Modern Treasury has acquired Beam.Build for what's next →

Accelerating Corporate Adoption of FedNow and RTP: The 3 I's Framework

FedNow and RTP are an opportunity for the US to achieve parity with other countries when it comes to faster payments. Today, we’re sharing our 3 I's framework as a way to drive ubiquitous adoption and standardization of these faster payments rails.

Organizations are increasingly excited about the potential of for both B2B and B2C use cases. At Modern Treasury, we’re witnessing firsthand how companies like Side and Stewart Title leverage these new payment rails for faster brokerage payouts and escrow settlements, which can now occur 24/7/365.

Additionally, there is a growing demand for instant microdeposits, where companies are verifying new customer accounts instantly using RTP and FedNow, streamlining the user experience. However, significant investments are still needed across the multiple layers of the ecosystem to achieve ubiquitous adoption.

This article introduces the 3 I's framework—Infrastructure, Interfaces, and Instructions—as essential components for driving widespread adoption and standardization.

Introducing the 3 I's Framework

To successfully adopt FedNow and RTP, the payments ecosystem—including the Federal Reserve, The Clearing House, banks, core providers, processors, and regulatory agencies—needs to focus on three critical areas:

- Infrastructure: The foundational capabilities that need to be provided by the networks and banks to use FedNow and RTP for B2B and B2C use cases.

- Interfaces: Standardized user interfaces to ensure a consistent, reliable, and secure payment experience.

- Instructions: Clear guidelines and standards for all stakeholders on managing the risks of instant payments to instill confidence and address fears.

Let's dive into each of these components.

Infrastructure

Unified Directory

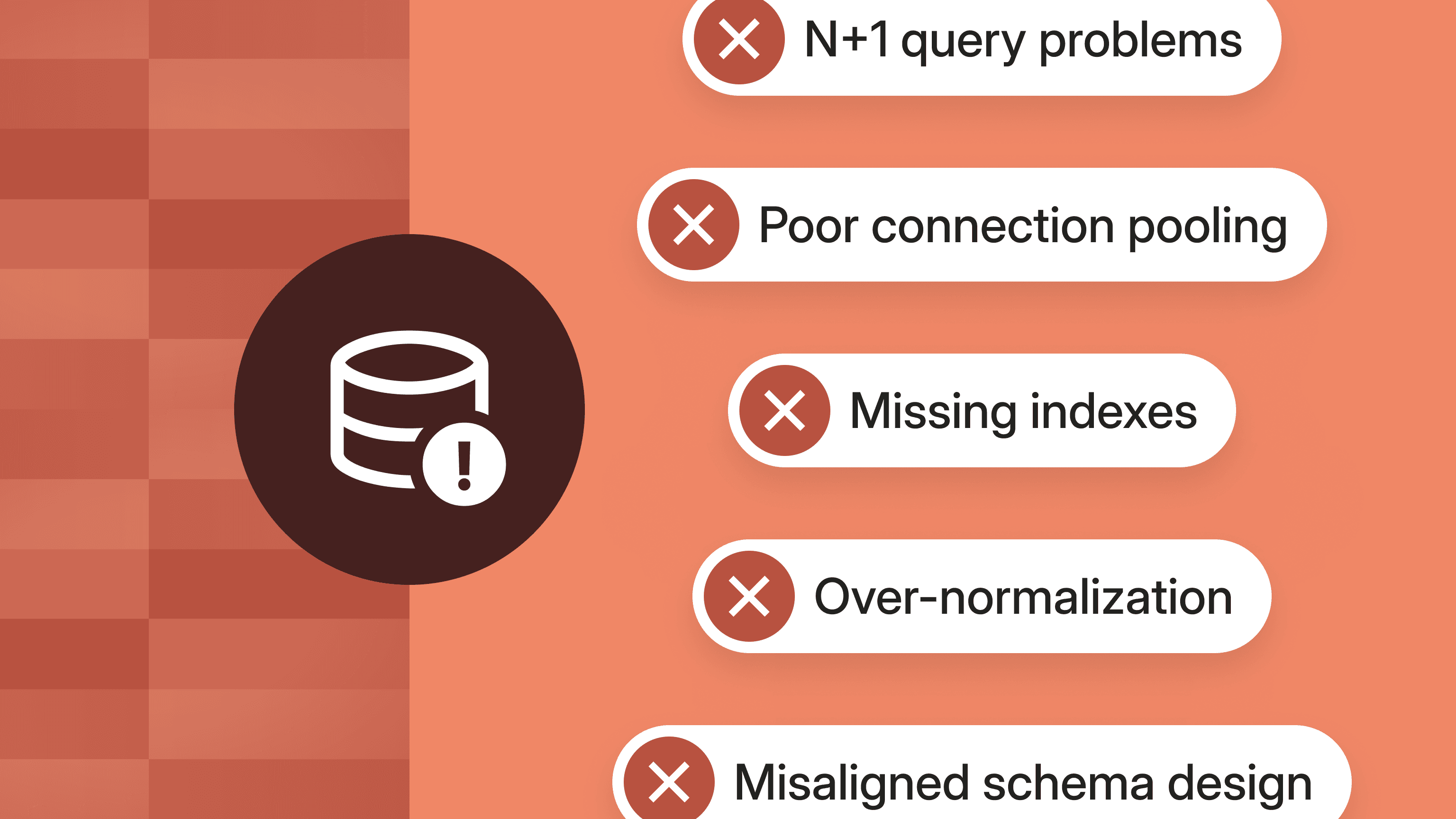

A unified directory of FedNow and RTP supporting routing numbers available to all payment providers is essential for managing eligibility, account limits, and deny lists to track fraud. This centralized system will enable customers to initiate FedNow and RTP payments and Request for Payment (RFP) messages with confidence. By reducing the risk of fraud and providing a reliable database, the unified directory will enhance trust and efficiency in the payment process.

Debit Authorization Mandates for Request for Payment (RFP)

RFP is a powerful feature of FedNow and RTP, enabling instant, irrevocable, and 24/7/365 pay-ins. However, in its current state, it only facilitates individual payments that need to be authorized every time. Debit authorization mandates, also known as standing debit authorization, for RFPs are required to facilitate recurring payments use cases like bill payments or payroll debits. This can replace traditional methods like ACH debits and wire drawdowns, and will address ACH debit fraud and reduce the operational costs associated with wire drawdowns. By simplifying the process and enhancing security, corporates can save on fees and streamline their payment operations.

Intentional and Configurable Delays

Introducing intentional and configurable delays for unrecognized counterparties or transactions above certain amount thresholds can significantly reduce fraud. For instance, the first payment to an unrecognized counterparty could be delayed by an hour, providing an opportunity to cancel the payment if fraud is detected. Allowing customers to configure these delays based on their specific needs adds an extra layer of security.

Real-Time Reconciliation and Data Visibility

Real-time reconciliation and data visibility are crucial for effective financial management. Knowing the exact status of a payment at any given time—whether it has failed or been completed—is essential to orchestrate downstream product experiences, manage cash liquidity, and reconcile systems. Currently, banks and core providers often only provide end-of-day or intraday reporting, which is insufficient for corporates to manage real-time payment systems. Investing in technology that provides immediate transaction status updates is essential.

Interfaces

Standardized RFP User Experience (UX)

RFP adoption is hindered by fragmented user experiences across different banking apps, with each bank presenting a different notification and payment experience. Standardizing the RFP UX creates a consistent experience for end users, making it easier to use and drive demand with banks and merchants. This standardization will help users learn and trust the new payment behavior, ultimately leading to greater utilization of RFP and lower drop-offs in payment completion rates.

Unified Identity

Moving beyond bank accounts and routing numbers as the sole identifiers for payments is critical. Instant payment systems like UPI in India and Pix in Brazil have demonstrated the effectiveness of using aliases or IDs, similar to Venmo or Cash App, for sending payments. This approach enhances security by masking sensitive account details, which don't need to be kept secret like account numbers.

Aliases integrate seamlessly with two-factor authentication (2FA), adding an extra layer of protection. Additionally, they reduce manual errors when entering payment information, ensuring greater accuracy. By consolidating data across different payment rails, a unified ID aids in fraud prevention and simplifies the payment process, providing a more secure and user-friendly experience.

QR Codes for In-Person Payments

Incorporating QR codes, as seen in UPI and PIX systems, can help make in-person payments using FedNow and RTP easier. QR codes provide a simple and efficient way to conduct transactions, making real-life payments quicker and more convenient. This can significantly enhance the user experience and drive adoption of real-time payments in everyday transactions.

Instructions

Comprehensive and Clear Fraud Guidelines

Clear fraud strategies are essential for building trust and ensuring the smooth adoption of instant payments. To be sure, the current legal frameworks for RTP and FedNow do set rules for fraud loss allocation. But new fraud scenarios raise new policy questions—notably, under current law, where a scammer manipulates a business into authorizing a payment, the business may be surprised to discover that it bears the loss. Even courts may struggle to apply existing law to new fraud scenarios, which can lead to confusion and hesitancy among banks and corporates.

To ensure safety and foster confidence, the instant payments ecosystem needs comprehensive guidelines, education, and coordination on fraud loss ownership—across not just banks, but also processors, corporates, and end users.

Modernizing Laws Governing Payments and Settlement

Existing laws need to keep pace with FedNow and RTP to fully leverage their capabilities. For example, in real estate, states have “Good Funds” laws that govern permitted payment methods for closing funds. While these laws help ensure finality of payment, typically they were adopted long before the launch of irrevocable real-time payments and do not expressly list these new rails as permitted payment methods. Statutory updates to expressly enable payments by FedNow and RTP will be welcome accelerants to adoption, helping unlock the potential of real-time payments across various industries.

Looking ahead

The transformative potential of instant payments is clear, but achieving widespread adoption requires a concerted effort across the payments ecosystem. Each stakeholder, from networks like the Federal Reserve and The Clearing House to banks, core providers, and processors, must focus on enhancing Infrastructure, Interfaces, and Instructions.

Investing in unified directories enables us to manage eligibility and track fraud more effectively. Standardizing user experiences, particularly for the Request for Payment feature, will drive consistent and intuitive interactions for all users. Establishing clear and comprehensive fraud guidelines will build trust and reduce hesitancy among corporates and banks.

At Modern Treasury, we’re focused on partnering with our customers, banks, and the larger payments ecosystem to drive this next era of payments transformation. We’re building the best payment operations infrastructure to help our customers standardize bank integrations, orchestrate RTP and FedNow payments with a unified API, track and reconcile transactions in real-time, and manage cash liquidity with ease.

If you’re interested in learning more about how our customers are adopting FedNow and RTP, please reach out to our Payments Product Lead Ani Narayan at ani@moderntreasury.com. For more information on how Modern Treasury can help you modernize your payment infrastructure, reach out to us.