Best Practices for Setting up a Robust Approvals System

Businesses seeking to optimize their payments operation strategy need a robust approvals system. This guide walks through what to consider when creating one.

Businesses seeking to optimize their payments operation strategy need a robust approval system. Approval workflows facilitate the movement of funds, increase transparency, and add an additional layer of security and control on top of payments. That’s true for legitimate payments that can be costly to recover or reverse—think wire transfers or checks—and to help prevent internal fraud.

Consider an organization sending several wires to a counterparty for multiple bank accounts. By the time the customer realized the bank accounts were not legitimate, the wire transfers already settled. The end user had withdrawn all funds—leaving the organization unable to recover the amount of the transfers. If the business had an existing approvals system for wire transfers over a certain amount or required manual approval, these payments could not have been initiated without authorization.

From an overall business perspective, approvals save time, labor, and in some cases, boosts the bottom line. Businesses can create custom payment approval rules based on the amount, bank account, or custom metadata filters for full control over payment initiation—and adjust the rules as they grow.

Navigating the Challenges of an Approvals System

Before implementing a comprehensive approvals system and granting access to a second party, business owners should consider some of the common workflow pitfalls. While an approvals system provides an opportunity to triple-check payments to minimize the risk of internal fraud and prevent payment errors, the meticulous nature of a manual approval process makes it time-consuming, which can lead to delays or inconsistencies. Business owners will first want to determine which areas of the process they can streamline through software automation.

In terms of approvers, who businesses entrust with this added layer of responsibility requires strategic thinking and planning. Either too much or too little access can create bottlenecks in the system. Say an employee without an in-depth understanding of payment operations is granted permissions for approvals. Customer service, for example, doesn’t need to have the same information or approval access as the finance team. This employee might have the best of intentions, but wind up approving payments that should not move forward.

On the flip side, the approvals process can stall when teams’ approvals access is so limited that they don’t have the required information or authorization to process payments. Delegating approvals to an individual with many responsibilities who cannot review and authorize payments in a timely fashion can also create a bottleneck.

You will also want to create simple, straightforward approval rules—and a clear workflow trajectory of the sequence of authorizations for approvals throughout your organization. Keep in mind that an approvals system with too many layers of approval can add complexity, canceling out increased efficiency or transparency. With these challenges in mind, configuring an approvals system requires awareness of an organization’s needs and business objectives.

Best Practices Approvals System

Before configuring an approvals workflow, an organization needs to consider its current status. What approval process makes the most sense for its size, structure, and the nature of its payment orders? It might ask: what teams should be responsible for approvals? Do they want three sets of approvers or is fewer sufficient?

The next step is setting up approval rules and permissions, or determining which situations require approvals. For instance, complex international wires that factor in exchange rates may need a more rigorous approval process than basic check transactions.

When using Modern Treasury, approval rules must have at least one condition and one approver. To get started, you can set up a simple first rule that requires an approval for any payment, meaning approvers must check that a payment amount is greater than $0.

You’ll also want to consider how your approvals system will change with your business. As your business scales, for example, your organization will need to adjust approval rules and permissions to ensure the right people have access at the right time. This may need to be revisited when internal roles shift, or if it makes sense for another team to make approvals because it’s more efficient. Access and workflows all depend on the unique needs of your organization.

Close

Configuring an approvals workflow helps businesses add a layer of control and security on top of their payments. Simple, straightforward approval rules—and a clear trajectory for who is authorized for approval—can reduce errors and create a more secure and efficient workflow across your organization to prevent internal fraud.

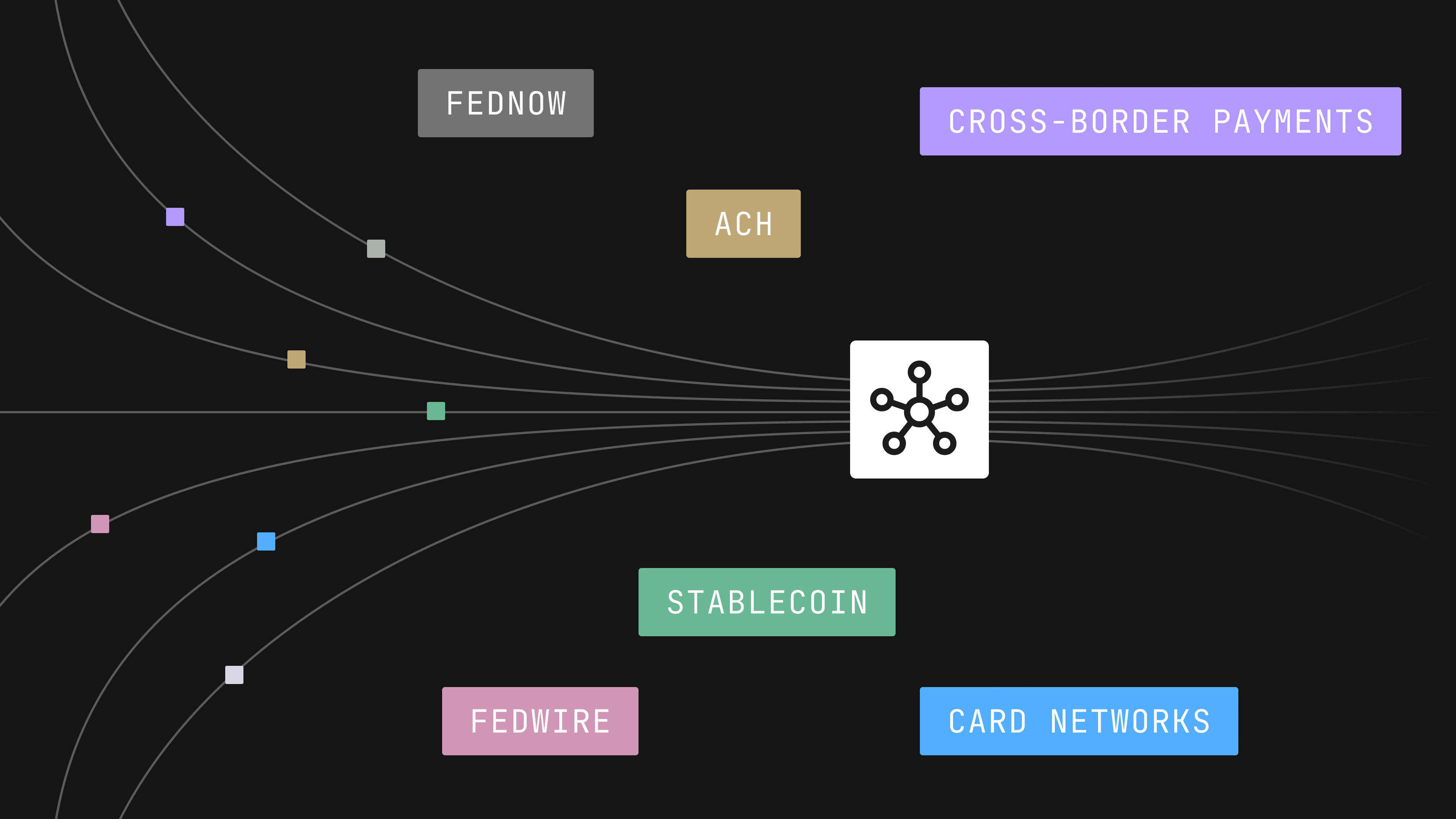

Modern Treasury allows organizations to customize approval workflows, automating the process leading up to manual approvals. For each payment that’s created, Modern Treasury’s rules engine checks the payment against your organization's approval rules. When a rule's conditions are met, the payment will require approval as per the rule's specifications—and you can authorize the payment with confidence every time.

Move money with confidence with an efficient approval workflow. Get in touch with the Modern Treasury team today.