Empowering Finance Teams With AI: Tech Talk Recap

Discover key points from our recent tech talk focused on the power of AI to reimagine core financial workflows.

Generative AI is transforming financial services. With benefits to automation, optimization, and innovation, AI is already proving revolutionary to the industry—specifically given its ability to enhance business operations, boosting efficiency and accuracy across essential finance functions.

Modern Treasury’s approach to AI centers around a robust framework and our team includes experts who have successfully guided financial leaders in integrating AI into their operations. In our tech talk this past Wednesday, these experts offered valuable insights and practical advice based on first-hand experience. The following abbreviated recap includes high level takeaways from event speakers Brian McKinney, Head of Payments Engineering, and Wayne Lin, Product Manager, as well as moderator Patrick Harrington, Head of AI.

Can you explain the current AI ecosystem and its relevance to finance?

Patrick: The modern AI ecosystem, at a high level, decomposes into three core facets. We hear a lot about foundational models, like when you think of OpenAI having their GPT-3, GPT-4. These are foundational models that have been trained on large chunks of the internet. Think of Wikipedia, think of Google Books, think of crawling the web—a lot of images in conjunction with text. The second core facet is AI and machine learning infrastructure to handle large data.

There's been a lot of development over the past 20 years in the big data space—in particular, around the AI infrastructure, the involvement of GPUs, and the demand for these types of chips. The third core facet of the modern AI ecosystem is a vertical application of these tools. How does modern AI meet product development working back from clear customer pain points? And ultimately, how does that manifest in a business?

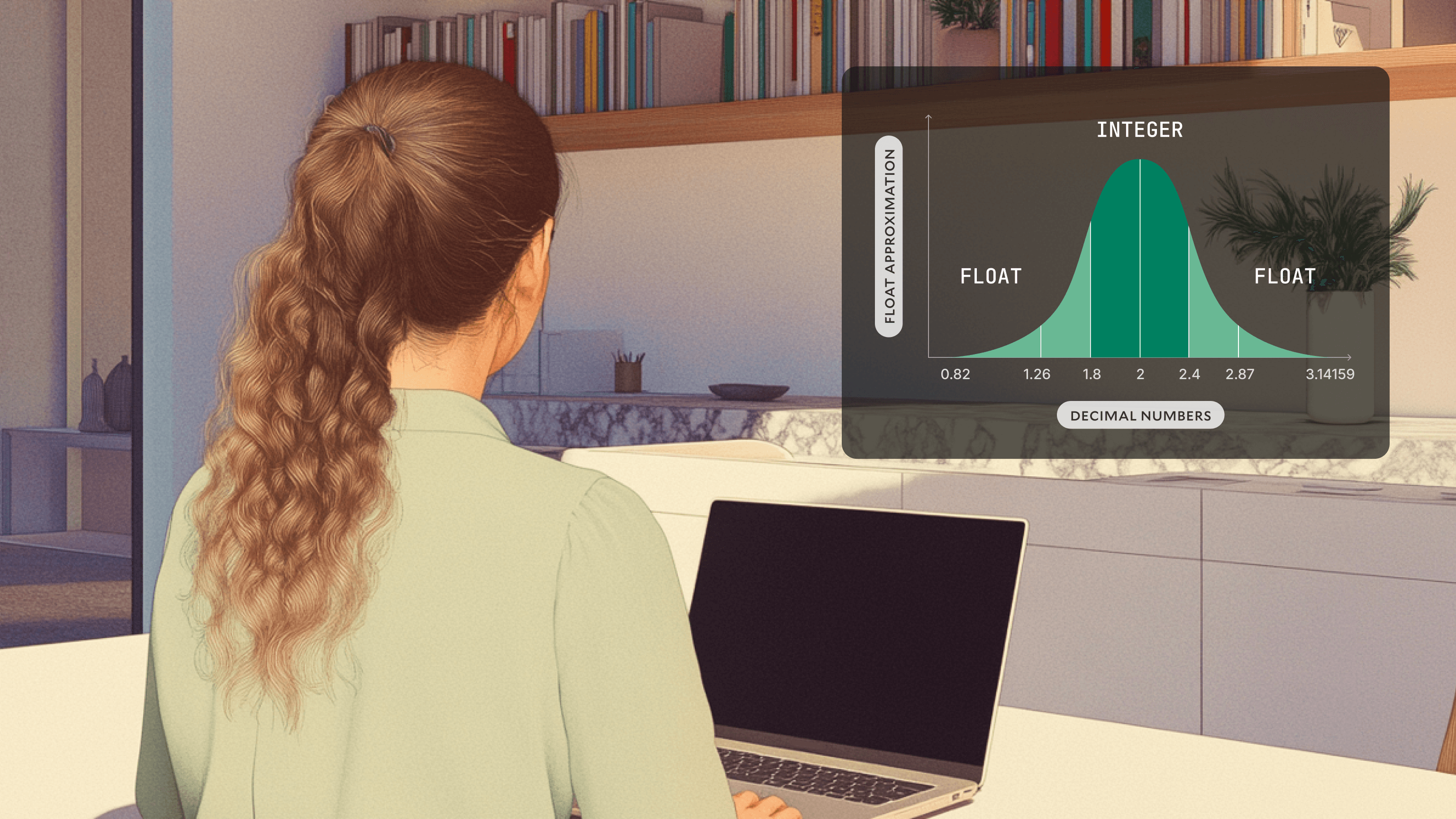

Wayne: What is possible with AI and machine learning? It's really bringing inference patterns from big data. Finance is dealing with increasing amounts of data, whether it's accounting or transaction categorization, reconciliation, fraud detection, or anomaly detection. I remember even reading that the Journal of Accountancy had published an article about how modern accountants need to know SQL or need to know Python data manipulation skills. These become core skill sets because you're manipulating data so often.

How is AI applied in Modern Treasury’s reconciliation product?

Wayne: Within our product, we've been able to incorporate AI technology effectively in two areas. One is in finding match suggestions when there are exceptions and the second, which we've seen a lot of interest in, is rule suggestion itself. The team can notice patterns based on what they know about the business and patterns can encode rules.

But when you're at a large enterprise and you have hundreds of rules, it becomes increasingly difficult to think about capturing those incremental patterns. Having this AI system that can help monitor for changes in financial data or additional fund flows that lead to new patterns, and then suggest rules for the team to review and approve, that's where we save people time.

What should finance leaders consider when implementing AI?

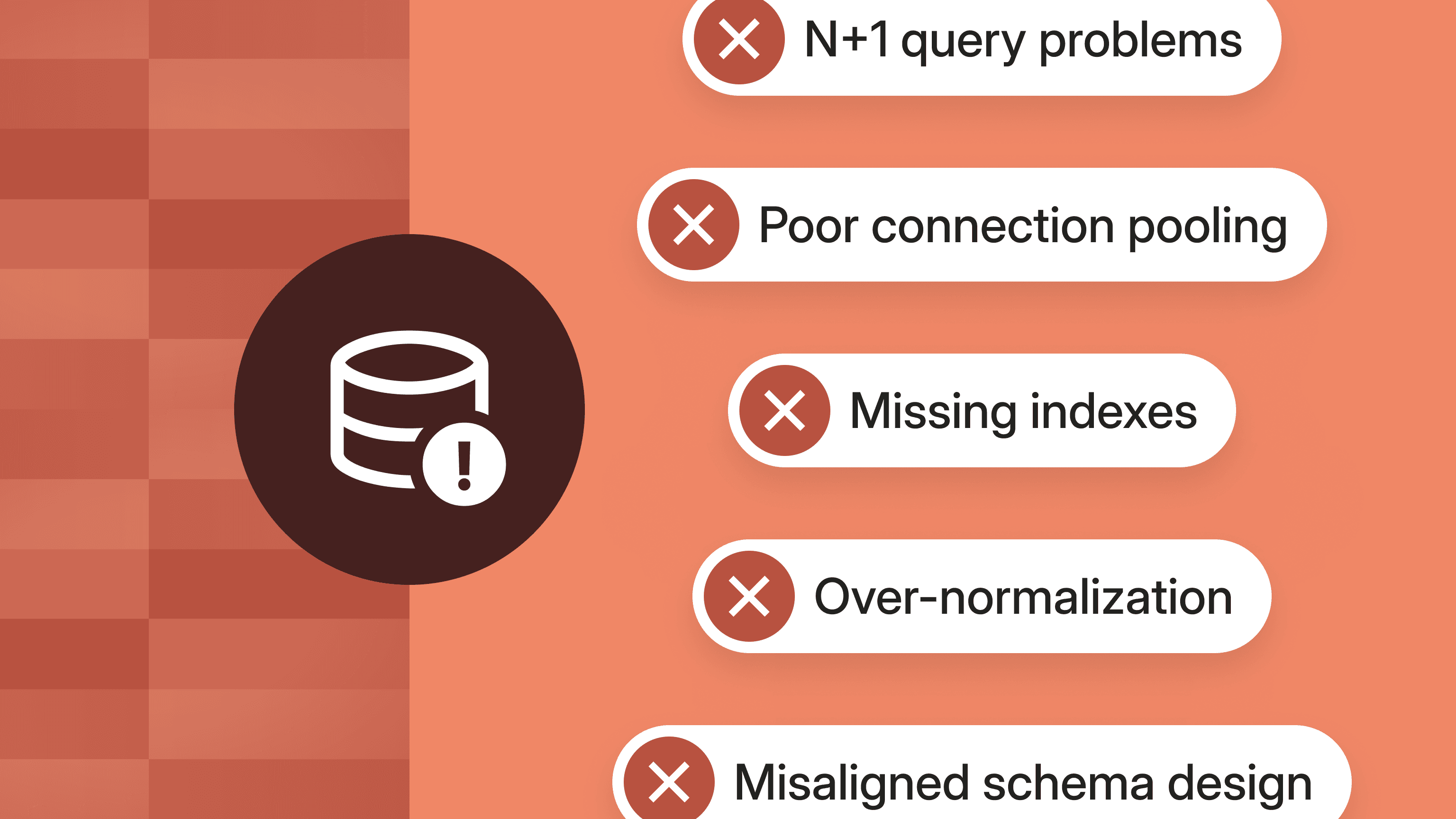

Brian: First, you have to understand the sets of data that you're working with: the context and risk profile around each set of data. Building a strong relationship with your legal and compliance teams is critical. Once you understand your data, you're moving forward on a data strategy. Most companies might say, “Great, well, how do we actually do AI?” And this comes down to the build-buy-partner question.

Building foundational models on the AI side, in general, is a pretty steep barrier to entry. Most companies are going to opt for the buy or partner aspect. This is where you start leveraging more and more third-party vendors, and start to think about the questions to ask these sets of third-party vendors. As we touched on, especially in finance, security and privacy are paramount. Really question your vendor and understand how they think about security. What kind of standards do they pass? Do they have incidents where they’ve not met the bar in terms of security and privacy? And finance accuracy and quality are also absolutely critical.

What are some challenges and opportunities related to implementing AI in finance?

Wayne: Whether or not AI is going to drive impact is dependent on whether or not the results are actually good. When you're evaluating partners, it is vital to validate, “Do they have a long-term investment posture around improving quality and performance?” That's why it goes back to tailored solutions. In order to get the incremental gains, you need the company to be super focused on driving performance and quality in your problem domain.

Brian: Take a small problem that you have, something you're doing manually today. Find something that's manual, error-prone, and undifferentiated. Do a really small pilot, and if you see success with that, well, then what's the next thing? And what’s the next thing after that? Think about it from a pure workflow perspective. You'll start to build success, you'll build confidence, and then over time, you will become more and more efficient. Ultimately, you're turning what is today viewed as a cost center into something that makes your business more effective, more efficient, and allows you to be more nimble.

Any key takeaways for finance leaders?

Patrick: We are in a transition phase of a new, powerful addition to our technological cycle. Finance is rule-based, similar to language. And so a lot of these modern models are very appropriate for financial applications. Now is the time to leverage AI for productivity enhancement. This technology is not just a future concept; it's a present tool that can significantly enhance efficiency and accuracy.

Wayne: Leaders should focus on working backward from specific business problems to identify where AI can have the most impact. This ensures that AI initiatives are aligned with business objectives and deliver tangible results. Investing in tailored AI solutions that are continuously improved for accuracy and performance is key to achieving long-term success.

How can finance teams get started with AI?

Brian: Educate your team about AI and its potential benefits. Provide training sessions and resources to help them understand how AI can enhance their work. It’s important that everyone is on board and understands the value AI can bring.

Wayne: Choose the right AI tools that integrate well with your existing systems. Look for solutions that offer transparency and allow you to audit and understand how decisions are made. This will help maintain trust and ensure compliance with regulatory standards.

Next Steps

For more insights, watch the full recording of this tech talk.

To learn more about how Modern Treasury’s operating system for money movement can help your business reliably manage moving, tracking, and reconciling payments at scale, reach out to us.

Quotes have been edited and arranged for concision and clarity.