Modern Treasury has acquired Beam.Build for what's next →

Customer Spotlight: Stewart Title

Stewart Title is a leading title insurance and real estate services company. They partnered with Modern Treasury to help modernize their payment systems and processes.

Stewart Title is a leading title insurance and real estate services company with over 130 years of experience in the industry. The company provides title insurance, escrow services, and technology solutions, all designed to facilitate transactions for homebuyers, real estate professionals, and financial institutions.

Stewart Title is engaged in multiple transformational projects to modernize legacy systems, bringing more visibility and transparency to the organization as well as automating and modernizing numerous processes.

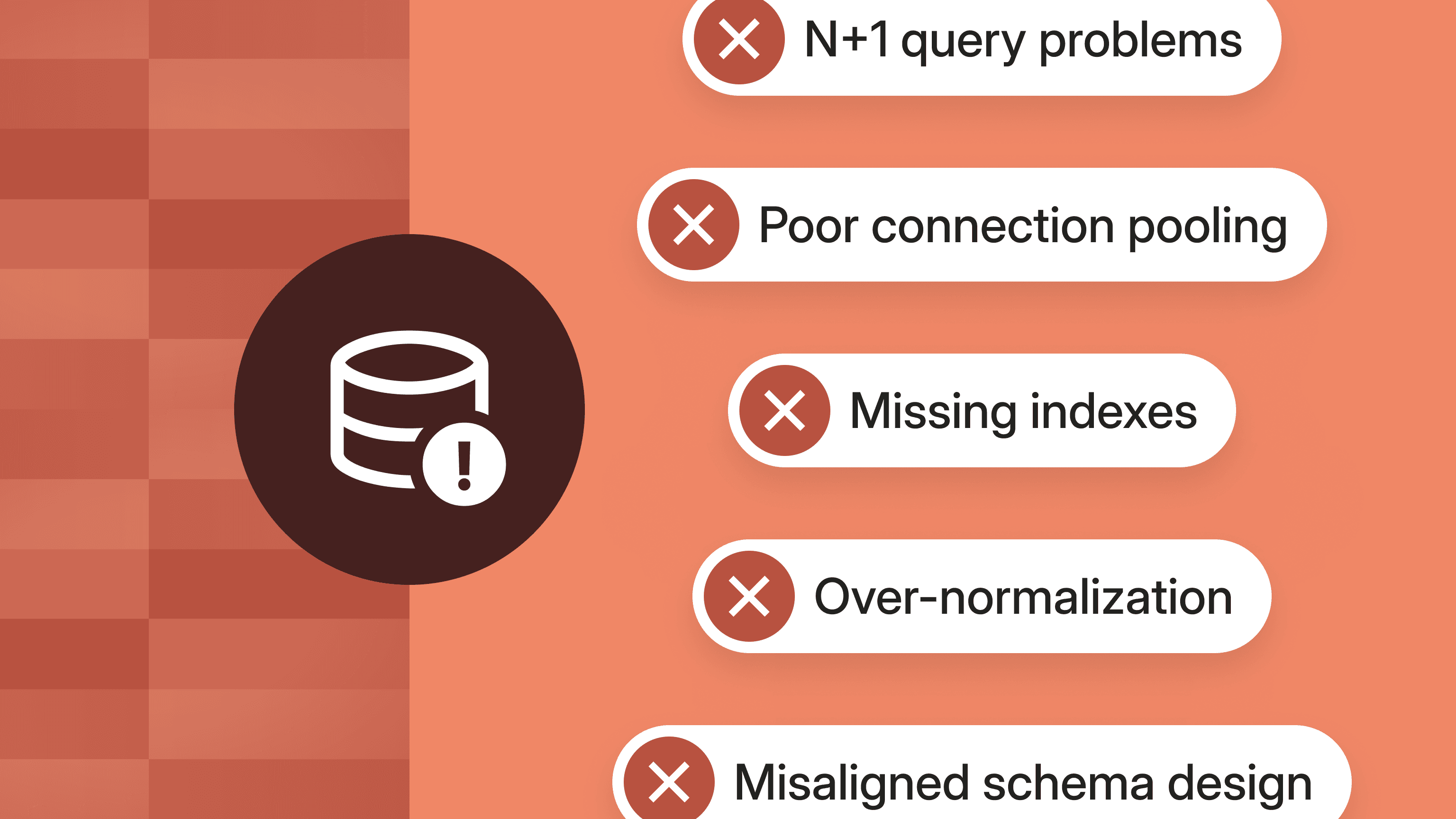

As a whole, the title industry depends on antiquated payment rails and systems that are costly and slow. Stewart Title processes several million checks and wire transfers annually. Handling these transactions with legacy systems can be slow and inefficient.

With payment transformation top of mind, Stewart Title partnered with Modern Treasury to help modernize its payment systems, creating more efficient payment processes and industry-leading customer experiences.

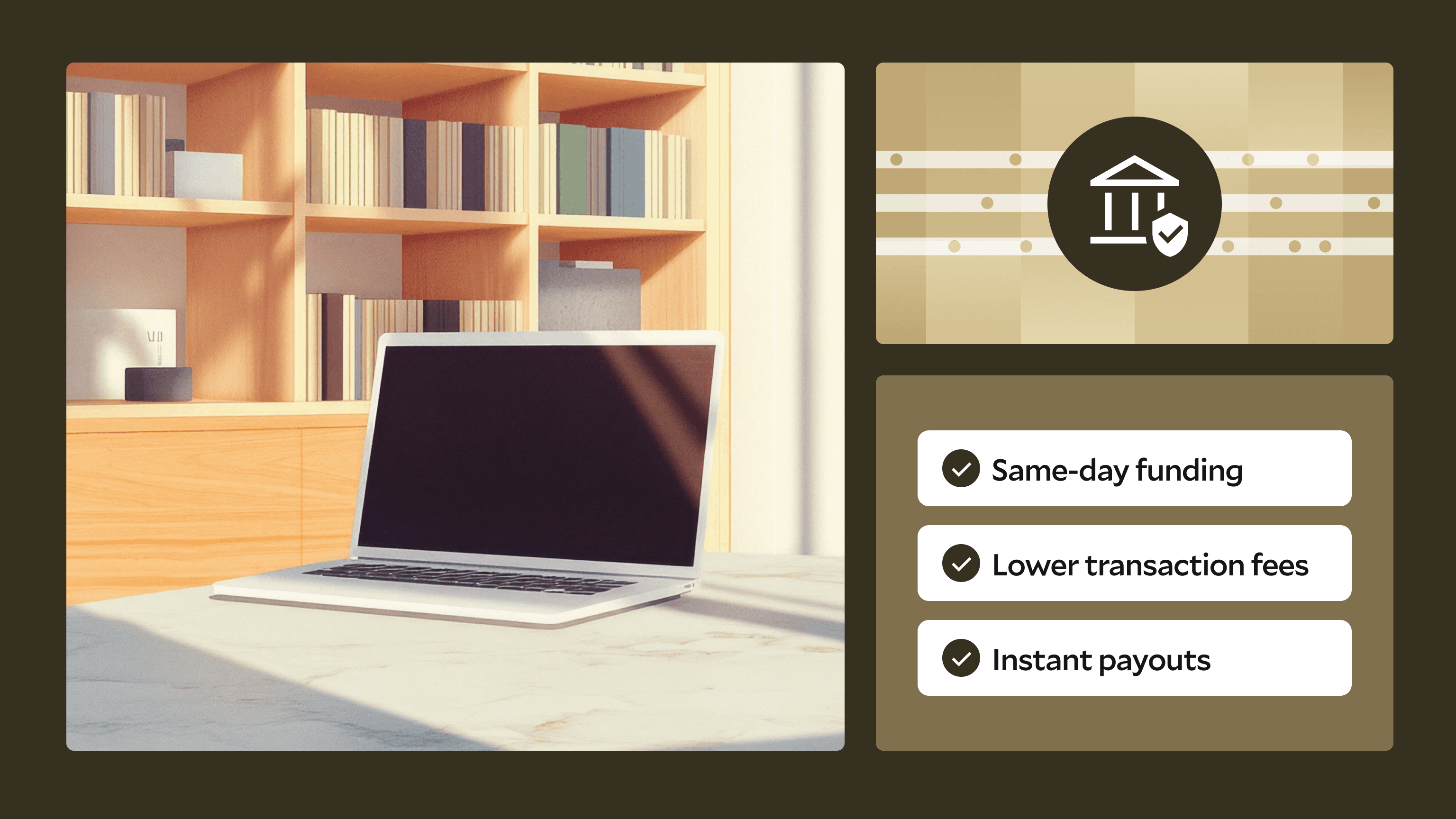

“Real estate requires the ability to move money quickly, accurately, and securely,” said Bob Taylor, Vice President of Centralized Escrow Accounting for Stewart Title. “Instant payments fulfill all three of those requirements, enabling us to deliver faster brokerage payouts and escrow settlements, which can now occur 24/7/365, all while reducing transaction fees. We fully expect this to become a competitive differentiator in our industry, and we’re pleased to lead the way.”

With Modern Treasury, the company will be able to transition 70% of wires and checks to electronic payment methods such as ACH and RTP.

Mr. Taylor further stated, “Not only do they optimize costs and reduce fraud risks, but these faster payment rails also enable Stewart Title to create better customer experiences.”

The company anticipates the impact to include:

- A faster closing process: Stewart Title’s entire closing process — from earnest money deposits and mortgage payouts to seller proceeds — is expected to speed up as customers and the company facilitate electronic payments.

- Electronically delivered agent commissions: Real estate agents can receive commissions electronically in a secure environment rather than waiting for checks to arrive and clear.

- Convenient, 24/7 closing opportunities: Because instant payments are not constrained by traditional banking hours, Stewart Title anticipates customers being able to one day close real estate transactions at a time most convenient for the customer, including evenings and weekends.

Through its partnership with Modern Treasury, Stewart Title now has a single platform to manage all money movement for ACH and RTP. Additionally, by orchestrating and automating electronic payments, Modern Treasury is poised to help Stewart Title deliver a better customer experience, drive efficiencies, and optimize costs.

“At Stewart Title, we are committed to providing exceptional service and staying at the forefront of innovation in the real estate industry,” Mr. Taylor said. “Partnering with Modern Treasury is an exciting step forward in our journey to modernize our payment operations. By adopting their platform, we aim to streamline processes, enhance security, and deliver a seamless payment experience for our customers, agents, and partners."

In partnership with Stewart Title, Modern Treasury is excited to help continue facilitating the transition from wires and checks to ACH and RTP, streamlining transactions, boosting efficiency, and enhancing security.