Join us at Transfer 2025 to hear how industry leaders are building payments infrastructure for a real-time world.Register Today →

Announcing New Features for Finance and Treasury Teams

Modern Treasury is pleased to share new capabilities that support finance and treasury teams, including Automated Sweeps, Account Groups, and Enhanced Account Views.

Companies that move money at scale have unique payment operations needs. This is especially true for finance and treasury teams—as stewards of their company's cash, these teams must manage a high volume of transactions and financial operations quickly. They require up-to-date cash visibility and automation to keep pace with the speed of their products.

That is why we’re pleased to announce new capabilities that support finance and treasury teams, including Automated Sweeps, Account Groups, and Enhanced Account Views.

These enhancements provide real-time data and automated financial workflows. They enable finance and treasury teams to gain insight into their financial operations, streamline workflows, and drive efficiency and better decision-making throughout the business.

Sweeps

Most companies manage their liquidity manually. Finance and treasury teams log into multiple bank portals, individually monitor account balances, and manually process transfers between accounts. As a result, finance teams:

- Lose valuable time

- Lack insights to make better decisions with their cash

- Operate their businesses with less efficiency

With Sweeps, finance and treasury teams can manage their account balances and automate their cash movement across banks within Modern Treasury’s unified operating system.

How Sweeps Work

Modern Treasury enables finance and treasury teams to automate and simplify their transfers across banks and accounts in a centralized source of truth. Finance and treasury teams can now use Modern Treasury’s dashboard to:

- View real-time account balances and transactions across multiple banks within a centralized dashboard

- Automate account transfers based upon custom rules, including maximum set balances, minimum set balances, sweep intervals, and cadences

- Set permissions to limit sweeps to authorized individuals

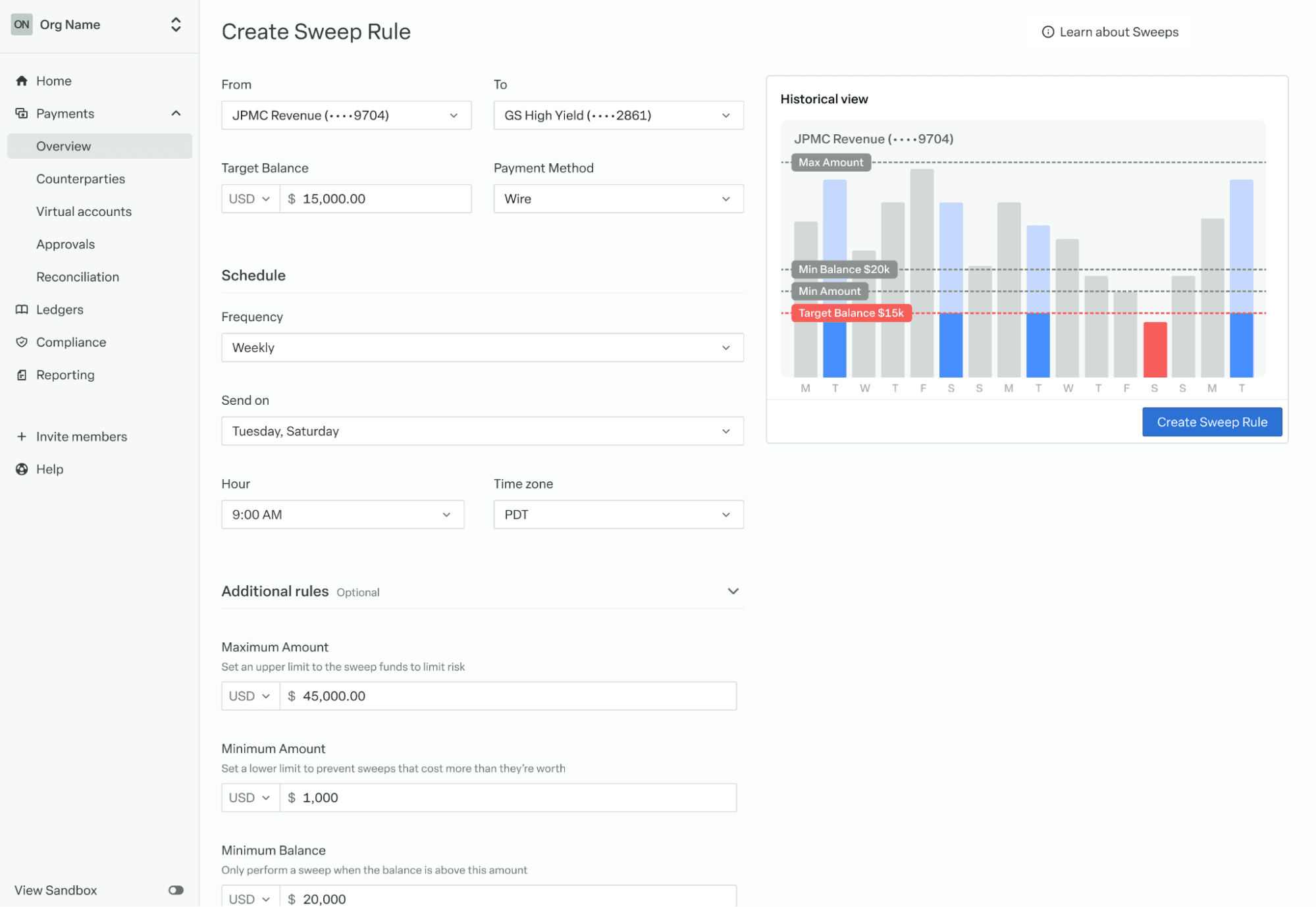

The Modern Treasury Sweeps interface

With Sweeps, teams can configure custom automation rules to:

- Top up accounts. Move funds into an account to meet a set target balance.

- Ex: I’d like to fund this account to maintain an FDIC target balance of $250,000.

- Draw down accounts. Sweep funds out of an account until it meets a set target balance.

- Ex: I’d like to create a zero balance account (ZBA) that automatically sweeps all funds above a nominal balance into an operating account.

- Recurring sweeps. Sweep funds based upon set schedules and intervals

- Ex: I’d like to sweep funds every Tuesday and Saturday into this separate account to fund my product operations.

Sweeps helps teams dramatically improve visibility into their cash positions with real-time data. Sweeps also simplifies subsequent financial workflows based upon this data.

Sweeps are a great fit for businesses sweeping funds to earn yield, pay expenses, operate Zero Balance Accounts for security and simplicity, safeguard deposits, and manage their product operations across banks.

Updating our Financial Dashboard

Finance and treasury teams often wind up toggling between bank portals, spreadsheets, and other tools to gain a full picture of their company’s finances.

With new financial capabilities in the Modern Treasury dashboard, these teams can now track, manage, and report on their financial operations, all in one place.

How It Works

Updates to the dashboard include Account Groups and Enhanced Account Views.

Account Groups

Account Groups are flexible filters that allow finance and treasury teams to aggregate and group select accounts (see how here). For finance and treasury teams, these filters provide custom reporting and cash visibility to drill down into specific areas of their business, replacing the need for spreadsheets and other messy tools.

For example:

- A finance team might create an Account Group called “Expenses,” which aggregates internal accounts (i.e. ZBAs for payroll, expense payments etc.)

- Companies also might create Account Groups that are specific to their business model: “collections”, “third-party investment accounts”, “marketplace customer accounts”, “capital market accounts” etc.

Account Groups give finance teams the tools and flexibility to manage and report on their financial operations in a way that aligns with their business needs.

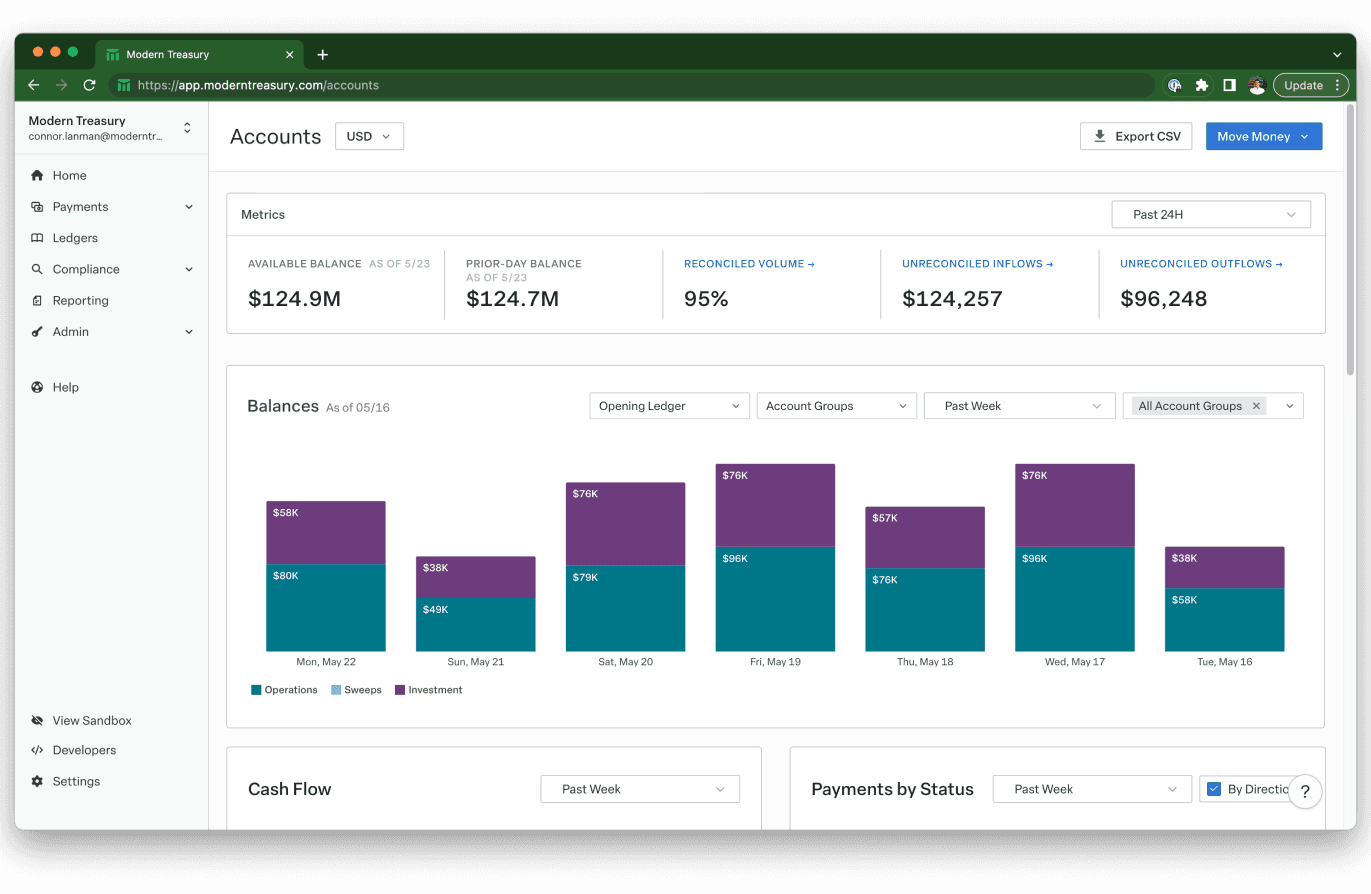

An example of Account Groups filtered to display “Operations”, “Sweeps”, and “Investment”

Enhanced Account Views

Enhanced Account Views are updates to Modern Treasury’s UI enabling teams to instantly access data regarding balances, cash flow, and payments’ status. These dashboard views offer finance and treasury teams greater visibility and insight into their financial operations through four new features:

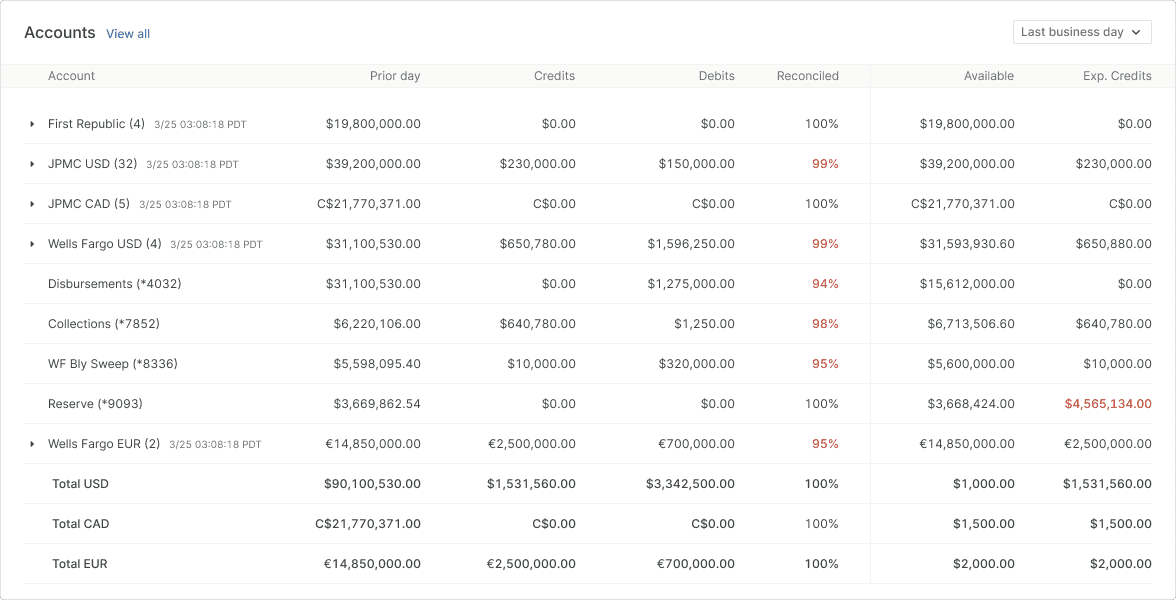

Balances Table

The Balances Table provides finance and treasury teams with a comprehensive summary view of accounts, including key data, such as prior day and available balances, prior day money in and money out, reconciliation status, and anticipated money movement based on scheduled payments.

An example of the Balances Table

Using the Balances table, finance and treasury teams can drill down into specific accounts for deeper analysis.

Historical Balances

The Historical Balances module consolidates balances across banks and accounts into a single view. This provides finance and treasury teams with insight into how cash states are changing over time.

In addition, the Historical Balances module allows finance and treasury teams to dig into specific accounts and monitor individual transactions.

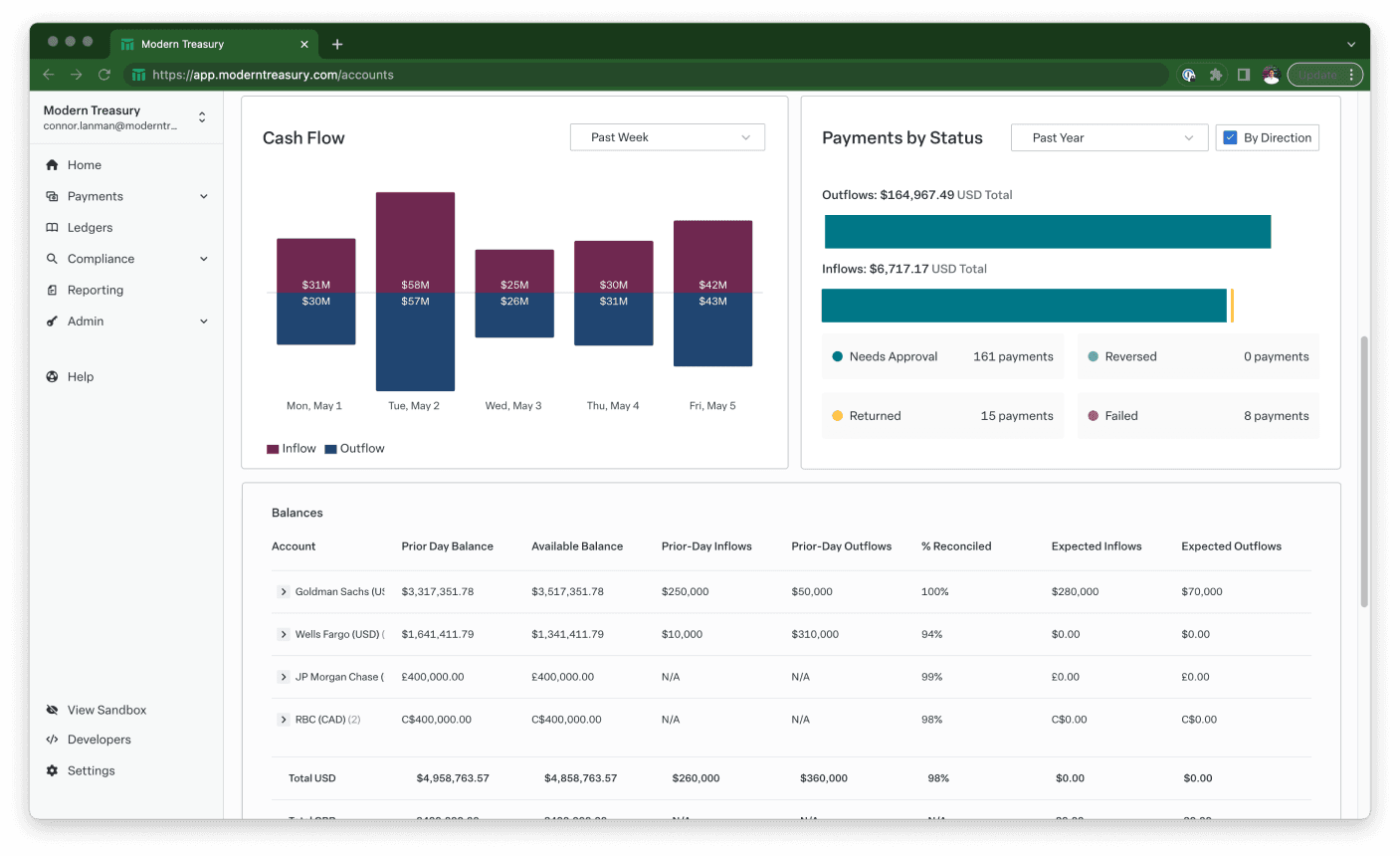

Cash Flow Visualization

Our new Cash Flow module allows finance teams to visualize incoming and outgoing cash flows across all internal bank accounts.

An example of Cash Flow Visualization and Payments by Status

This feature helps users understand the flow of funds and its impact on overall balances.

Payments By Status

The Payments by Status feature centralizes Payment Orders and corresponding statuses within their Modern Treasury instance.

Users can quickly identify any issues or discrepancies and efficiently review and address them, ensuring smooth money movement operations.

Learn more about Enhanced Account Views here.

Financial Insight, Clarity, and Efficiency with Modern Treasury

From automated cash movement to custom financial reporting, Modern Treasury’s new releases can help companies streamline and uplevel payments.

To learn more about these features or explore the operating system for money movement, please reach out anytime.

Try Modern Treasury

See how smooth payment operations can be.