How AI and Automation are Reshaping Payroll Workflows

In this Journal, we explore how AI-driven automation is reshaping payroll.

Managing payroll has become increasingly complex in today's fast-paced business environment. Traditionally, payroll workflows have been laden with errors, delays, and compliance issues, prompting companies to turn to modern technology for solutions. Enter AI and automation. As Modern Treasury’s Head of AI, Patrick Harrington, puts it, “Finance is rule-based, similar to language. And so a lot of these modern [AI and ML] models are very appropriate for financial applications. Now is the time to leverage AI for productivity enhancement. This technology is not just a future concept; it's a present tool that can significantly enhance efficiency and accuracy.”

By leveraging AI, payroll processes can become more efficient, accurate, and real-time—ultimately saving time, cutting costs, and boosting employee and customer satisfaction. Here, we'll explore how AI-driven automation is transforming payroll, speeding up payments, improving efficiency, and benefiting both businesses and their employees.

The Benefits of AI for Payroll

As AI continues to evolve, opportunities for applications that can enable the payroll management world to do its best work will continue to grow. Currently, 77% of business leaders have embraced AI in their payroll functions. There’s a clear opportunity for improving processing times and reporting accuracy and reducing the need for manual oversight.

AI has the potential to handle complex payouts, such as split payments and cross-border transactions. Similarly, as AI monitors payouts, business ledgers can reconcile and update automatically. Streamlining this process reduces human error and helps maintain financial transparency, so companies can always know the available balance in their accounts in real-time.

Reshaping Workflows

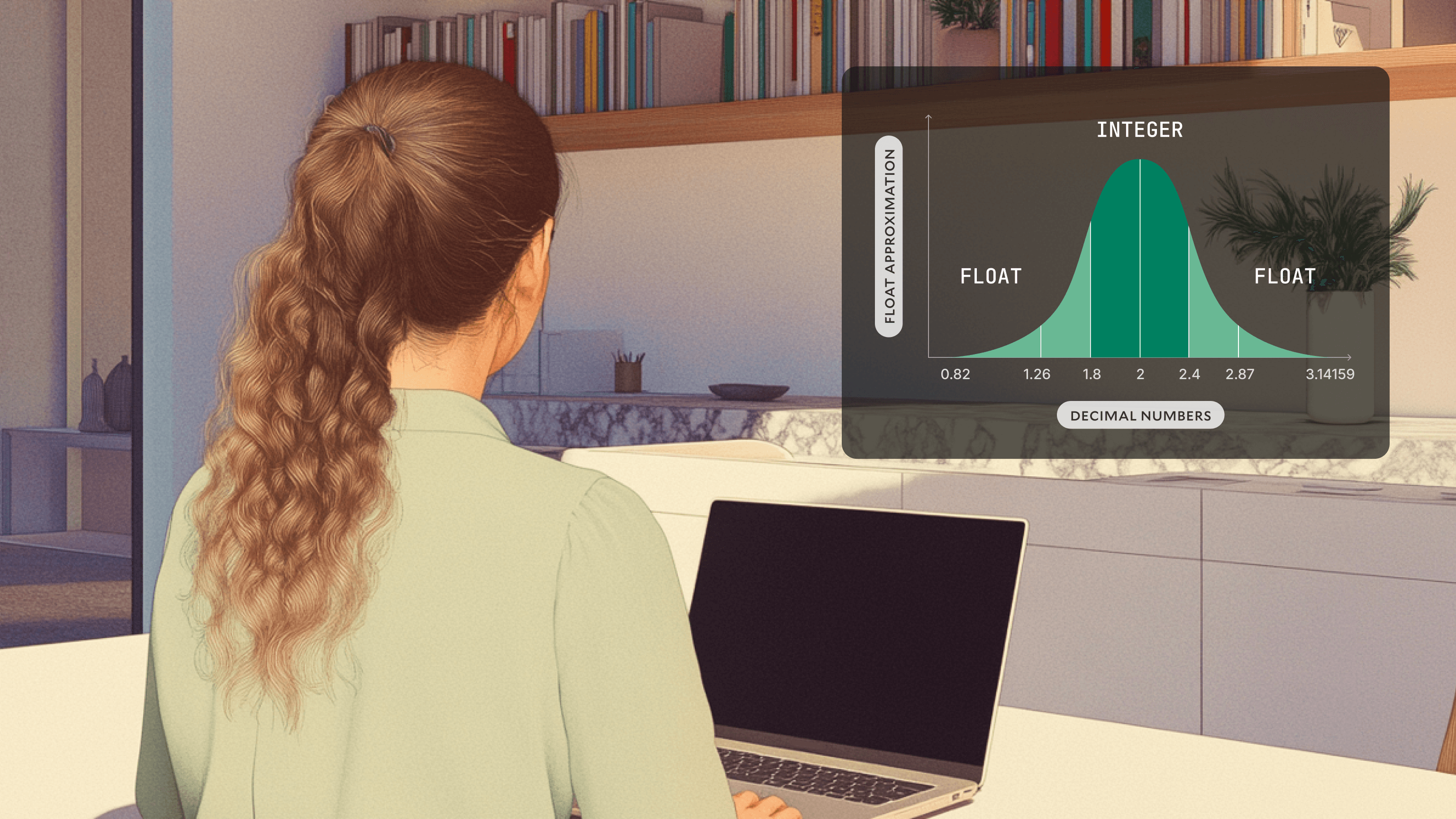

One of the biggest opportunities for AI and payroll workflows is the ability of AI to detect reporting errors and anomalies. Because AI uses pattern recognition and is always learning from historical data, it is especially good at catching things as small as decimal point errors. What is tedious and tiring for the human eye becomes manageable and accurate with the implementation of AI.

Delivering Faster Payments

Real-time payroll adjustments can ensure employees are paid fairly and accurately, regardless of changing schedules, paid holidays, and total work hours, and streamlined payroll processes can remove the pressure of meeting payroll deadlines.

AI-powered systems can seamlessly integrate with faster payment rails like FedNow and Real-Time Payments (RTP). Through APIs and intelligent scheduling, AI can ensure that money moves more efficiently, reducing the reliance on traditional, slower payment systems that may take 1-3 business days.

Employees can access their wages the same day, which can be particularly valuable for those living paycheck-to-paycheck or facing emergency expenses. Businesses benefit from timely payments, which leads to improved employee morale and stronger financial stability.

Generative AI can also flag anomalies and errors in the payroll process. Let’s say a payroll service, PayRoll With It, works with restaurant owners across several states. If a restaurant in Portland, Oregon, hires someone who lives in Washington, AI would flag if that restaurant did not have tax registration in Washington state and then help start the process. With automation, users can avoid delays and errors in payroll, which results in happier employees and better results.

Faster payroll processing means businesses can respond faster to payroll changes or adjustments, ensuring employees are paid accurately and on time. It also reduces the cost of payroll services, leading to more competitive rates for businesses.

Improving Efficiency

While AI can already detect errors in some cases, there is potential for systems to become even more advanced in this arena, like automating exception handling in more complex payroll cases, for example. By recognizing patterns and anomalies, AI can streamline exception handling—like retroactive pay adjustments, varying tax treatments, or one-off bonuses. This allows a platform with integrated AI to address these irregularities automatically via pre-programmed rules, reducing the need for human oversight.

Utilizing AI and automation in payroll processing allows businesses to handle payroll tasks with far fewer manual steps. AI can easily take care of the calculations, approvals, and payments in a way that minimizes human intervention. By integrating directly with banks and accounting systems, businesses can reduce errors and speed up the process, freeing up teams to focus on more strategic work.

Automation with AI also helps ensure compliance with payroll regulations, reducing the risk of costly errors and audits. It also enhances fraud detection by monitoring transactions in real-time and flagging unusual activities.

With AI-based systems that centralize payroll data and updates in real time, HR, finance, and operations teams all have immediate access to the same information, eliminating the need for back-and-forth checks or waiting on updates. This transparency helps teams collaborate more efficiently, especially when resolving issues or answering employee questions about payments or benefits. Notifications and alerts can also be set up to keep everyone in the loop, whether it's about upcoming pay runs, compliance checks, or any discrepancies. This cross-channel clarity reduces miscommunication and speeds up decision-making and problem-solving.

Beyond operational efficiency, automation with a platform like Modern Treasury can help companies scale faster. As a company grows, the payroll process scales with it, adapting to more employees and complex payment structures without needing more hands on deck. This helps businesses optimize resources and eliminates the need to invest in additional payroll software or personnel as they expand.

Harrington notes, “ AI is no boogeyman… Across professions, technical details regarding how these systems operate can feel elusive. Perhaps the most important thing to know about AI and related workflows is that they are statistical models at heart—not omnipotent robots. AI models suss out nuanced correlations, trends, and concepts from over 20 years of consumer internet data and content, all in a statistical manner. These technologies are best seen as new tools to augment—not usurp—a finance professional’s toolbox, offering more gains to productivity than reasons to fear.”

Employer and Employee Benefits

The global, post-pandemic workforce leaves payroll managers handling multi-currency payrolls, global legislation, and contract workers, often on different payroll schedules. AI can quickly identify legislative changes, tax rates, and calculations to speed up payroll processing times and decrease the room for human error. Its capacity to give real-time insights into valuable data can help drive more impactful decision-making.

In traditional payroll systems, employee hours, tax withholdings, and benefits data are manually checked for accuracy. AI-driven systems can automatically verify this data in real-time. Machine learning algorithms analyze historical data to identify discrepancies, flagging errors before payments are processed. This significantly reduces the back-and-forth between payroll processors and employers, which can often delay payouts.

Faster validation means fewer delays in payroll cycles. For businesses, this reduces administrative overhead, and for employees, it ensures timely payments without errors like incorrect deductions or missing hours.

AI can also prevent burnout. AI has the potential to remove the tedious tasks we reference above. In return, payroll staff can focus more on high-level strategic planning.

How Modern Treasury Streamlines Payroll

AI has the potential to transform the payroll process into a more secure and transparent workflow. There may even be a day when a fully autonomous process exists with minimal human oversight. These innovations are exciting advancements in the industry, but there’s more to it. Understanding how to implement AI into organizations in a way that is ultimately beneficial for internal teams and customer experience is key.

At Modern Treasury, our team has established a robust framework for responsibly integrating AI into our platform. As Harrington says: “By integrating ML and AI, we aim to continue revolutionizing financial operations, streamlining workflows for companies, and drive meaningful innovation across a variety of sectors… While innovation is amazing, innovation in and of itself does not make a better customer experience by default. We have to understand how to translate that innovation into products and workflows that are delightful, create efficiency, and ultimately create greater value for all parties.”

Modern Treasury is the payment operations platform for the instant economy. If you want to learn more about our approach to AI and how it can help you simplify your payroll processes, reach out to us.