Join us at Transfer 2025 to hear how industry leaders are building payments infrastructure for a real-time world.Register Today →

Introducing Netsuite to Continuous Accounting

We are excited to announce our integration with NetSuite. Modern Treasury customers can now sync their data to NetSuite, making it even easier to automatically reconcile transactions for accounting.

We are excited to announce our . Modern Treasury customers can now sync their data to NetSuite, making it even easier to automatically reconcile transactions for accounting.

This post will cover some NetSuite basics, product decisions we made while building our integration, resources available to connect NetSuite with Modern Treasury.

NetSuite Basics

NetSuite is a cloud-based software suite offering business accounting and ERP solutions to enterprise companies. NetSuite has more than 20,000 customers, spanning more than 200 countries and territories. Fun fact: NetSuite is heralded as the first cloud company, pioneering the way since 1998.

NetSuite is known for its flexibility, enabling it to handle some of the most complex financial and accounting setups. NetSuite’s ability to adapt to different use cases sets it apart from other accounting software, but this can be a double-edged sword. On one side you have the ability to model any financial setup, and on the other side, it is challenging for partners to build a one-size-fits-all integration. We designed our product to accommodate this type of system flexibility.

Product Goals

Having previously built our integration to QuickBooks Online, we had already set the following goals with our accounting integrations:

- Our customers can use our integration without significantly changing their existing accounting processes.

- Our customers’ books should be more comprehensive than if they were done by hand.

- Our customers should have complete visibility and control over how their data is being used and synced. There should be no surprises.

Now that we are adding a second accounting integration, we added an additional goal:

- Minimize the differences for our users between all integrations.

While the accounting software may differ, how our users interact with Modern Treasury should not.

How our Integration Works

NetSuite offers a number of ways to integrate with their platform, the newest of which released earlier this year—SuiteTalk REST Web Services. We chose the REST API over its predecessors (SuiteTalk SOAP Web Services and server-side scripts known as RESTlets) for the following reasons:

- REST is a widely-adopted and supported standard

- The SOAP API is tied to the layout of pages in the NetSuite dashboard, making it possible to “break” the integration by making changes to the UI.

- RESTlets are scripts that run directly on your NetSuite account, requiring installation.

- The REST API requires no installation besides generating authentication keys.

Customers connect their accounts using NetSuite’s Token Based Authentication, which can be set up and managed from the NetSuite dashboard. Our customers provide us the credentials supplied by NetSuite, and we are able to maintain that connection until the user chooses to disconnect.

All our Continuous Accounting integrations are designed to operate more or less the same way. We introduced our QuickBooks Online integration last year. Let’s look at some of the differences with the addition of NetSuite.

Mapping Modern Treasury to NetSuite

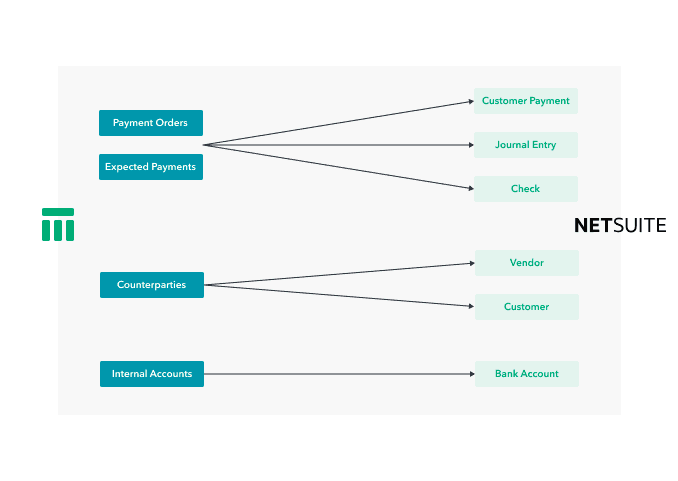

We recognize that different customers have different needs, and due to the flexibility of NetSuite, businesses may use different resources. When you set up your Modern Treasury account with NetSuite, you will be able to configure some of the resources used in the integration. Below is a diagram of one possible mapping of Modern Treasury to NetSuite resources we support today:

Subsidiaries

More complex businesses may be using NetSuite One World, which offers access to and use of multiple subsidiaries. The use of subsidiaries can create logical groupings for your business such as geographies, tax schemes, etc.

In Modern Treasury, we offer support for both those using subsidiaries and those that are not. You can set a default subsidiary to make auto-syncing more fluid.

Set Up

Connecting NetSuite to Modern Treasury is a bit more complex than other ERPs. As such, we have focused on reducing this integration time and complexity in both our dashboard and our documentation. We have added comprehensive, step-by-step guides to our docs, and of course, we’re always here to help.

Summary

Modern Treasury now integrates with NetSuite to help our clients close their books accurately and instantly. This functionality can be used both in the API and through our dashboard. We are continually working to improve, expand, and add new ledgers to our Continuous Accounting product suite.

If you’re interested in learning more about why we built this integration, how we thought about it, or using Modern Treasury to integrate with NetSuite, please reach out.

Try Modern Treasury

See how smooth payment operations can be.