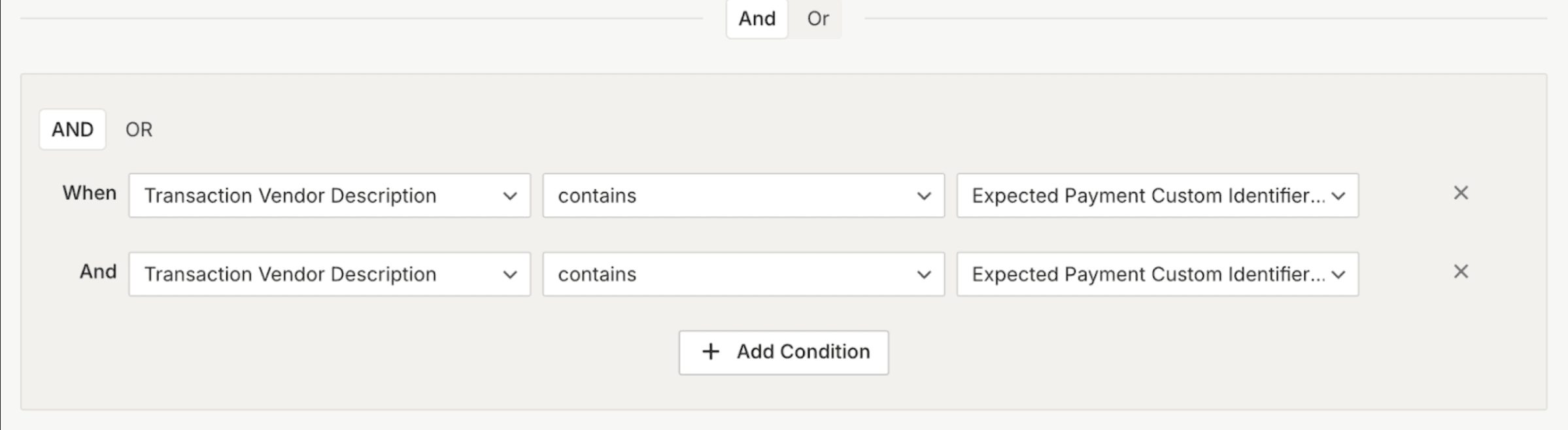

Reconciliation Rules are created and managed directly in the dashboard and don’t require engineering involvement. Sophisticated rules can be created by combining conditions with ANDs and ORs, or leveraging user-defined custom identifiers (e.g., reference numbers, counterparty email addresses, or merchant names) to do advanced string matching against bank data.

Finance teams can adjust rules over time allowing for accuracy to be continuously improved. This allows operations teams to directly intervene as needed, focus on business rules and ensure automation is reliable and trusted.

More information about using Reconciliation Rules can be found in our guide .

Exception Management Workflows

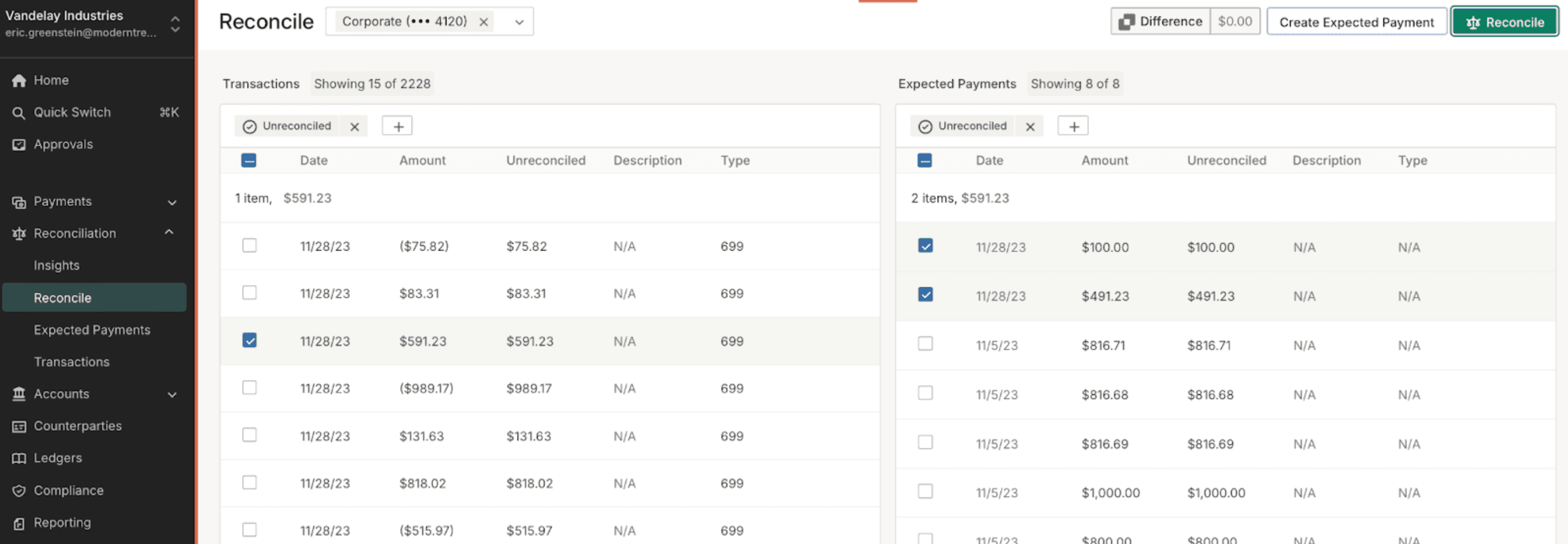

Exception management is easy and fast in Modern Treasury’s workstation. Users can quickly identify and resolve exceptions by triaging unreconciled Transactions (the line items in a bank statement) alongside unreconciled Expected Payments (our object to represent payment intent).

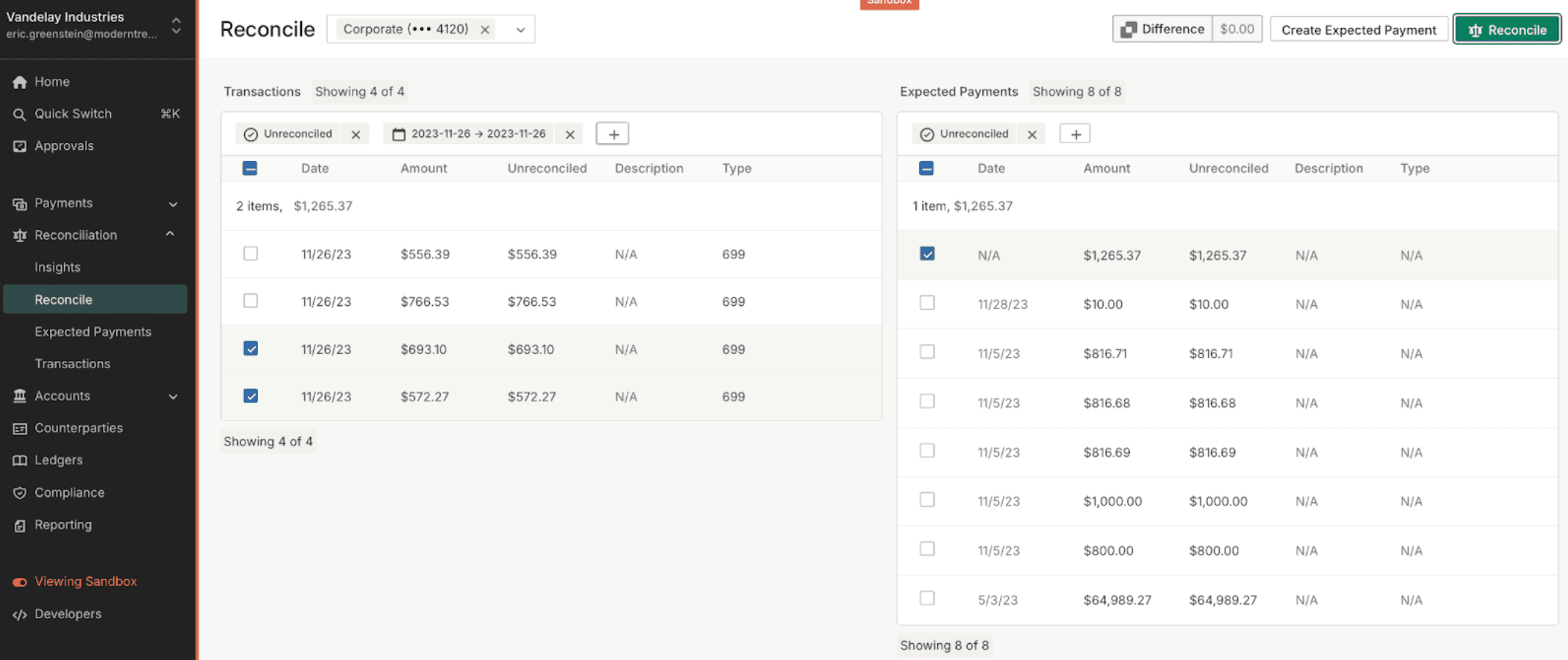

Now users can resolve additional types of exceptions within the same workflow. For example, users can manually reconcile batch payments exceptions (one Transaction to many Expected Payments).

Or reconciling multiple Transactions to one Expected Payment in the case of payment installments.

Users can handle scenarios where a Transaction is for less money than expected. They can choose to wait for an additional payment, or simply mark the Expected Payment as reconciled, and either roll over the balance or write off the loss.

This functionality enables finance teams to breeze through reconciliation workflows. It also builds on our recently announced AI suggestions feature, which allows companies to quickly manage exceptions. Modern Treasury can act as a central workstation for finance teams to speed up reconciliation.

BAI2 File Imports for Reconciliation

Continuous and automated reconciliation requires a reliable stream of normalized bank transaction and balance data. The most reliable and easiest way to ingest bank data is by setting up a managed bank connection—Modern Treasury supports several dozen of the largest banks in the USA.

For banks that are not currently supported by a managed connection, there are now additional ways to move data into Modern Treasury for reconciliation and cash management: BAI2 bank files can now be ingested directly via API or uploaded in the UI.

Or alternatively, transactions and balances can be posted directly via API.

With these alternative solutions, companies perform reconciliation in Modern Treasury without a direct bank integration. For more details, read our guide here.

Account Balance Reconciliation

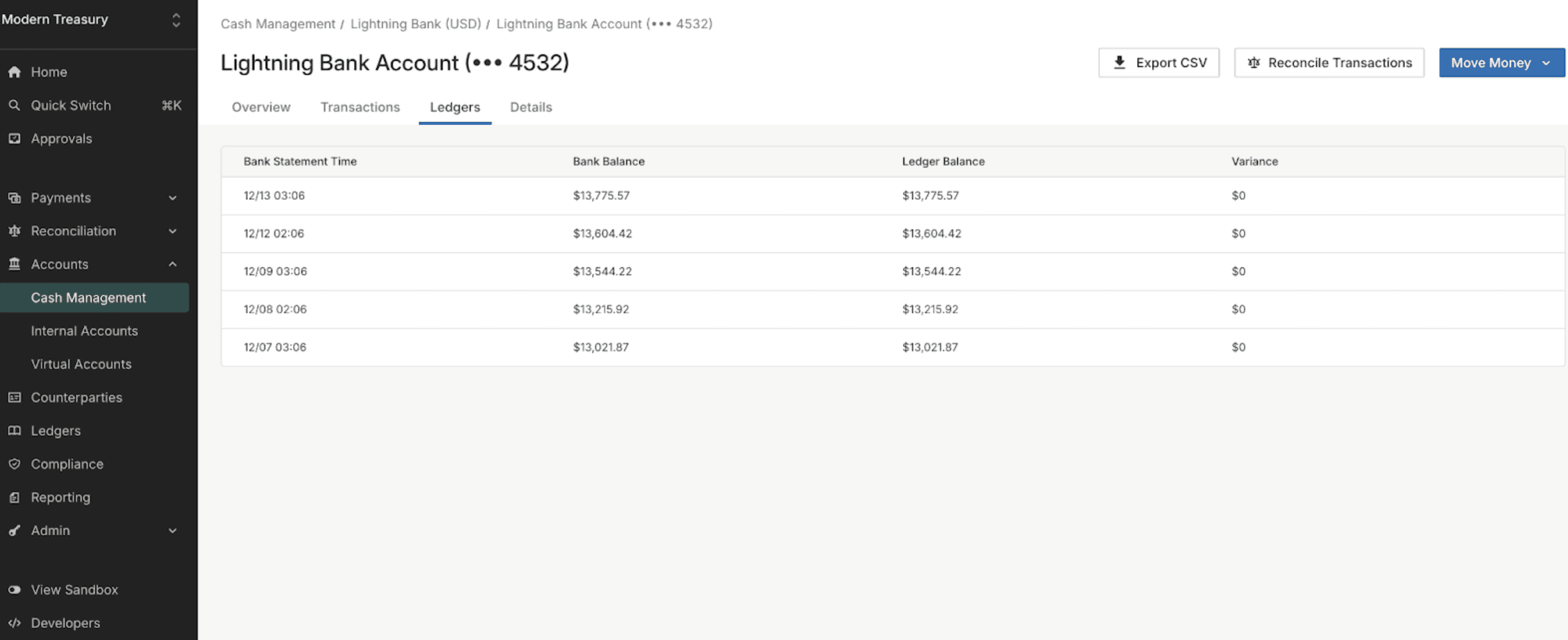

Finally, customers can now identify discrepancies between ledger account balances and internal accounts.

Ledger Accounts are used to track discrete numerical balances of any kind in our ledger database. Internal accounts are representations of customer accounts that are connected to Modern Treasury.

This enables two sources of balances to be kept up to date and reconciled continuously. When companies use FBO accounts at banking partners to hold balances on behalf of users, maintaining an accurate subledger of users' balances is required by many banking partners.

For more on this new feature, read our documentation here.