Join us at Transfer 2025 to hear how industry leaders are building payments infrastructure for a real-time world.Register Today →

The Difference Between RTP and RFP

In this journal, we cover RFP, its differences from RTP, and the potential it has to influence faster payments adoption in the US.

When it first launched in 2017, the Real-Time Payment Network was the first new payment rail that the US had seen in 40 years. The ability to send funds instantly, across financial institutions, was game-changing for US payments. Now, another powerful new tool is available in the form of Request-for-Payment (RFP).

While they’re both options for faster payments—and the similarity between the two acronyms may be confusing—RTP and RFP are not the same thing. In this journal we’ll take a deep dive into how RFP works, how it differs from RTP, and its potential to influence widespread adoption of faster payments in the US.

What is RFP?

Request-for-Payment (RFP) is a messaging system paired with an instant payment. Using RFP, businesses can send a bill or invoice straight to a customer using that customer’s mobile banking app. The RFP can include all the information a customer needs to remit the requested payment, meaning the customer can then approve and send the payment from their banking app in a single step.

RFP is not just an instant payment concept. In fact, it’s also used on the ACH network. Businesses currently using the ACH Network can utilize RFP by agreeing to Nacha’s Request for Payment rules within existing trading agreements.

However, what makes it potentially game-changing is when the request occurs on an instant network, such as the RTP network. Citibank, BNY Mellon, JPMorgan Chase and PNC Financial Services Group offer RFP messages using the RTP Network. Once FedNow launches in 2023, all federal reserve banks on the FedLine® network—or over 10,000 financial institutions—will also have access to RFP transactions.

What is the Difference Between RTP and RFP?

While both RTP and RFP are used to initiate and complete forms of faster payments, the two are fundamentally different in a number of ways.

Push vs. Pull

RTP payments are credit-only (also called “push” payments), meaning that transactions are initiated via an account credit with the payer giving permission to “push” the funds from their account to another. RFPs, on the other hand, are “pull” payments: a customer receives an RFP, reviews it, and then consents to having the funds debited (“pulled”) from their account.

KYC/KYB

To ensure that a business minimizes their rate of failed RFP requests, it is important that they know who they are transacting with and requesting payment from. RFPs require explicit consent from the recipient, so the risk of unauthorized payments or insufficient funds are low. Strong Know-Your-Customer (KYC) and Know-Your-Business (KYB) compliance programs can still help with reducing fraudulent or failed RFPs. Because they are push transactions, KYC and KYB compliance programs don’t apply in the same way to RTP transactions.

Transaction Data

In the case of a standard RTP payment, there is usually some data attached to the transaction, like any notes that the sender may include when pushing the payment to the recipient. For RTP, think of things like a note on a Venmo message or an RTP transaction for an Airbnb booking with the duration of the reservation or the reservation ID.

RFPs, though, are an extremely data-rich instant payment option. Providing businesses with multiple ways to embed information about a bill or invoice within the transaction itself. In addition to speeding up access to working capital and cash on hand for businesses, RFPs streamline reconciliation by making transactions more identifiable and easy to categorize because of the nature of the data embedded in the transaction.

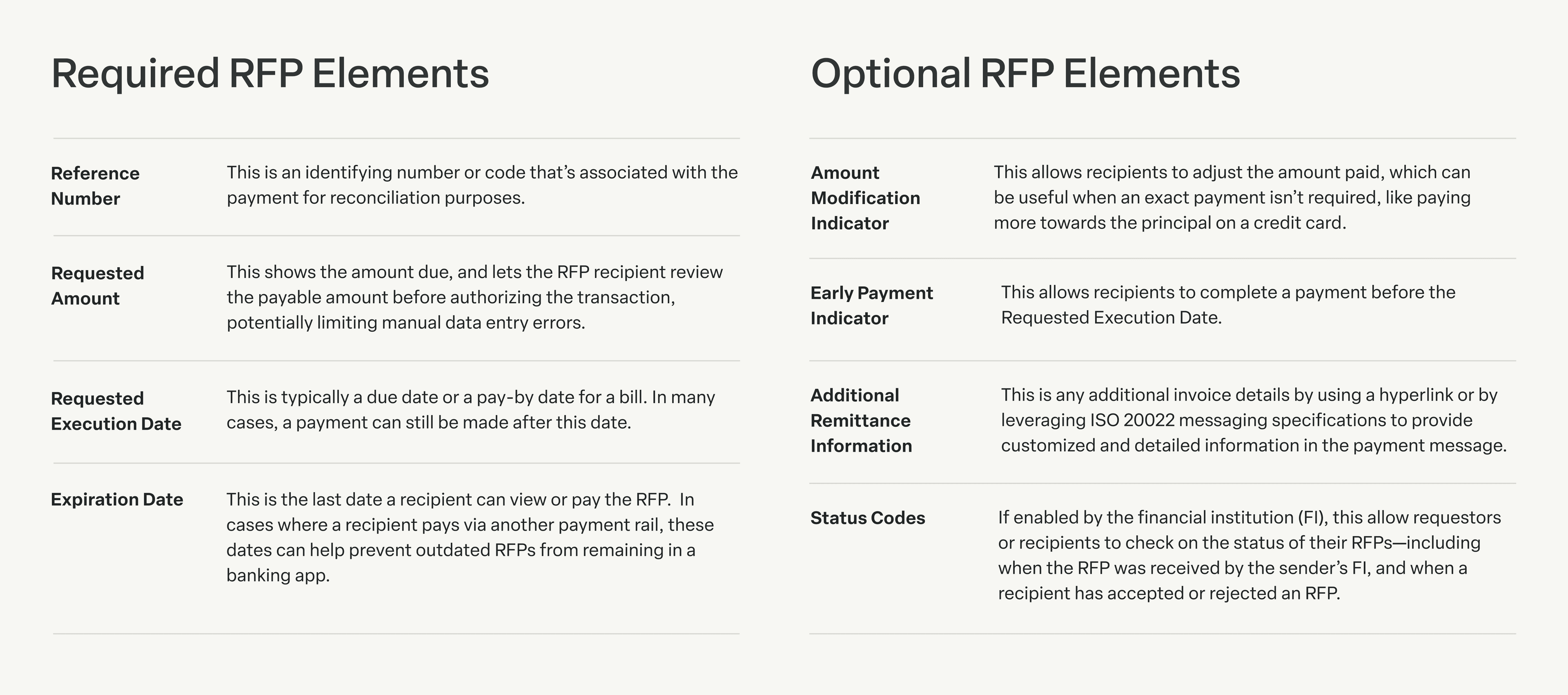

As with all forms of instant payment, RFPs must include account details—like account numbers and routing numbers—for the requestor and the recipient. But there are several other elements, both required and optional, that can be included in an RFP to add additional information about the requested transaction. This is helpful in creating a detailed record of the transaction for the purposes of identification to the recipient and reconciliation for the business.

Make RFP a Reality For Your Business

In the complicated world of payments—where payments can be made via merchant websites, through banking apps, using third-party processors, or even by swiping cards and mailing checks—RFPs offer a simple, streamlined payment process with benefits for everyone on all sides of a transaction. RFPs have the potential to be revolutionary in helping drive a wider-spread adoption of faster payments–from financial institutions to businesses and consumers.

Financial institutions can offer RFP (and other faster payments) to their customers to provide more modern, transparent, and timely payment options.

For consumers, using an RFP is more convenient and faster than traditional methods of paying a bill or invoice. Plus, they can be confident that their payment will post directly to a biller’s account straight away, essentially eliminating things like late fees or overdrafts.

For businesses, using RFPs can save a business approximately 8% of the typical processing cost per invoice, according to the UK’s Faster Payments Council. RFPs also offer reduced incidences of fraud and invoice scams, more streamlined reconciliation, increased transparency into all sides of a transaction, and sped up access to funds from customer payments.

Modern Treasury is a platform designed to help businesses streamline their payment operations. If your business is ready to utilize faster payment options like RTP and RFP, reach out to us today to find out how we can help.

Try Modern Treasury

See how smooth payment operations can be.