Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

Request-for-Payment (RFP) is essentially a messaging system paired with an instant payment. Using RFP, businesses can send bills and invoices directly to customers via mobile banking app. Once received, customers can also use the RFP to make payment for the invoice and share any relevant corresponding remittance information with the business. Currently, the ACH Network and the RTP Network both offer RFP. Upon its launch, FedNow will also offer an RFP option.

Using RFP, a business can send a bill directly to a customer using that customer’s mobile banking app. The customer can then approve and send the payment from their banking app in a single step.

RFPs can provide benefits for businesses, consumers, and financial institutions including:

- Allowing businesses to streamline their payment operations and increase customer satisfaction with quick, easy, and straightforward payments via RFP.

- Giving consumers higher visibility and control over their cash flow.

- Improving the overall payment experience for customers on both sides of a financial institution.

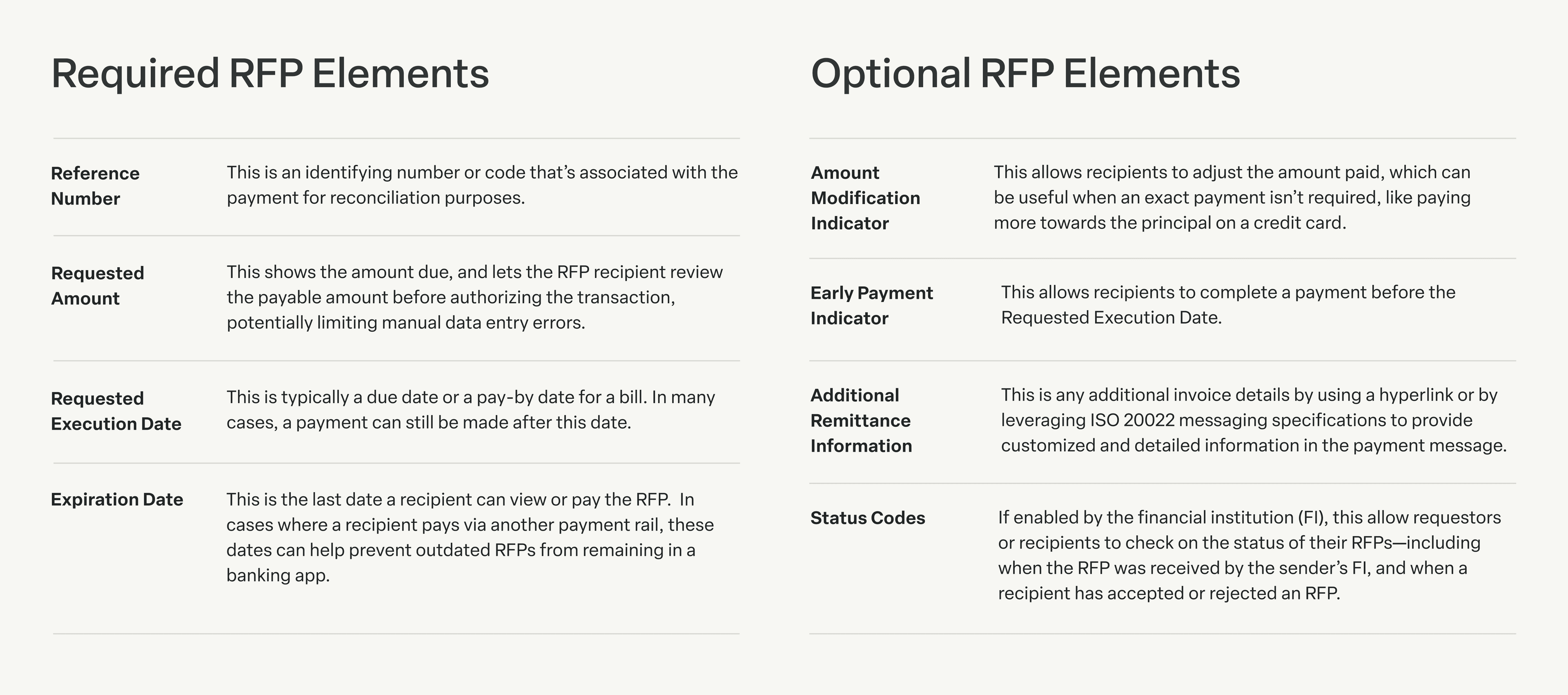

As an instant payment option, RFPs are very data rich. Though all instant payments include some form of data about a transaction—like account numbers and routing numbers—RFPs offer multiple ways to embed information about a bill or invoice within the transaction itself. These more detailed data points are helpful in creating a reliable record of the transaction for both identification to the recipient and reconciliation.

How does a Request for Payment (RFP) work?

Let’s look at one example of an RFP in action. Imagine that you run a coffee bean wholesaling business, called Coffee Beans For All. Let’s say you have a customer, Sandra, who regularly uses your service to buy beans for the coffee shop that she owns.

Each month when Sandra’s coffee bean order is ready, you create an RFP that includes identifying banking details for your company and for Sandra, the amount of her bill, and the requested payment date. Your bank will send the RFP to Sandra’s bank. She will then receive a notification (push, text, email, or all three) that her bill is due. She can then sign on to her mobile banking app, review the details of the RFP, and pay the bill right away or schedule it to be paid at a later date.

This is just one example of how RFPs could be used by a business. RFPs can also be used for wallet funding, e-commerce, person-to-person (P2P) payments, and point-of-sale payments.

Learn

Everything you need to know about the payment rails that power the world’s economy, from ACH and wires to RTP, FedNow, and more.

ACH credits and debits are two kinds of ACH transactions. Whereas a credit involves depositing, or “pushing,” funds into a bank account, for a debit, funds are withdrawn, or “pulled,” from an account.

The two kinds of financial institutions in the ACH network are ODFIs (Originating Depository Financial Institution) and RDFIs (Receiving Depository Financial Institutions).

US companies moving money internationally will likely weigh the pros and cons of SWIFT vs. Global ACH when it comes to attributes like speed and cost.

The Clearing House (TCH) is a banking association and payments company owned by 20 of the world’s largest commercial banks.

For business-to-business (B2B) companies, embedded payments integrate payment processing directly into software platforms

ACH (Automated Clearing House) is a payment processing network that facilitates electronic transfers between banks in the United States. It enables automated electronic debiting and crediting of checking and savings accounts. ACH payments work by batching transactions together, which are then processed at scheduled daily intervals.

A return is a credit or debit entry initiated by the Receiving Depository Financial Institution (RDFI) that returns a previously originated payment to the Originating Depository Financial Institution (ODFI).

ACH return codes identify the reason an ACH payment was returned by the recipient's bank. They make it easier to spot and resolve payment failures.

An ACH reversal refers to an erroneous ACH payment that a payment originator requests to take back, or reverse.

Payment rails are the underlying systems and networks that facilitate the movement of funds between parties in financial transactions.

Pix is Brazil’s instant payment platform that launched on November 16, 2020. Created and managed by the Central Bank of Brazil, Pix enables fast payments and transfers at any time, year-round.

A Standard Entry Class or SEC code is a three letter code that describes how a payment was authorized by the consumer or business receiving an ACH transaction.

A SWIFT code, also known as a SWIFT ID or Bank Identifier Code (BIC), is a unique 8-11 character code assigned to a bank for SWIFT wire transfers.

SWIFT payments or international wires are global payments made through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network.

ACH (Automated Clearing House) is a payment processing network that’s used to send money electronically between banks and financial institutions in the United States.

The Clearing House Interbank Payments System, or CHIPS is the largest private sector USD clearing system for wire transfers.

Electronic check presentment (ECP) is the process of electronically submitting a check to a bank for payment.

An electronic funds transfer (EFT), also known as a direct deposit, is the digital transfer of money between bank accounts. As digital transfers, they reduce the need for manual input and paper documents.

FedACH is the automated clearing house (ACH) service of the Federal Reserve Banks.

Part of the FedACH system, FedGlobal ACH offers low-cost and efficient cross-border ACH payments.

FedNow is a new payment rail that enables faster bank payments for financial institutions of any size, in any community, 365 days of the year.

Fedwire Funds Services, commonly known as Fedwire, is a real-time gross settlement transfer system that allows participating financial institutions to send and receive same-day fund transfers.

Fiat money is a form of currency issued by a government and declared legal tender, though not backed by a commodity.

Global ACH can help companies move money from US-domiciled accounts across borders using local rails. Learn how and when to use this payment rail.

The National Electronic Funds Transfer (NEFT) is a centralized payment system that facilitates transfers between certain bank accounts across India.

The National Automated Clearing House Association (Nacha) is responsible for overseeing the Automated Clearing House (ACH) Network, which is used to send money electronically between banks throughout the United States.

RTP (Real-Time Payments) is a payment processing network used to send money electronically between banks in the United States. It transfers funds between two bank accounts instantaneously and is available year round.

A Request for Payment (RFP) is an ACH Network message that can be used by businesses to send electronic invoices to their customers.

Same-Day ACH is an improvement to the ACH network that allows the processing of credit, debit, and return transactions several times a day.

Wire fraud is a serious criminal offense that uses electronic or interstate communications methods to defraud someone out of money or property.

A take rate refers to the fees online marketplaces (such as Amazon or eBay) or third-party service providers (such as PayPal) collect for enabling third-party transactions.

A wire transfer is an electronic payment made through a global network, allowing for fast, irreversible, foreign or domestic electronic money transfers.

ACH APIs enable companies with high transaction volumes to write software that automates payments over the ACH network.

An ACH credit refers to the process of electronically depositing, or “pushing,” funds into a bank account using ACH.

In an ACH debit, funds are electronically withdrawn, or “pulled,” from a bank account using ACH.

A Notification of Change (NOC) is used to notify the sender of an ACH payment to correct or change information related to a customer’s bank account.

A pre note or prenotification is a zero dollar payment to validate the account and routing details of a bank account before debiting or crediting it.

An International ACH Transfer—also known as Global ACH—is an ACH payment made cross-border from a US-domiciled account.

The issuer identification number (IIN) is the first eight or nine digits on a payment card tied to the financial institution that issued the card.

Originally known as Bankers’ Automated Clearing System (BACS), BACS Payment Schemes Limited clears and settles direct debit, BACS direct credit, and current account switch service in the United Kingdom.

The Bulk Electronic Clearing System (BECS) is a streamlined electronic payment method used to process low-value, bulk transactions in Australia and New Zealand.

The Faster Payments Service (FPS) is a banking service in the United Kingdom. The FPS was instituted in order to reduce payment times between accounts held by different customers.

The Single Euro Payments Area (SEPA) is a system of payment schemas that standardizes cashless transactions in euros.

Unified Payments Interface (UPI) is a real-time payments system for mobile applications designed and launched by the National Payments Corporation of India.