Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

The Top Money Movers in the US

In March, NACHA released their listing of top ACH financial institutions. We always want to know as much as possible about how money moves in the United States, so we took a deep dive into the data they published.

In March, NACHA released their listing of top ACH financial institutions. We always want to know as much as possible about how money moves in the United States, so we took a deep dive into the data they published.

If you want to learn more about ACH basics, head to this blog post.

Who’s on the list?

Many of the 65 financial institutions listed are familiar names: Wells Fargo, Citigroup, and Capital One, for example.

There are also specialty banks: USAA and Navy Federal support and serve military families, and Schools First Federal Credit Union which serves the education community in California. A number of US subsidiaries of international banks appear too, including MUFG (Japan), Santander (Spain), and HSBC (UK). A few digital-oriented companies made the list, including Green Dot which specializes in prepaid debit cards, and Ally which has no physical branches. Ally was started to help consumers and dealers finance General Motors automobiles.

Two more stick out. The first, Boeing Employees' Credit Union, serves those who live or work in Washington State and a few neighboring counties. It started in the 1930s to help Boeing employees purchase their tools during the Great Depression. The second, OptumBank, is the financial services arm of Optum, a health care infrastructure company. OptumBank manages a large number of HSAs, HRAs, MSAs, and FSAs.

The Top Three

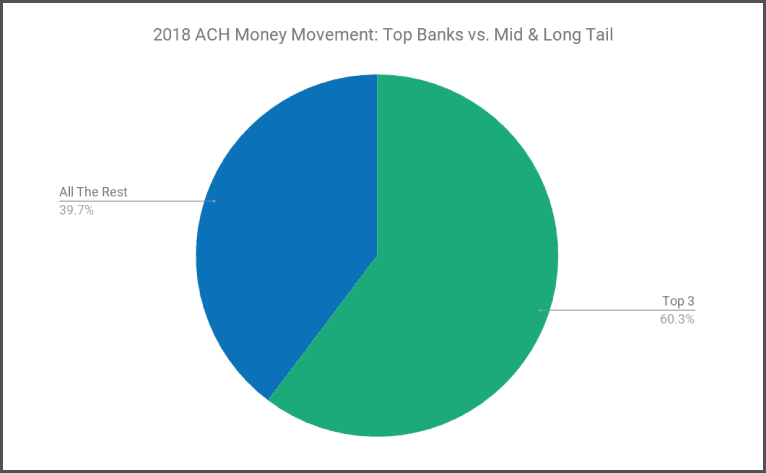

As part of our analysis, we combined originating and receiving data to determine which banks are managing the highest number of ACH transactions. The top three are not surprising:

- Wells Fargo

- J.P. Morgan Chase

- Bank of America

What is surprising is that these top three institutions were party to 1.5x the number of transactions compared to all the rest of the institutions on the list, combined.

Who moves money in which direction?

There are two ways to think about an ACH transaction. There’s the institution that originates the payment orders, or who asks the money to move. Then there’s the direction that money flows. Between originating and receiving (who issued orders) and money movement direction (credits and debits), there are four combinations. If you want to read more about this, head to this post.

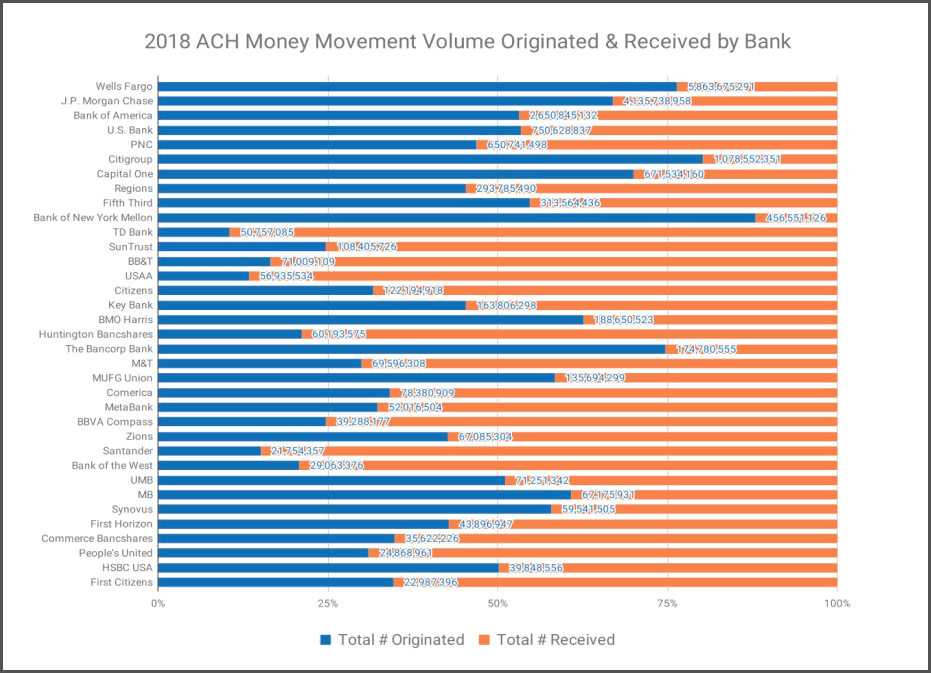

We cut the data in both directions. First, by originating and receiving:

The chart is organized by total volume, but a few high originators pop out: Wells Fargo, BNY Mellon, Citigroup, and The Bancorp Bank.

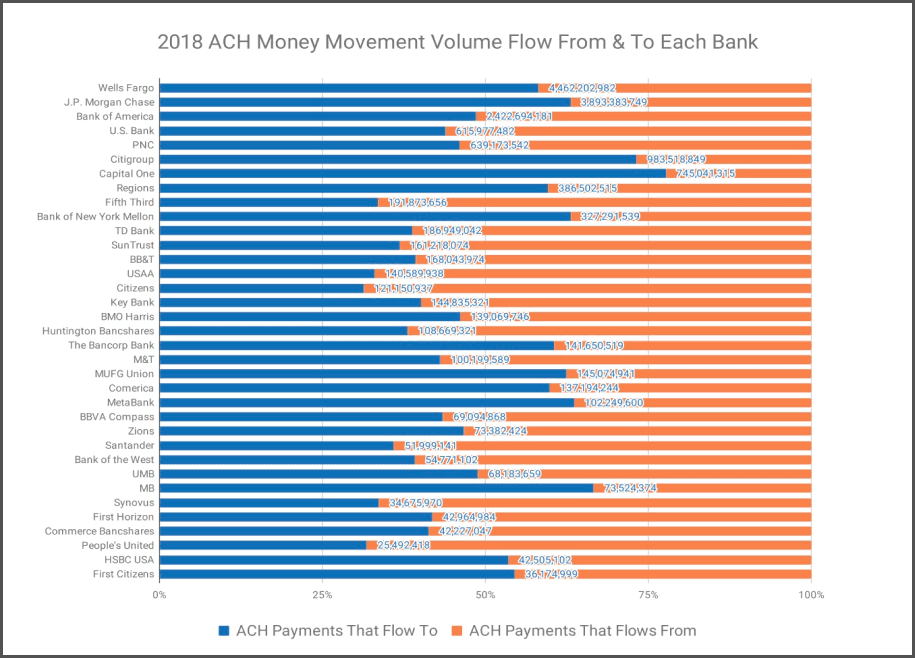

Second, we looked at the flow of money, things (mostly) look more evenly distributed:

One of the banks that receives more transactions than it sends (via ACH) is Capital One. Given that such a large portion of Capital One’s business is in credit cards, this is the behavior we would expect to see in the data.

NACHA says that 93% of ACH commercial origination volume can be accounted for the financial institutions on this list and that receiving volume accounts for 59%.

The original published data is in PDF form, so we’ve also decided to make all the NACHA data public in this Google Doc. Take a look and let us know what you think.

If this analysis was interesting, let us know! Get in touch anytime.

PS. Some notes on our method

All our data is here. Not all institutions on the list have originate and receive data. For that reason, we limited our analysis to the 35 institutions listed with data in both directions. With access to all the data, we would have added nine more institutions to the list:

We only have receive, need originating data:

- Navy Federal Credit Union

- State Employees Credit Union

- TCF

- Arvest

We only have originate, need receiving data:

- First Premier

- First National of Nebraska

- Northern Trust

- Deutsche Bank

- Credit One