Customer Spotlight: AvidXchange

AvidXchange is a leader in providing automated accounts payable solutions. They work with Modern Treasury to manage multiple bank integrations and support over 8,000 buyer customers and 1.2 million supplier customers.

AvidXchange, a leading provider of accounts payable (AP) automation software and payment solutions, helps businesses streamline and automate their AP processes—including managing invoices, purchase order matching, and workflow automation. AvidXchange's operations require a reliable and scalable payment infrastructure to handle high transaction volumes and ensure seamless payment processing for their clients.

Modern Treasury’s ability to maintain multiple bank connections was a key factor in bringing the two companies together. Bank redundancy is crucial for companies that process payments on behalf of their customers as it ensures operational continuity, mitigates risks, and enhances flexibility by maintaining multiple banking relationships. Access to multiple bank connections makes it easier to handle potential disruptions to transactions, comply with diverse regulations, and leverage the best capabilities at each bank, ultimately providing more reliable and comprehensive services to customers.

For AvidXchange in particular, bank redundancy offers flexibility in payment types, allowing them multiple options for processing payments on behalf of customers—thereby ensuring that AP transactions have a fallback option for still being processed on time, should issues arise.

Reducing the operational overhead associated with managing unique bank connections was another critical factor for AvidXchange. Traditionally, establishing and maintaining individual connections with each bank has required companies considerable time and effort—which could be better utilized in enhancing core services—but with Modern Treasury, companies don’t need to worry about building and maintaining those connections on their own.

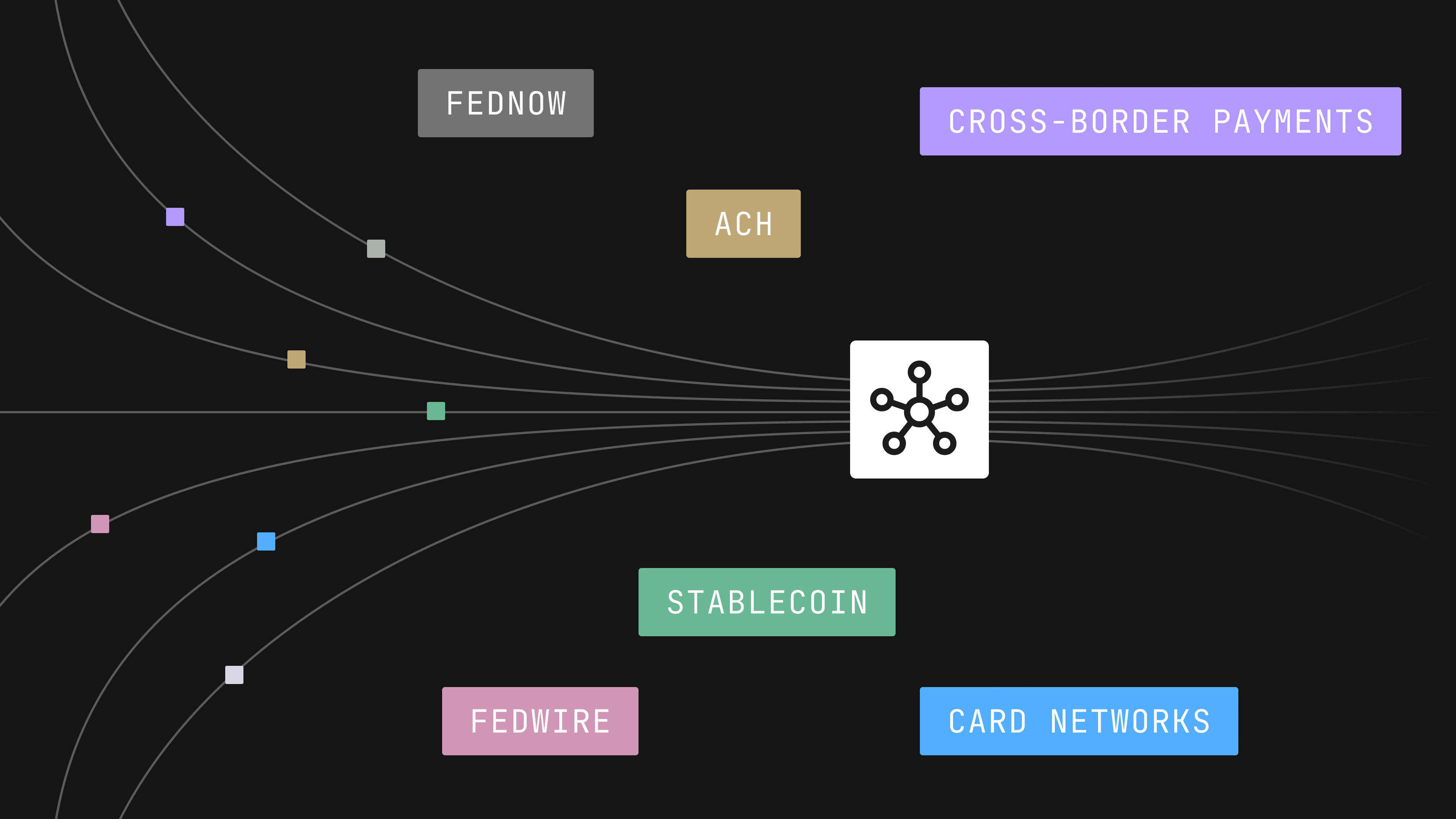

AvidXchange also utilizes our single API to manage their ePayments for AvidPay. AvidPay helps businesses replace manual payment processes and more easily pay bills by connecting them to their suppliers via the AvidPay Network. Leveraging Modern Treasury’s API allowed AvidXchange to consolidate their payment workflows and improve overall system efficiency—enhancing scalability and enabling AvidXchange to handle increasing transaction volumes across AvidPay with ease.

As Doug Anderson, Chief Product Officer at AvidXchange, puts it, “It all goes back to the experience we want to deliver. Modern Treasury didn’t exist, so we were building bespoke and rail-by-rail. But there is a better way…Infrastructure is like roads: The difference between gravel and an interstate highway. That’s what infrastructure can be for payments.”

In partnership with Modern Treasury, AvidXchange can quickly add additional bank connections and access new payment rails as they become available. This agility is crucial in the ever-evolving financial services industry, where new payment methods and technologies continue to arise. With the Modern Treasury platform, AvidXchange continues to meet their clients' evolving needs, providing them with the most efficient and innovative payment solutions available.

One of the things we love most about the work we do at Modern Treasury is the ability it gives us to work alongside companies like AvidXchange who continue to innovate and evolve to best meet their customers' changing needs.