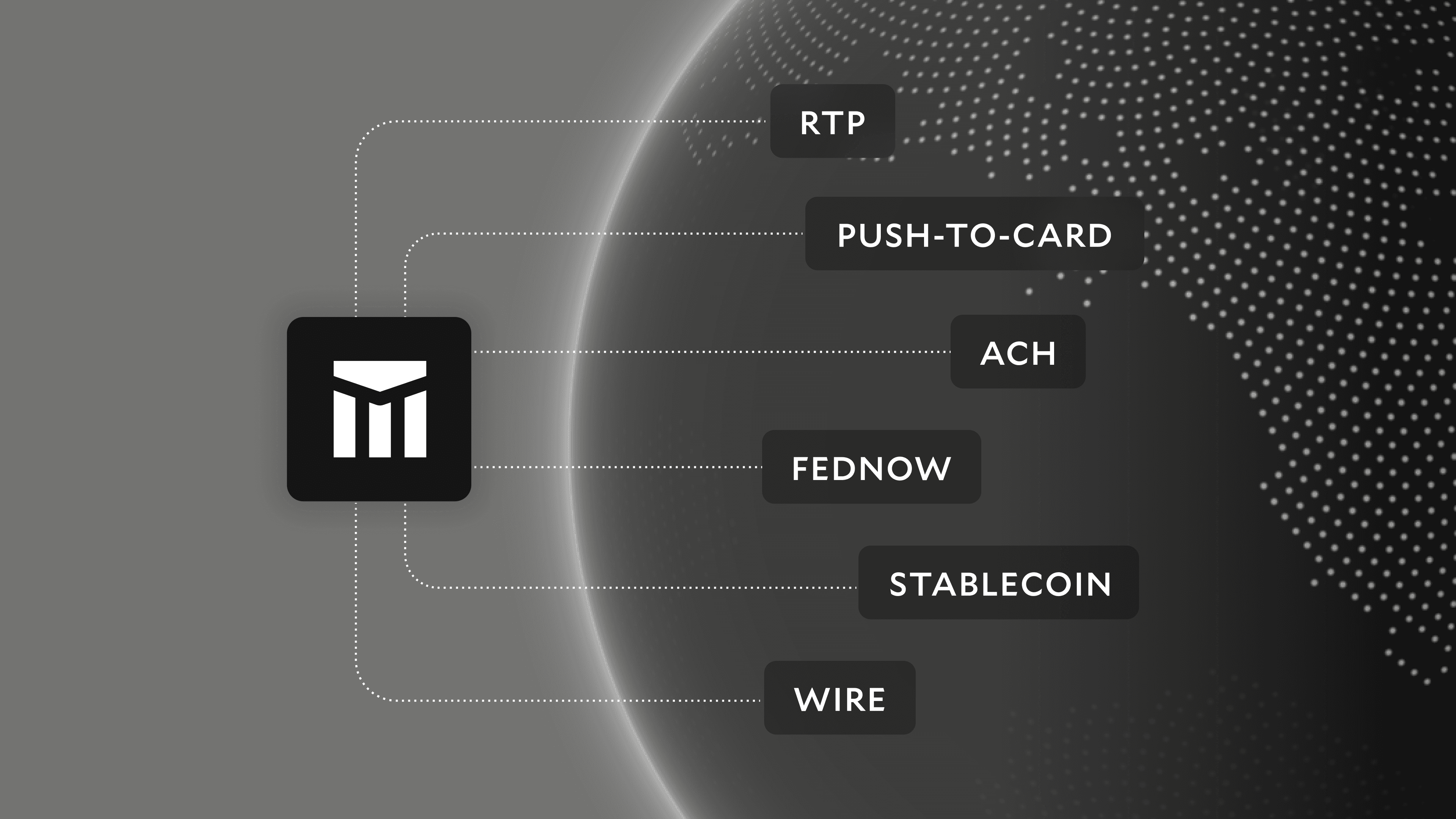

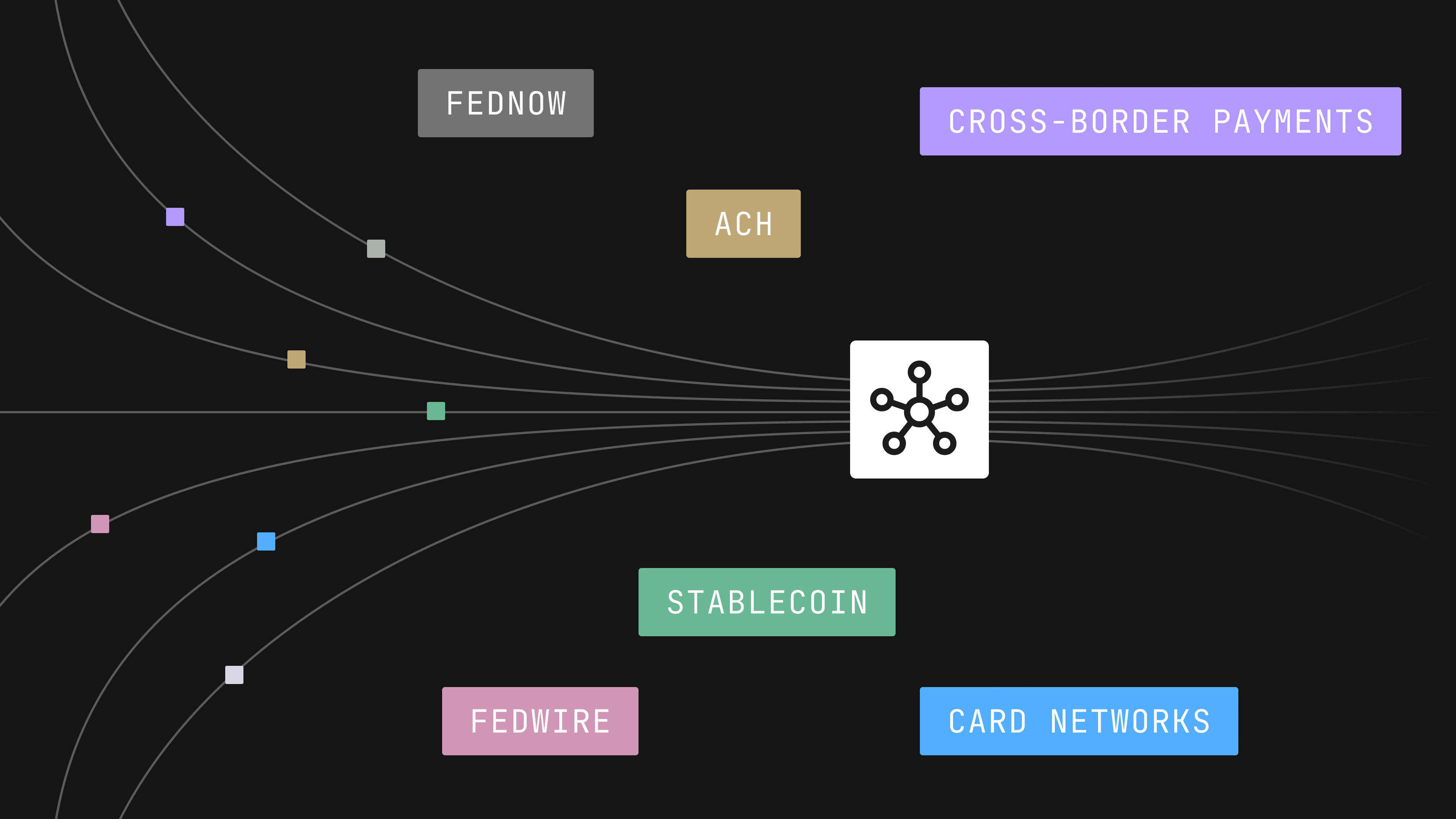

Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

Our Top Reads from 2020

2020 was a year like no other. To fill all that time at home, we consumed a lot of content. So what caught our eye in 2020? Here are our favorite posts from the year.

2020 was a year like no other. While we were busy growing our team, products, and customers, we still had a lot of time at home.

As we shared in summer, our team is committed to reading, listening, and writing. So to fill that time at home, we consumed a lot of content. We are fintech nerds after all.

So what caught our eye in 2020? Here are our favorite posts from the year.

What We Read (And Listened To)

For all of us, 2020 will forever be associated with the pandemic. In March, Sequoia Capital’s “Coronavirus: The Black Swan of 2020” brought memories of 2008 and pushed us to reevaluate how we conduct our lives and work. Chetan Puttagunta and Bill Gurley of Benchmark went on Invest Like the Best to discuss how startups should adjust.

As the government began contemplating major stimulus packages, including direct payments to households, some of America’s payment system issues came into focus once again. The Brookings Institution published a study called “How to fix the Covid stimulus payment problem” discussing why the government is is unable to transmit payments to citizens rapidly.

In many cases, these changes came up against legacy systems written in COBOL, and we thoroughly enjoyed “The Code That Controls Your Money” about COBOL’s origins, challenges, and the opportunities inherent in replacing systems written in that language over the past sixty years.

“No one quite knows how much COBOL is out there, but estimates suggest there are as many as 240 billion lines of the code quietly powering many of the most crucial parts of our everyday lives.” —Clive Thompson

Closer to home, some of the leaders we most respect published deep dives into various aspects of payment and reconciliation technology. Notable reads include Michelle Bu’s “Stripe’s Payments API: The First 10 Years” about the evolution of Stripe, and Ayo Omojola’s “Financial Reconciliation when you’re managing a ledger,” a compelling problem statement outlining the challenges that come with managing payment operations at scale, and specifically the reconciliation of cash to ledger.

“A while back when I was idea hunting I once asked a senior member of our accounting team; if I could solve one problem for them, what should I pick? The response: ‘instant month-end close.’” —Ayo Omajola

Finally, this has been a blockbuster year for startups, IPOs, and Y Combinator companies specifically. The IPOs of DoorDash (S13) and Airbnb (W09) were capstone events to a tumultuous year, covered by in-depth Acquired podcast episodes.

In growing from small startup to bigger startup, we are grateful for the lessons in Jessica Livingston’s “Startups: The Very Beginning”, Patrick O’Shaughnessy’s interview with Michael Seibel, and Paul Graham’s essay on Earnestness. These pieces remind us where we come from and how to keep going, even in difficult times.

“I don't know of a single case of a startup that felt they spent too much time talking to users. The way you stay on the right path in the early stages of a startup is to build stuff and talk to users. And nothing else.” —Jessica Livingstone

And for a moment of levity, we loved the SNL sketch “Cheques.”

What We Wrote

While we were singing along to Kate McKinnon whispering “a cheque is drama, a cheque is a promise... God knows how many zeroes they’ll add,” we were writing too. We dig into topics that come up as we build product, help customers troubleshoot, and work closely with banks.

Here are the five posts that received the most feedback, twitter love, and comments from our customers and community:

- A history of faster payments and their adoption rates around the world.

- A surprising history of“fintech,” which has been around for much longer than the term “fintech.”

- An explanation of direct transmission, the way almost every scaled company builds and manages payments through their bank.

- A primer on security for bank payments. This one hit the front page of Hacker News.

- The difference between a third party sender and a third party service provider, one of the sneakiest secrets in payments, and how one intermediates (and slows down) your payments.

Oh, and we also sometimes listen to ourselves talk. Here are our founders on podcasts discussing payments engineering and the complexity of payment operations.

We’re looking forward to more reading and writing in 2021.