Why Processors Hold Funds Up to 7x Longer Than Your Bank

When we talk to companies, we’re often surprised by the misconceptions that exist around ACH.

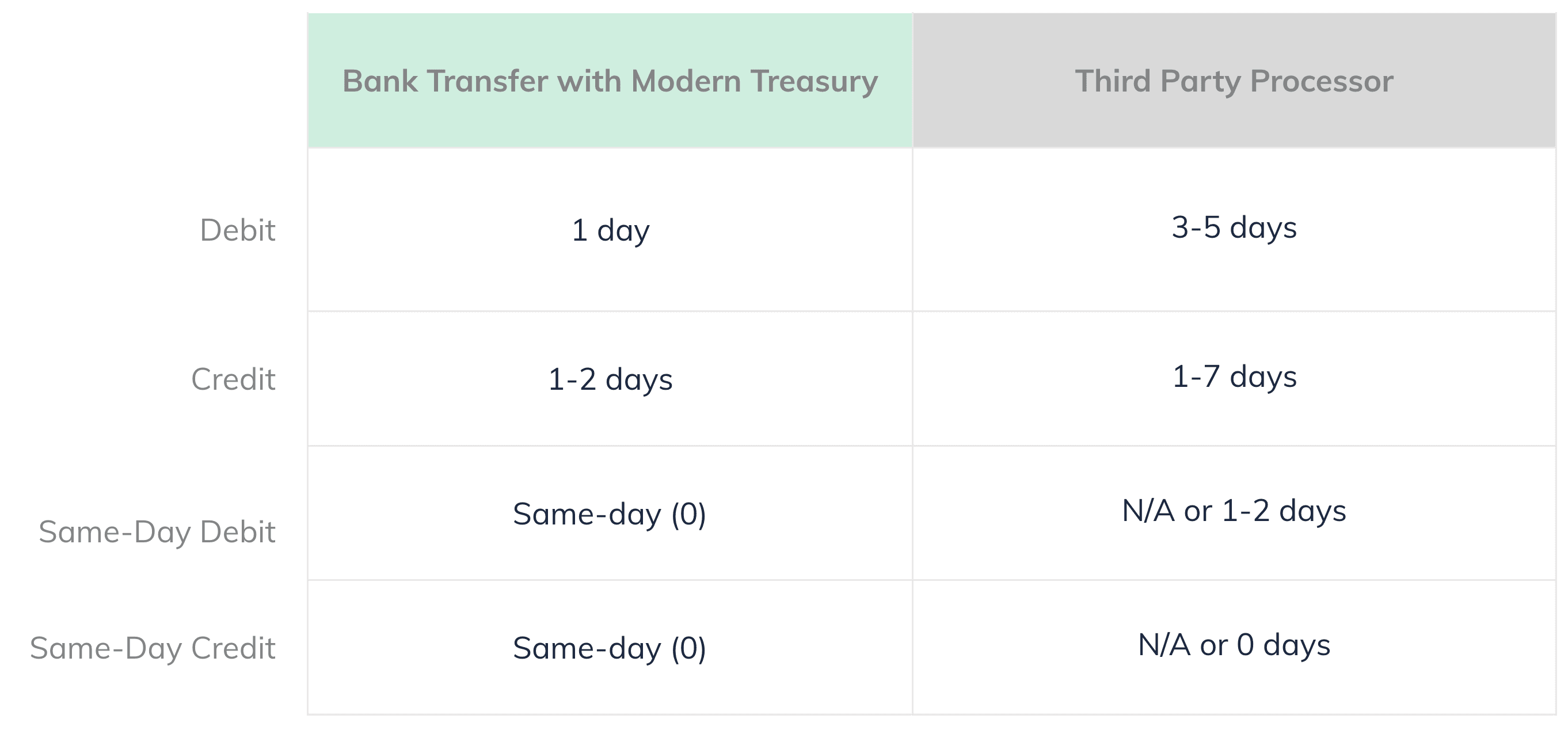

When we talk to companies, we’re often surprised by the misconceptions that exist around ACH. One of the most common is that ACH payments take 3, 5, or even 7 days to settle. Many people believe this because most payment processors advertise such timings.

According to NACHA, the organization that governs ACH:

The Nacha Operating Rules require that ACH credits settle in 1-2 business days and ACH debits settle on the next business day. Recent enhancements to the Nacha Operating Rules now enable same-day settlement of virtually all ACH transactions.

This means that if you charge your customer over ACH on Monday evening, the funds would be in your bank account by Tuesday morning.

Or if you send money to a contractor on Monday evening, they’ll have it in their bank account by Tuesday or Wednesday.

And if you use same-day ACH, the payment will settle in a few hours.

ACH can be fast. Yet payments processors advertise longer settlement times than those the banks guarantee you. [1]

The reason for this is that the processors are taking on risk by processing the payment through their own bank accounts. [2] By sitting in the flow of funds, they can end up liable for myriad issues that may arise. For example, if a customer challenges a debit to their account, the money would get withdrawn with an ACH return (R07).

Since the processors handle payments for a large pool of customers, they take the lowest common denominator approach. Almost everyone gets slow payments. Only the largest customers can negotiate this down. This approach gives the processors time to wait for ACH returns or other indications of fraud.

While this may be prudent for processors, it may not make sense for your business. Ultimately, businesses know their customers and counterparties better than these platforms do. Waiting 3-7 days for a payment to settle may materially deteriorate your customer experience or introduce onerous cash drag to your process.

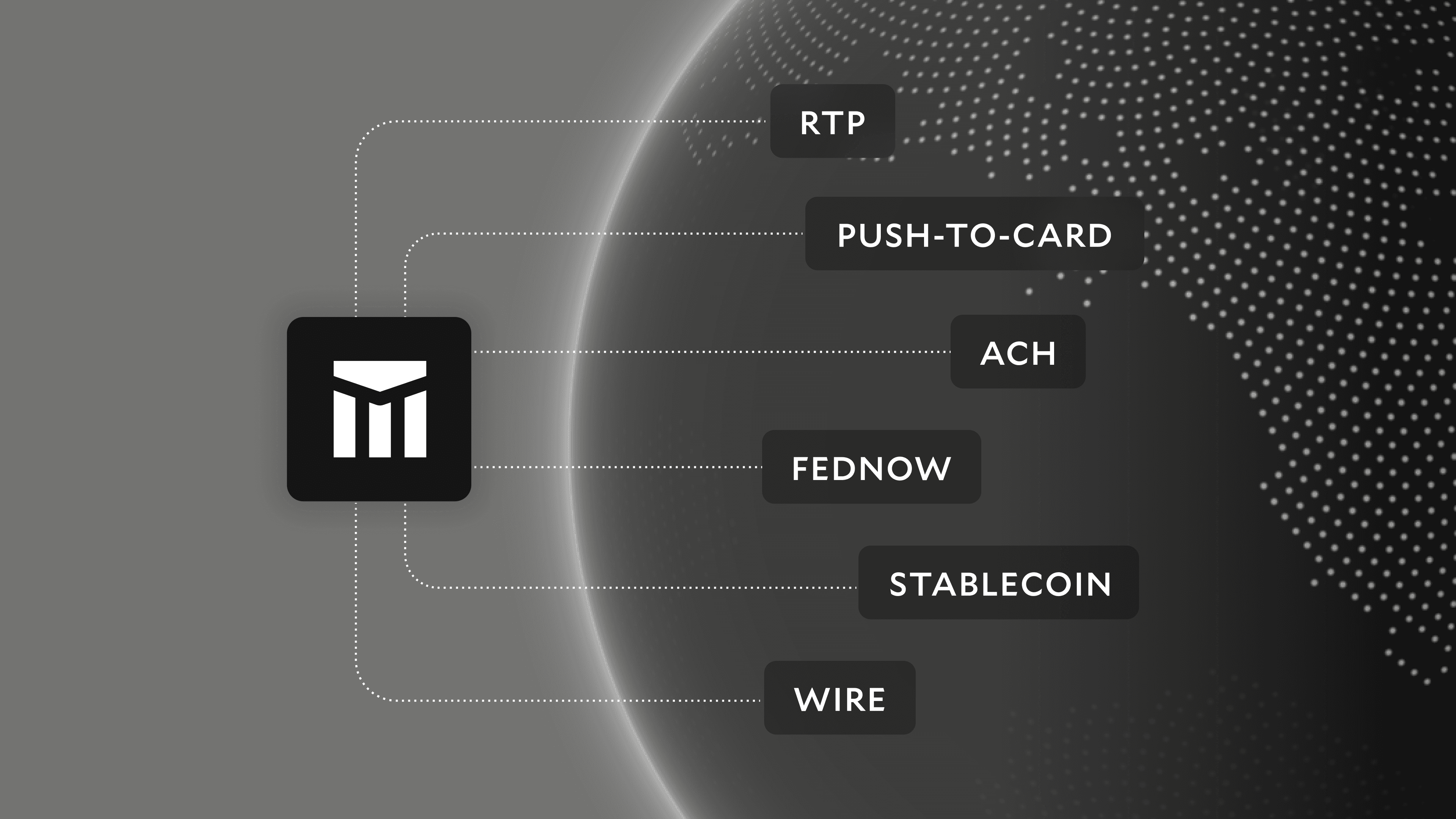

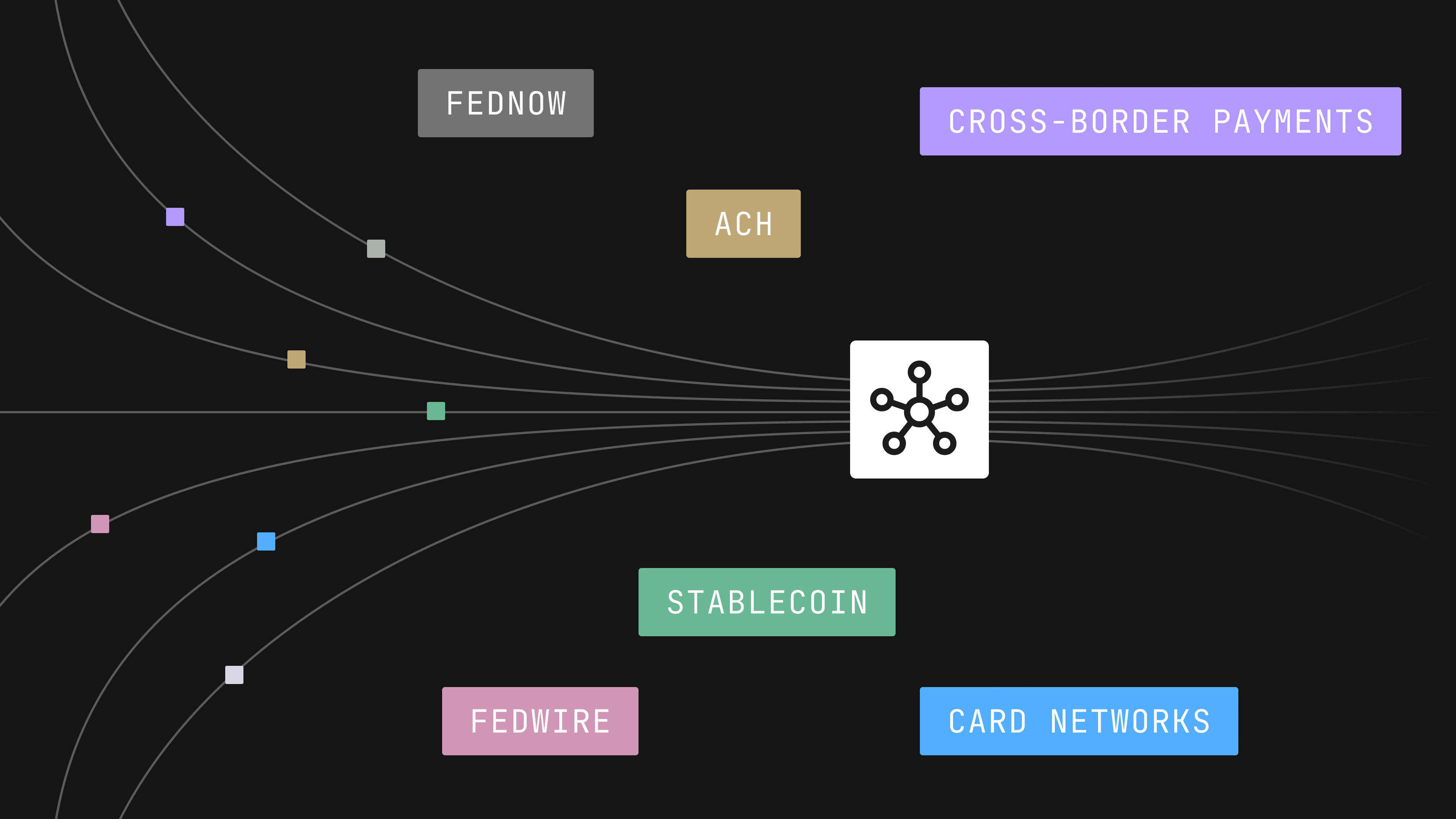

The best way to realize faster payments is to process the payments directly through your bank. Many companies like Gusto, Airbnb, Uber, and LendingHome have entire engineering teams that have built these systems in-house. At Modern Treasury, we believe all companies should be able to fully leverage the ACH system as these companies do. If you’re interested in learning how, please reach out.

Here are some published processing times from processors Dwolla and Stripe (more Stripe).

Note that the term "processor" is used differently for ACH than for credit cards. For an overview of payment processing in credit cards, a helpful resource is the background section in the OCC's handbook:

https://www.occ.treas.gov/publications/publications-by-type/comptrollers-handbook/merchant-processing/pub-ch-merchant-processing.pdf