Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

Interoperability Between RTP and FedNow

RTP and FedNow have a lot in common, but they are not the same payment rail. In this journal, we discuss how the two systems can achieve interoperability.

Introduction

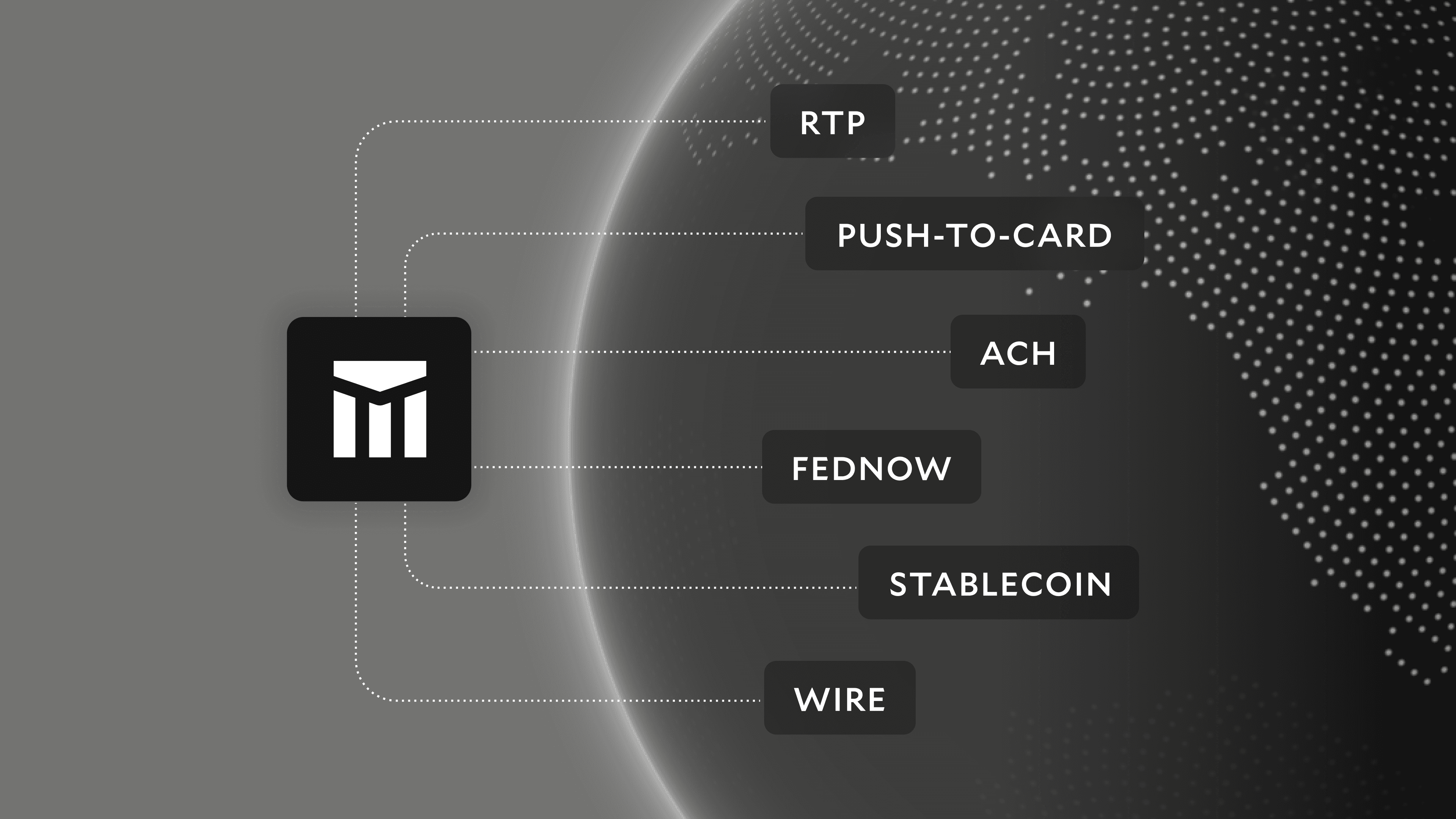

When it comes to faster payments in the US, there are two major players: the Real-Time Payments (RTP) Network, which went live in 2017, and FedNow, which will launch in 2023. With the launch of the RTP Network and looking ahead to the arrival of FedNow, it feels like the US is on the precipice of groundbreaking changes to money movement. At Modern Treasury, we are big believers in the idea that, eventually, all payments will begin and end with software and both of these payment rails are marked steps in that direction.

As many are aware, the Real-Time Payments (RTP) Network is a payment processing network used to transfer money electronically between two bank accounts instantaneously, 24 hours a day—including bank holidays and weekends. Any federally insured depository institution can utilize the RTP network.

Similar to RTP, FedNow will also enable instant fund transfers between two bank accounts, 24/7/365. All federal reserve banks—through the FedLine® network, which services over 10,000 financial institutions—will have access to FedNow.

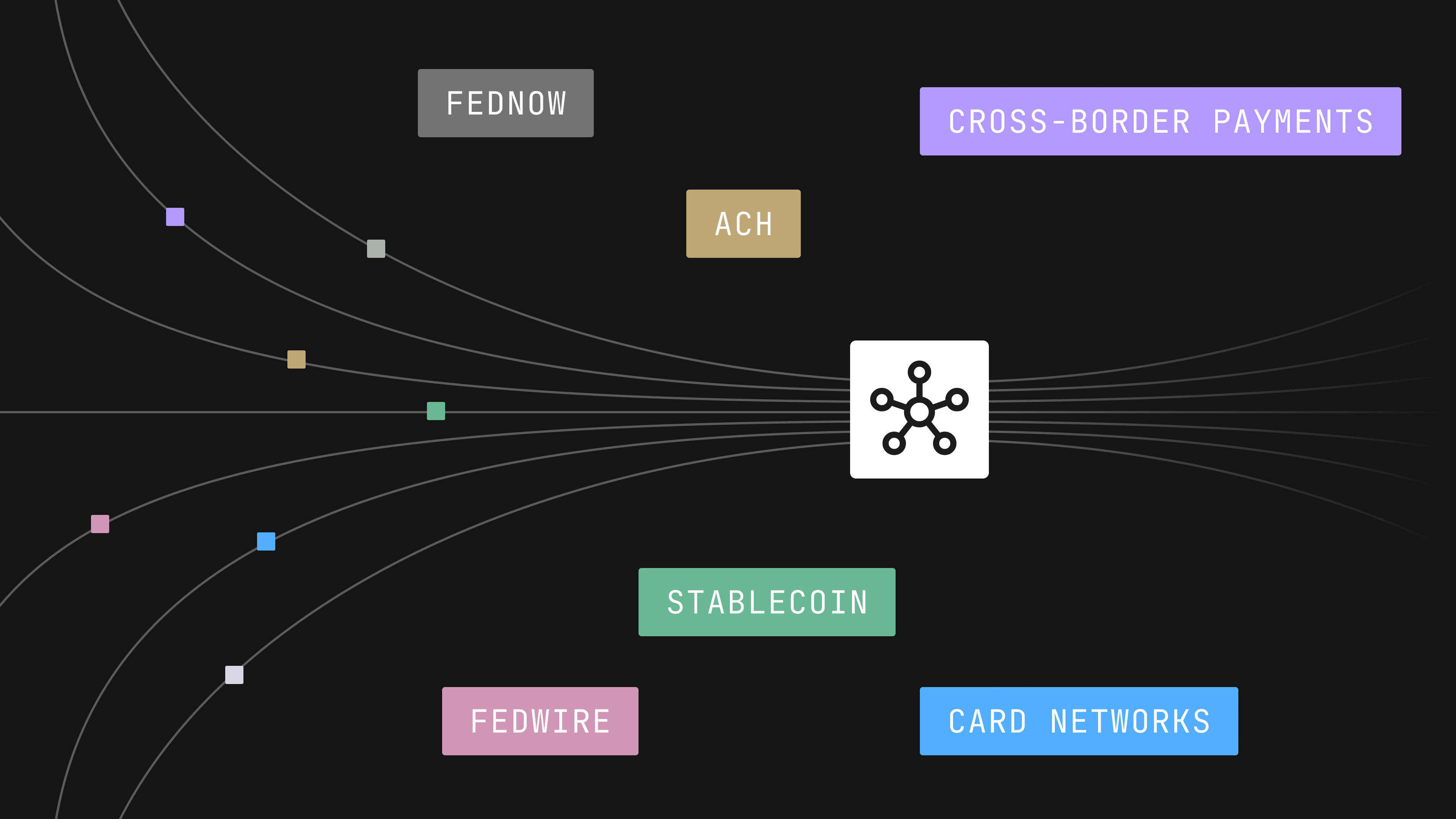

Though RTP and FedNow have a lot in common—from instant transfers to round-the-clock availability—they are not the same. The Clearing House was heavily consulted while FedNow was being built, and while the two systems work similarly and share some common architecture, they are still two different payment rails. In this journal, we’ll take a closer look at how the RTP Network and FedNow may still be able to work together.

What Is Interoperability And Why Does It Matter?

Put simply, interoperability is the ability for different software systems to be able to work together via the exchange and use of information. In the context of faster payments, interoperability is the hope that both RTP and FedNow will be able to work in conjunction with one another.

In a recently published comment letter, the American Bankers Association (ABA) asked the Federal Reserve to strive towards achieving technical interoperability with The Clearing House’s Real-Time Payments Network. ABA specifically requested that the Fed make changes to include the RTP Network in their proposed revision of Regulation J.

For context, Regulation J “provides the legal framework for depository institutions to collect checks and other items and to settle balances through the Federal Reserve System.” The Fed’s currently proposed revision to the regulation would create a new subjection applying only to FedNow transactions, with no mention of the RTP Network.

On a more granular level, the challenge around RTP and FedNow interoperability is that, while the communication language that each system uses is the same, the setup for sending and receiving payments via either system is slightly different.

In the US, there are two different types of interoperability: message exchange interoperability and message routing interoperability. With message exchange interoperability you can initiate a payment without the receiving financial institution being on the same service. But for message routing interoperability, both senders and receivers of a payment must be on the same service.

RTP and FedNow won't be inherently interoperable because they only have message routing interoperability. This is confusing because it makes it sound like the two systems will be interoperable, but really it means they’re only interoperable with themselves. To send an RTP payment, the receiver will need to be using RTP and vice versa. This is also true for FedNow, both sending and receiving parties will need to be using accounts that are enabled for FedNow transactions.

Where the two systems align as closely as possible is in the messaging specs: both RTP and FedNow will use ISO 20022. ISO 20022 is a standardized way of formatting messages that move money between financial institutions, businesses, and banks. This includes messages with information regarding payments, ATM transactions, fraud, and more. ISO 20022 files facilitate this transfer of information, offering a universal format for domestic and global financial communication.

Every ISO 20022 file has a specific four-part identity, signifying its category, type within that category, variant, and version. These categories are four-character identifiers indicating the message’s broad classification, such as cash management, camt; securities clearing, secl; and ATM card transactions, catp.

The standardized use of ISO 20022 could provide FedNow and RTP with a form of message exchange interoperability because messages are sent and received using the same standard.

How Will FedNow And RTP Work Together?

One possible workaround to the issue of interoperability between FedNow and RTP, could be a setup similar to the way FedACH and the Electronic Payments Network (EPN) work together, where both systems are technically separate but interoperate so well that it is difficult to distinguish between the two.

An additional solution could be to look at the way that The Clearing House Interbank Payments System (CHIPS) and Fedwire work together. Together, Fedwire and CHIPS form the primary US network for high-value payments, both domestic and international. Fedwire, as the name suggests, is part of the regulatory body of the Fed and is owned and operated by the twelve Federal Reserve Banks. CHIPS is its private sector counterpart, operated by The Clearing House and owned by the approximately 50 financial institutions that participate in its system.

Fedwire is a real-time gross settlement transfer system, which means that it processes each transaction individually and in full. CHIPS, on the other hand, is a netting engine, meaning the system allows multiple payments between the same parties to be aggregated rather than all processed as individual payments. In 1981, to prevent potential issues from waiting overnight or over a weekend to settle large volumes, the Federal Reserve agreed to provide same-day settlement to CHIPS participants through Fedwire.

Unlike CHIPS and Fedwire, both RTP and FedNow offer the same real-time services, but allowing financial institutions to utilize both could be an answer to the interoperability issue between the two. Because both systems use ISO 20022 messaging format and similar architecture, it is likely there would only be a few differing rules and regulations to manage in sending files between the two. While this sort of arrangement isn’t an ideal example of interoperability, it could offer a solution beyond a “one or the other” approach.

Widespread adoption of both FedNow and RTP is likely to be highly dependent on whether or not there is interoperability (or the appearance of interoperability) between the two services. Despite the obvious upsides to FedNow and RTP—convenience, 24/7/365 settlement, higher visibility into payment data, and reduced risk of payment failure, to name a few—if consumers or financial institutions are forced to choose between using either RTP or FedNow, it could be easier to fall back on cheaper, more familiar rails like ACH or card for the majority of payments.

Adoption of real-time solutions like RTP and FedNow has the potential to be a true game changer for faster payments in the US and worldwide. As our Co-Founder and CTO, Sam Aarons, said in a recent interview:

“When you think about this at a macro level: faster, easier money movement means better economic connections. If we can make ubiquitous, fast payments work in the US, we open ourselves to other possibilities: fast payments across borders, the opportunity to really redefine how the world moves money.”

With Modern Treasury’s simple API, your company can use both RTP and FedNow without having to worry about their interoperability. We can take care of the communication between the RTP Network and FedNow on our end, so you don’t have to. To find out more about how Modern Treasury can help your business streamline faster payments, reach out to us here.