Resilient Payment Systems: 3 Things to Consider This Week

Given recent events, many companies are thinking about improving the resilience of their payment systems via a multi-bank strategy. This journal digs into three primary considerations for shoring up fund flows right away.

The events of the past week spotlighted the importance of the banking system and the faith we all place in it. As a former banker, I’ve been sobered by the reminder.

Depositors at Signature Bank and Silicon Valley Bank got the assurance they needed that their deposits would be protected. However, a portion of their client base also uses these banks for money movement needs. As a result, these bank failures can prevent companies from operating their businesses or core products.

The operational thrash caused by events these last few days have many companies thinking about how to build resilience into their payment systems via a multi-bank strategy. We’ve been advising our customers (and non-customers, as we’ve now expanded our consulting scope) to focus on the following three things.

1. Prioritize your payment needs

Few banks offer the financial products to address all of your company’s payment needs. Most likely, your business will need to stitch together banks with differing strengths and capabilities.

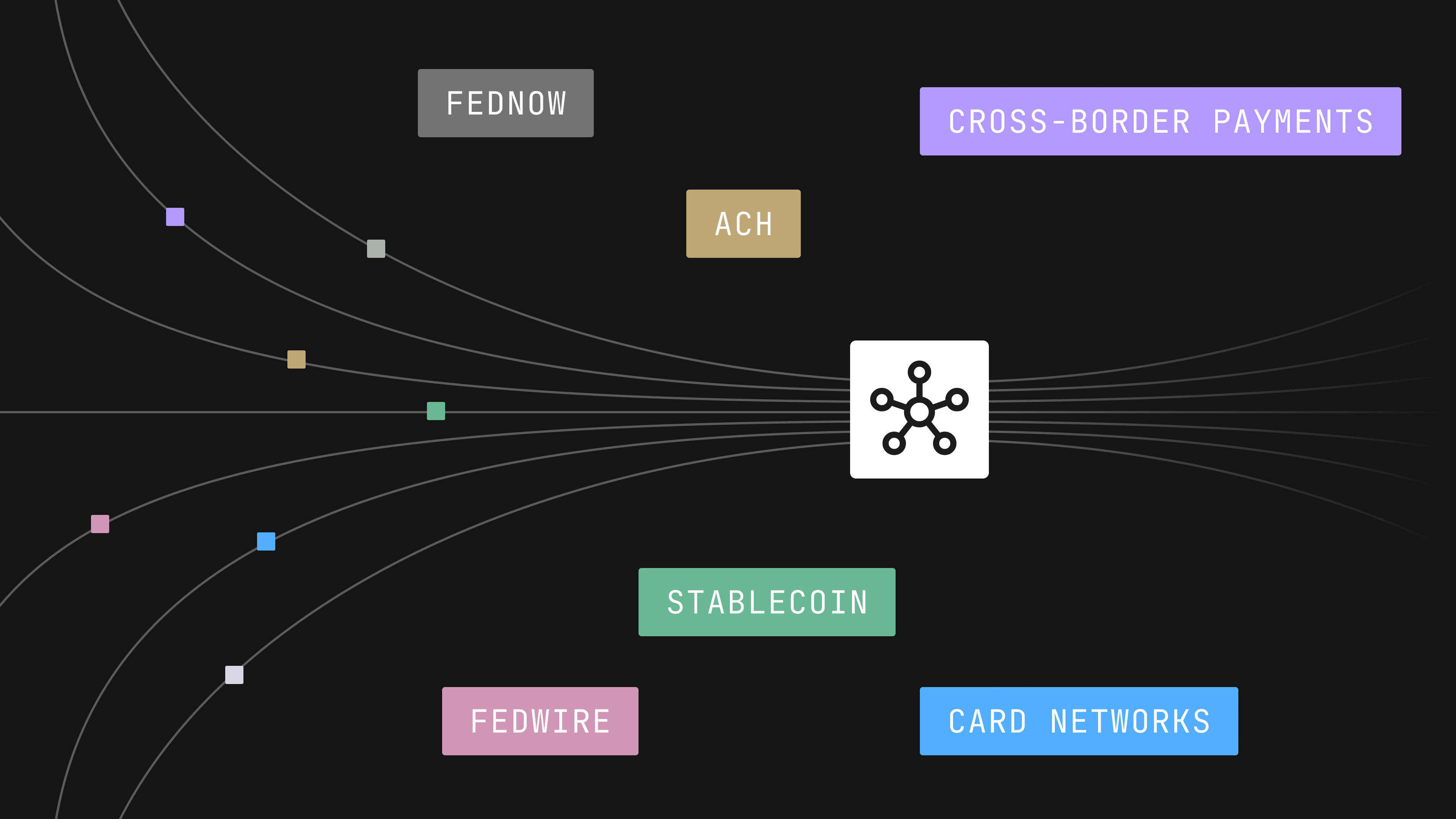

Right now, it’s important to distinguish between nice-to-have capabilities and must-have capabilities. As an example, companies might need to prioritize critical capabilities, such as programmatic ACH and wire functionality, over secondary products, like virtual accounts, real-time payments, or international rails.

Here are three suggestions to help you get started:

- Identify your core payment flows, reconciliation, and tracking needs.

- Copy this list of bank products. List your flows and needs in the rows of the first column of the worksheet.

- Check which bank products are required for each payment flow.

If you have questions about any of this, reach out to our bank partnerships team. We can talk through it, whether you’re a Modern Treasury customer or not. We’re standing by to consult.

Over time, it’s a best practice to build redundancy across all payment capabilities, which may mean additional bank partners. However, in the near term, prioritize core product needs.

2. Connect with banks

Banking is a relationship business. We recommend that you begin connecting with bankers as quickly as possible. If you need help with this, please reach out. We have a network of over 20+ partner banks, and a team dedicated to helping companies start or expand their multi-bank strategy right now. We’re happy to connect you with our contacts.

Your bankers will need to learn as much about the company as they can in a short time frame. Be ready with information that details your flow of funds, your customer base, and how well you know those customers. The clearer you can be about how your business operates, the faster the process can go.

Developing these relationships will also help you understand the bank’s strengths and product capabilities. Ask which products the bank offers, which account structures they support, and what timelines can they enable. We’re here as a resource to help match bank capabilities against your needs.

3. Understand your bank’s infrastructure

Each bank has its own infrastructure and technical configurations. It’s important to understand the operational requirements for each bank. A couple of common considerations:

- What is the integration protocol? (e.g., SFTP, FTP, API)

- What is the transaction reporting format? (e.g., BAI2, ISO CAMT)

- What is the reporting cadence? (e.g., prior-day, daily, intraday)

- What are the payment rail nuances?

- What are the ledgering implications?

- What are the security procedures?

If you don’t use a payment operations platform like Modern Treasury, expect that you’ll need independent infrastructure for each bank, including integrations, payment file formatters, and transaction file parsers. In addition, you will need application logic to create and reconcile payments according to each bank’s specifications, and tooling to integrate those operations within your databases and workflows.

It’s a lot, we know. Modern Treasury can help.

We offer an API endpoint to initiate and reconcile payments across any bank and payment rail. This means you can switch between your bank accounts with a single line of code, or a few clicks on the dashboard. Additionally, we provide an independent, scalable financial database to track payments across banks, and a bank-certified compliance product to help you manage a compliance program across multiple relationships.

Build resilience with Modern Treasury

Modern Treasury exists to make it easier to integrate and manage multiple bank relationships. And if we’ve learned anything from the last few days, a multi-bank strategy is key to building a resilient company. Our team offers the expertise to help you connect with the right bank partner, and the infrastructure to help you scale your products and workflows across multiple relationships.

Given the events of the past week, we are expanding our bank integration support to all companies, regardless of whether they’re a customer. If you want to talk through the three focus areas, receive a consultation on prioritizing redundant builds, or integrate to a bank partner quickly, reach out anytime.