The two kinds of financial institutions in the ACH network are ODFIs (Originating Depository Financial Institution) and RDFIs (Receiving Depository Financial Institutions). Many banks are both, which means they can both send and receive ACH payments.

Every ACH payment needs an ODFI and RDFI to ensure that each payment request transmitted is completed and accurate. These financial institutions communicate through an ACH operator—The Clearing House or Federal Reserve—to complete entries on behalf of their customers, the originators and receivers, respectively. Originators and receivers can be consumers, businesses, or government agencies.

Both ODFIs and RDFIs need to be certified through Nacha to send and receive any payment request via the ACH network. Some financial institutions are only RDFIs, which means they cannot send ACH payments, only receive them.

Because they are certified, both ODFIs and RDFIs must adhere to financial compliance and controls, such as:

- Nacha’s Operating Rules

- Know Your Customer/Know Your Business (KYC/KYB) or Customer Due Diligence (CDD)

- Anti-Money Laundering (AML) controls

- Regulation E

How do ODFIs and RDFIs work?

The ODFI, acting on behalf of the originator, will send a payment request, or entry, to an ACH operator, such as the Clearing House. The entry will contain the following information:

- The name of the bank receiving the entry and it’s ABA routing number

- The type of account (i.e., checking or savings)

- The receiver’s name

- The receiver’s account number

The ACH operator will transmit the entry to the RDFI, who, acting on behalf of the receiver, will complete the request for an ACH debit or an ACH credit. They have 48 hours to complete the request; this is additional time given in the event that an ACH return code can be processed should an issue arise with the entry request.If the receiver and originator’s accounts are both at the same bank, the RDFI and ODFI are the same. In this case, the transaction does not need to go through an ACH originator to complete; it can go directly from one account to the other. This is called an intrabank, or “on-us,” transaction.

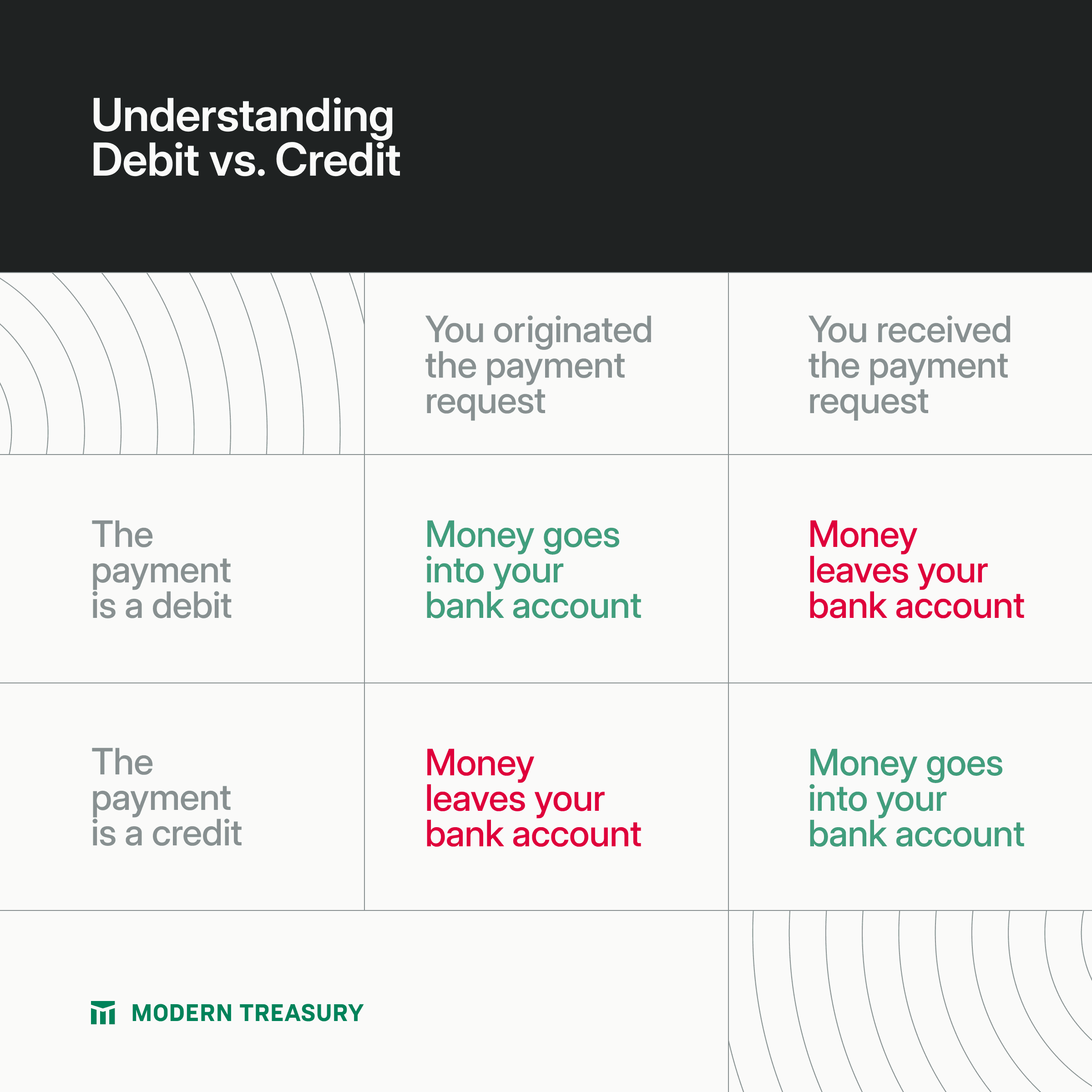

It’s important to note that “originator” does not always mean that money flows out of that account into a receiver’s account. Originators can submit a debit or “pull” payment, meaning they are requesting money be pulled from the receiver’s account to the originators account. Let’s look at an example of this.

Suppose St. Patrick’s Plumbing uses 4LeafClover’s CRM software to log their customer information for a monthly fee. St. Patrick’s Plumbing sets up an automatic bill payment, telling 4LeafClover to debit their account when payment is due. On the first of each month, 4LeafClover (the originator) tells their bank (the ODFI) to initiate a debit entry on St. Patrick’s Plumbing (the receiver) for the amount due. St. Patrick’s Plumbing’s bank (the RDFI) accepts the request for a debit and completes the payment to 4LeafClover. In this case, the originating bank had money flowing into their account.

As the chart above illustrates, the direction of money movement does not always flow from originator to receiver.

Learn

ACH (Automated Clearing House) is a payment processing network that’s used to send money electronically between banks in the United States.

ACH APIs enable companies with high transaction volumes to write software that automates payments over the ACH network.

An ACH credit refers to the process of electronically depositing, or “pushing,” funds into a bank account using ACH.

In an ACH debit, funds are electronically withdrawn, or “pulled,” from a bank account using ACH.

A Notification of Change (NOC) is used to notify the sender of an ACH payment to correct or change information related to a customer’s bank account.

A return is a credit or debit entry initiated by the Receiving Depository Financial Institution (RDFI) that returns a previously originated payment to the Originating Depository Financial Institution (ODFI).

ACH return codes identify the reason an ACH payment was returned by the recipient's bank. They make it easier to spot and resolve payment failures.

An ACH reversal refers to an erroneous ACH payment that a payment originator requests to take back, or reverse.

Credits and debits are two kinds of ACH transactions. Whereas a credit involves depositing, or “pushing,” funds into a bank account, for a debit, funds are withdrawn, or “pulled,” from an account.

FedACH is the automated clearing house (ACH) service of the Federal Reserve Banks.

Part of the FedACH system, FedGlobal ACH offers low-cost and efficient cross-border ACH payments.

The two kinds of financial institutions in the ACH network are ODFIs (Originating Depository Financial Institution) and RDFIs (Receiving Depository Financial Institutions).

A Standard Entry Class or SEC code is a three letter code that describes how a payment was authorized by the consumer or business receiving an ACH transaction.

US companies moving money internationally will likely weigh the pros and cons of SWIFT vs. Global ACH when it comes to attributes like speed and cost.

Payment rails are the underlying systems and networks that facilitate the movement of funds between parties in financial transactions.

ACH (Automated Clearing House) is a payment processing network that’s used to send money electronically between banks and financial institutions in the United States.

An electronic funds transfer (EFT), also known as a direct deposit, is the digital transfer of money between bank accounts. As digital transfers, they reduce the need for manual input and paper documents.

Global ACH can help companies move money from US-domiciled accounts across borders using local rails. Learn how and when to use this payment rail.

A Request for Payment (RFP) is an ACH Network message that can be used by businesses to send electronic invoices to their customers.

Same-Day ACH is an improvement to the ACH network that allows the processing of credit, debit, and return transactions several times a day.

A pre note or prenotification is a zero dollar payment to validate the account and routing details of a bank account before debiting or crediting it.

An International ACH Transfer—also known as Global ACH—is an ACH payment made cross-border from a US-domiciled account.