What is Double-Entry Accounting?

When maintaining your books, there are a number of accounting methods you can use to keep track of your company’s financial information. One of them is double-entry accounting. What is it, and when should it be used?

When maintaining your books, there are a number of accounting methods you can use to keep track of your company’s financial information. Two of the most popular types of accounting are single-entry and double-entry accounting. This article will discuss both to help you understand when it might make sense for your company to use double-entry accounting.

Single-Entry Accounting

Single-entry accounting is most successful for smaller businesses with low transaction volumes. It can be used by companies to track transactions that involve cash, taxable income, and tax deductible expenses. Like the name suggests, income and expenses are only listed one time in a single row, with positive values for income and negative values for expenses.

Double-Entry Accounting

Double-entry accounting records each transaction twice, as corresponding debits and credits. This method tracks not just cash on hand, but the value of all a company’s assets. For companies that produce physical goods, sales to consumers necessarily decreases the value of inventory on hand and rent paid necessarily decreases the value of rent owed.

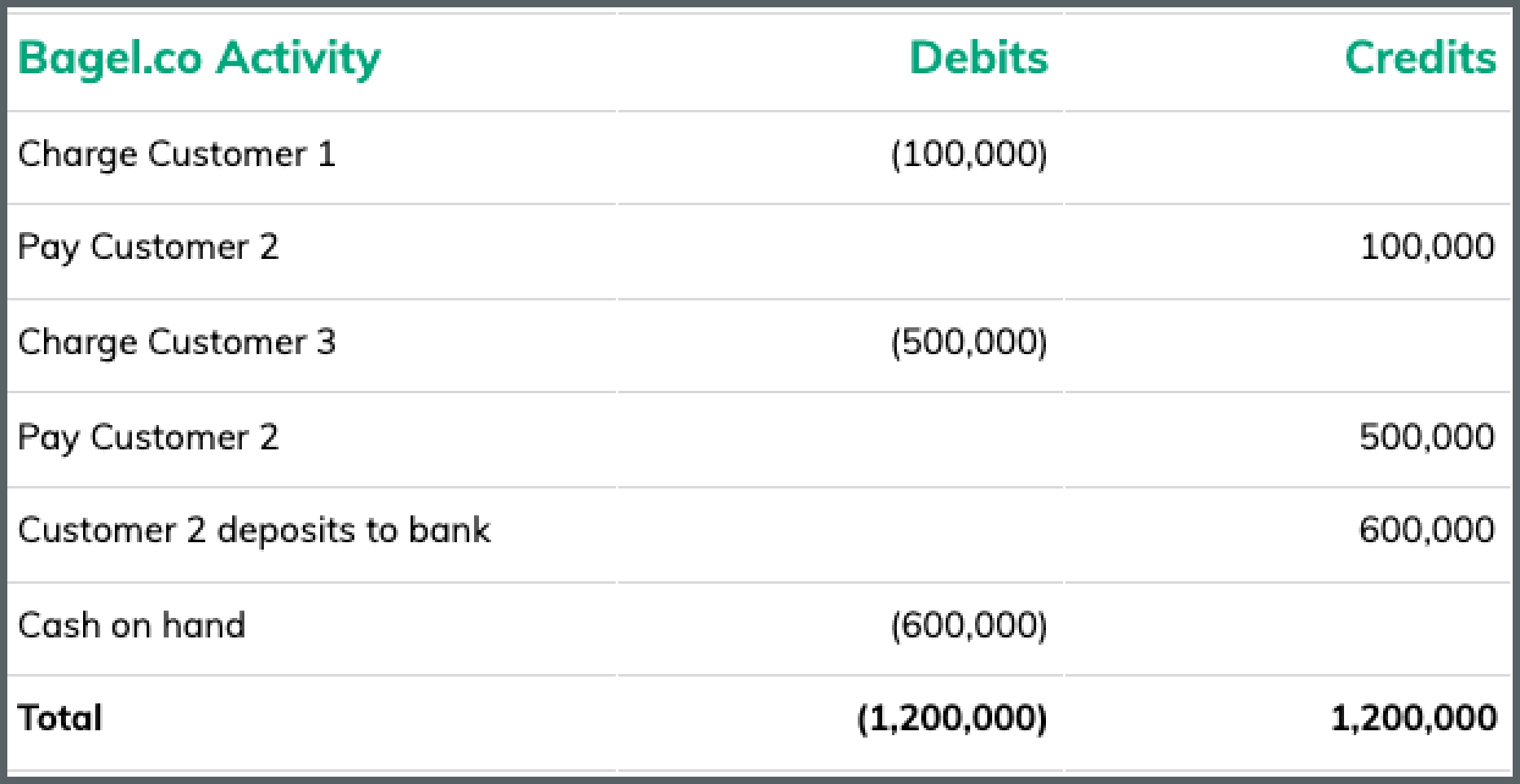

For example, let’s say you run Bagel.co, a company that allows users to buy, sell, and trade bagels. You use Modern Treasury to move funds between customer accounts you operate on behalf of your customers. Customers 1-3 buy and sell bagels to each other, and cash out the balances of their accounts on your platform to external banks. Below is a double-entry ledger of their transactions.

The formula for double-entry accounting can be remembered as Assets - Liabilities = Equity. When both sides of the ledger have been tallied, you can confirm accuracy because credits and debits will cancel each other out.

Why Use Double-Entry Accounting?

As mentioned, the main alternative to double-entry accounting is single-entry accounting, which can be useful for businesses with straightforward finances that do not have debts or other capital expenditures. Due to its simplicity, it can be kept in a journal known as a cash book, which will include an ending balance at the end of a given period. Single-entry accounting produces the income statement, or a report reflecting company profitability over time.

For businesses that move money as part of their core business, such as marketplaces, double-entry accounting is recommended. Not only does it enable accurate calculations and easy preparation of financial statements, it can also help reduce the risk of errors or fraud. Double-entry accounting is required under Generally Accepted Accounting Principles.

How Can Modern Treasury Help?

Modern Treasury enables companies that use double-entry accounting to track their ledgers using our Ledgers API. To get started, you can sign up for a Modern Treasury account instantly, or contact us to find out more.