Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

It’s Time to Require Better Ledgers

Modern Treasury CEO and Co-Founder, Dimitri Dadiomov, shares his thoughts on why and how third-party ledgers should improve.

Over the past decade, an ever-rising share of financial services consumed by Americans has come from non-bank firms, an industry often referred to as fintech. This brought us innovative new products and services, allowed financial services to leverage more modern technology, and improved customer experiences. But this growing phenomenon also brings risks to the financial system that should be addressed.

We saw a version of this unfold with the recent bankruptcy of Synapse, a fintech that provided “Banking-as-a-Service” services. As a fintech entrepreneur, I’ve always struggled with the term “Banking-as-a-Service” because it sounds like banking. What is banking, after all, if not a service? That’s not meant to be a joke. It is a serious question that the bankruptcy of Synapse has now surfaced to regulators. Is there a real difference between “Banking” and “Banking-as-a-Service”?

In the Synapse bankruptcy, a core challenge is that the banks working with Synapse did not have a real-time, reconciled ledger to track whose money was sitting in their accounts. The accounts were opened in Synapse’s name under various forms of omnibus account structures (often called For Benefit Of or FBO structures for short), allowing private companies to open bank accounts that commingle funds of multiple beneficial owners. When the banks sought to obtain, review, and reconcile Synapse’s records against their own, they ran into significant challenges, leaving many businesses and other customers without access to millions of dollars of their funds. Synapse filed for bankruptcy in April, and as of today, the work to identify and return user funds is still not complete.

There are valid reasons for FBO structures, and this practice is not, in and of itself, particularly risky or non-risky. However, a company that is responsible for deposit account recordkeeping on behalf of a bank should maintain the accuracy and integrity of those records, and give the bank continued access to those records. That way, if the company disappears or goes offline, the bank will still know who is owed what amount of money.

Best Practices for Building a Ledger

Knowing who is owed what requires a robust ledger, a tough technical challenge that companies should not underestimate or try to tackle from scratch. At my previous company, I built a ledger internally, and building it perfectly from the start was impossible due to the endless technical design and execution challenges. What should the ledger capture? How does it capture things in the right order, especially with high volumes of payment activity? What happens if someone reverses a transaction or issues a refund, or accidentally double spends? What are the latency requirements on the ledger? How should idempotency—the requirement to write things once and only once to represent the real world accurately—be implemented and enforced? How can new currencies be captured?

And that’s not mentioning the workflow and usability requirements for how the API should be designed, what reporting various teams would require, how data can be exported into a data warehouse, ERPs, and more.

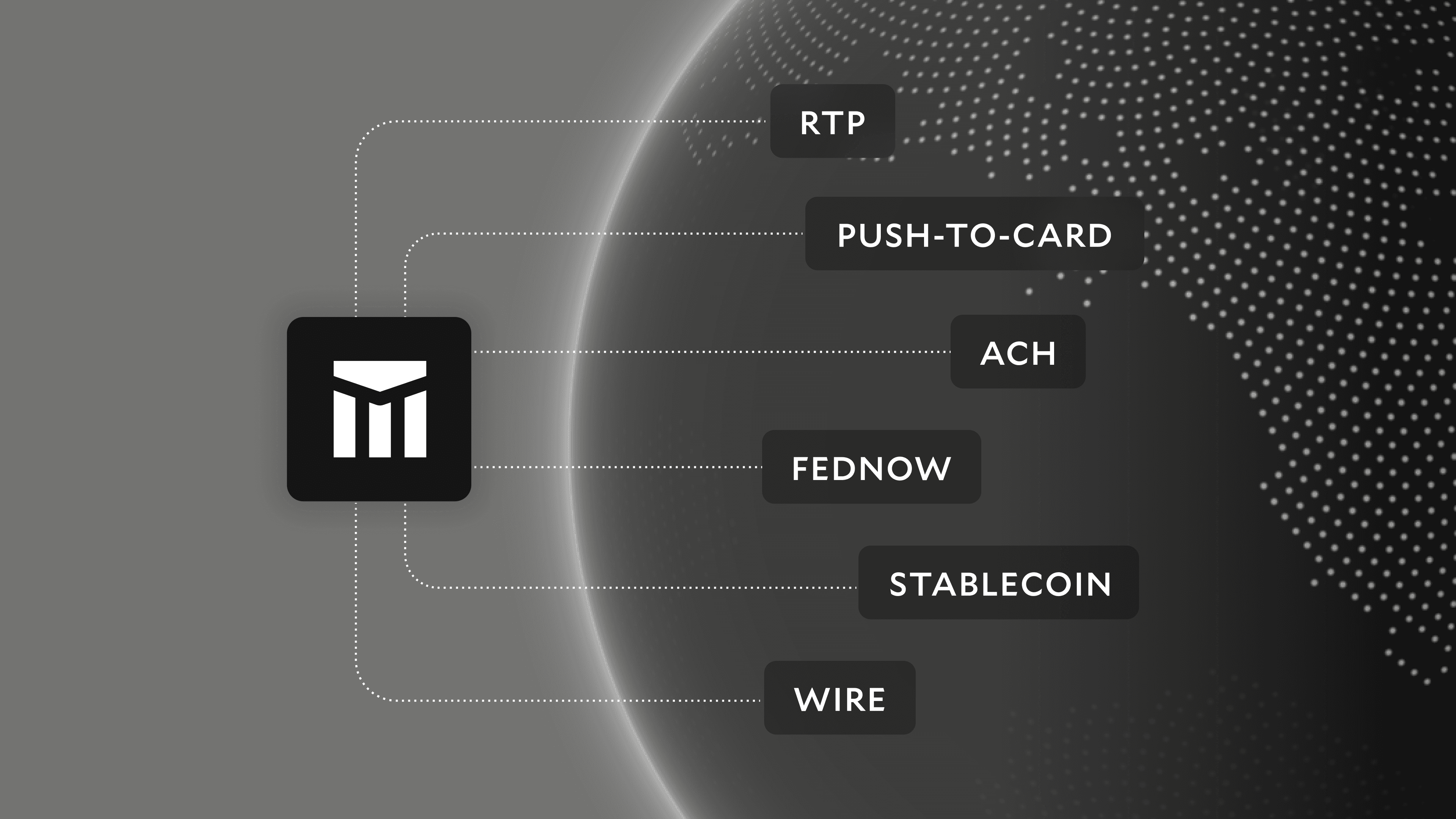

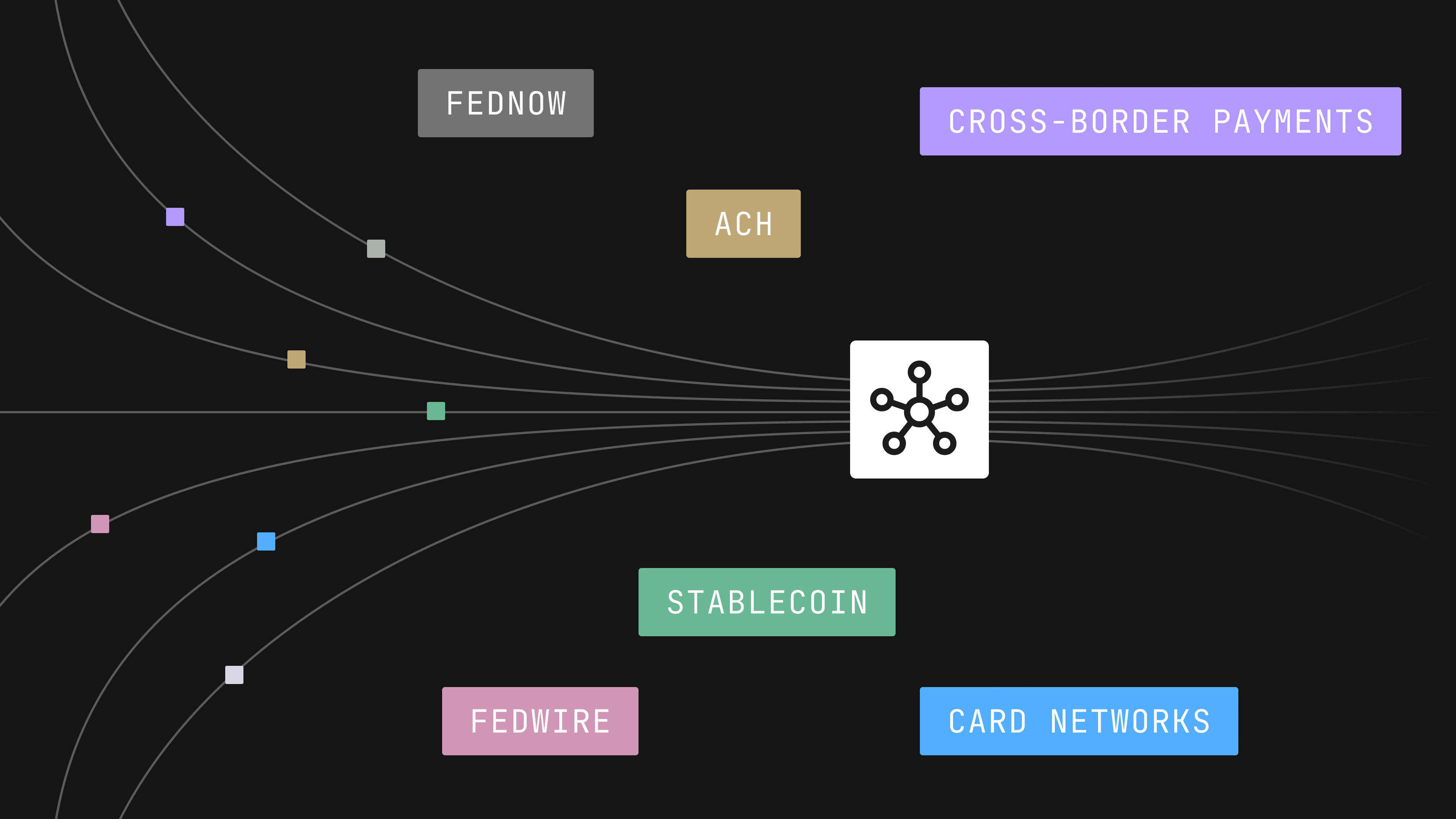

Modern Treasury offers a robust and real-time ledger as part of our platform. Over the past six years, I’ve seen firsthand how complicated the intersection of banking, fintech, and ledgering is. I can say with confidence that:

- Fintechs in this business must have a robust, trustworthy ledger capturing all transactions and account balances. Banks should require fintechs to share access to this ledger, and

- As a technical matter, fintechs should not build their ledgers in-house.

To protect customers if something happens to a fintech firm, banks need direct access to the fintech’s ledger records—which is a best practice that benefits the whole ecosystem. This means the ledger should be housed and maintained by a third party. The ledger must also have data reporting and workflow paths to serve an analyst’s needs well. User engagement with the ledger cannot be an afterthought.

The FDIC recently proposed a new recordkeeping rule for custodial deposit accounts like FBOs designed to ensure robust ledgering. I’m glad regulators and the ecosystem are focused on making ledgers more robust. We welcome the momentum and urge regulators, banks, and other ecosystem participants to ensure that the results systems are designed correctly and operate effectively.

Banks, as the ultimate depository institutions behind all fintech, should find ways to leverage services that non-banks can provide best to deliver safer and better solutions for consumers and businesses. A third-party ledger account system is the way to do this.

Find out more on Modern Treasury’s Ledgers offerings, or reach out to us.