Finance in the Fast Lane: Payment Ops in the Age of AI

AI, automation, and instant payments are revolutionizing payment operations—driving efficiency, cutting costs, and creating real-time financial insights for modern businesses.

Behind the scenes of every business transaction lies payment operations. As companies juggle more banks and accounts, keeping everything running smoothly has become increasingly challenging.

Best-in-class payment operations depend on several key ingredients: seamless connections to banks, a central dashboard to see all transactions, smart automation that works for you, technology that spots unusual activity, and ways to connect payment data to your actual business needs.

We’re at an inflection point for payment operations: a perfect storm of automation, artificial intelligence, and instant payment networks are creating possibilities for smarter, faster financial operations.

Automation and AI: Transforming Payment Workflows

Automation and AI can give payment operations a major upgrade. These technologies are making real-time processing the new standard, eliminating manual tasks, boosting accuracy, and cutting costs throughout the entire payment journey—from initiation through reconciliation.

AI can help further by adding smart capabilities that spot patterns and flag unusual activities. With LLMs, much of these insights can be accessed through simple conversations. This creates a cycle of ongoing improvement and reduces the need for specialists.

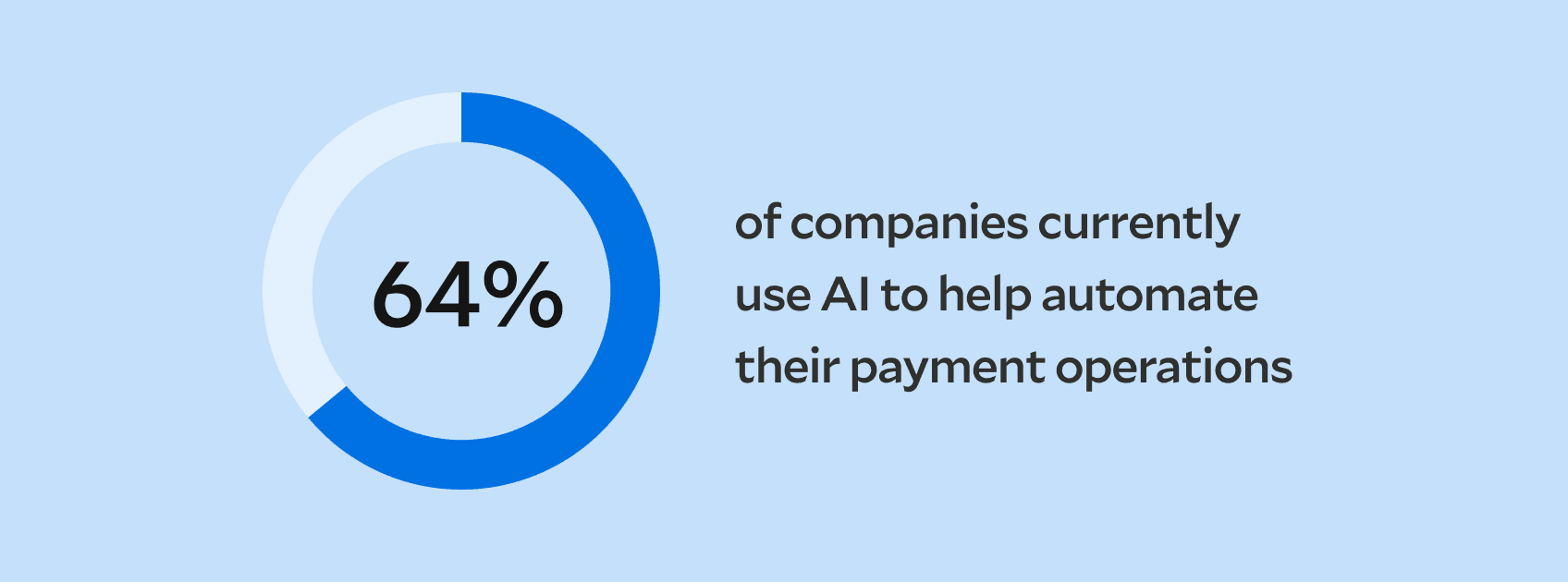

The numbers show this shift is well underway: our latest State of Payment Operations survey reveals that 64% of companies are already using AI to help payment automation, and 95% are either using or planning to use AI in their financial processes. The enthusiasm is clear, with 94% of businesses excited about how these technologies can transform their accounting and finance operations.

Some examples of AI for payment operations include:

- Proactive health monitoring that detects anomalies—like delays, duplicate payments, or liquidity gaps—before they disrupt operations.

- Intelligent reconciliation that auto-matches transactions using patterns from historical data.

- AI-powered execution of repetitive tasks, like payment retries and financial reporting, freeing up teams for more strategic work.

- Instant access to institutional knowledge through natural language queries about payment data, standard operating procedures, and business rules.

The Rise of Instant Payments

The evolution toward real-time operations is further accelerated by fundamental changes in payment rails themselves. Instant payment rails like Real-Time Payments (RTP) and FedNow are transforming the ecosystem by dramatically reducing processing times while lowering transaction costs.

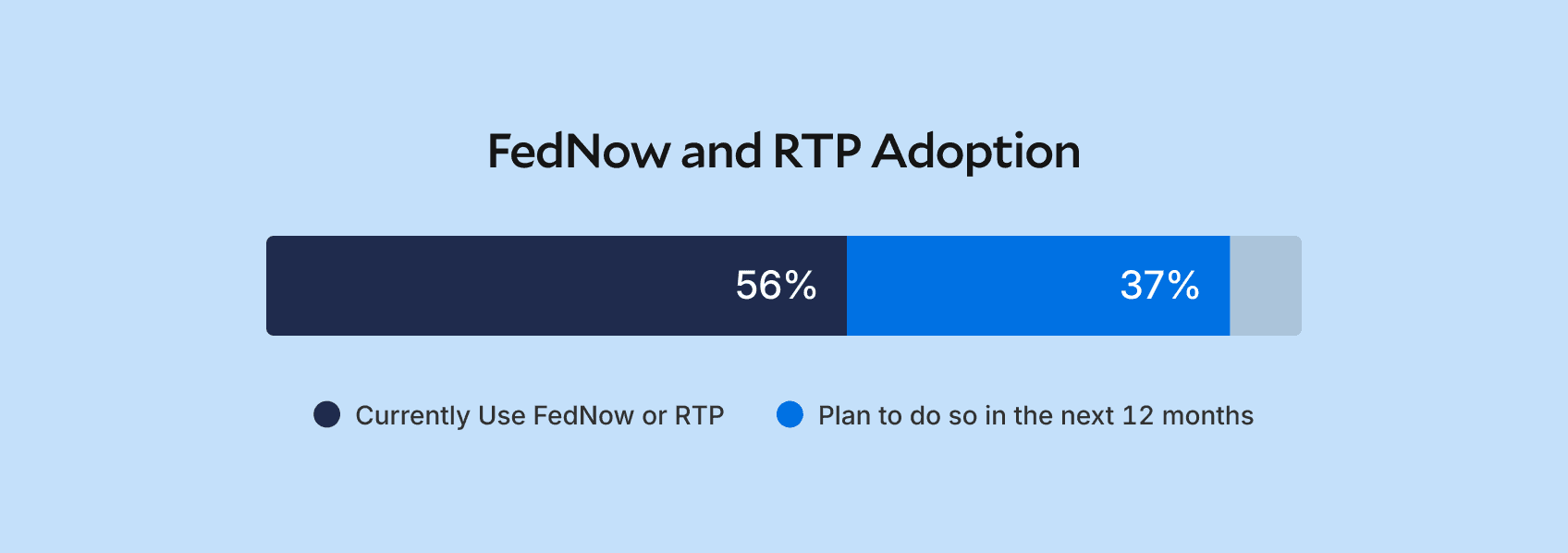

Adoption is accelerating rapidly, with 56% of companies already using FedNow or RTP and an additional 37% planning implementation within the next year. This transition is compelling organizations to modernize their infrastructure to support real-time processing and monitoring.

The operational implications are profound:

- Transaction cycles that previously spanned days now complete in seconds

- Customer expectations have evolved to anticipate immediate confirmation and funds availability

- Exception handling has become more complex and time-sensitive

- Cash flow management has transformed as instant access to funds changes how organizations optimize liquidity

- Cost reduction opportunities have emerged as instant payment rails typically offer substantially lower per-transaction costs

How AI Helps

These implications have direct business costs. If payments are 24/7, operations have to be, too, and the only efficient way to enable that is via AI and automation. Unless a business can afford round-the-clock teams to effectively handle issues, AI and automation are the tools they need to employ to make sure that their operations are tracking, managing, and reconciling their payments as they happen, in real-time, accurately.

Transformation in Action: Real-World Success Stories

Stewart Title: Modernizing a 130-Year Legacy

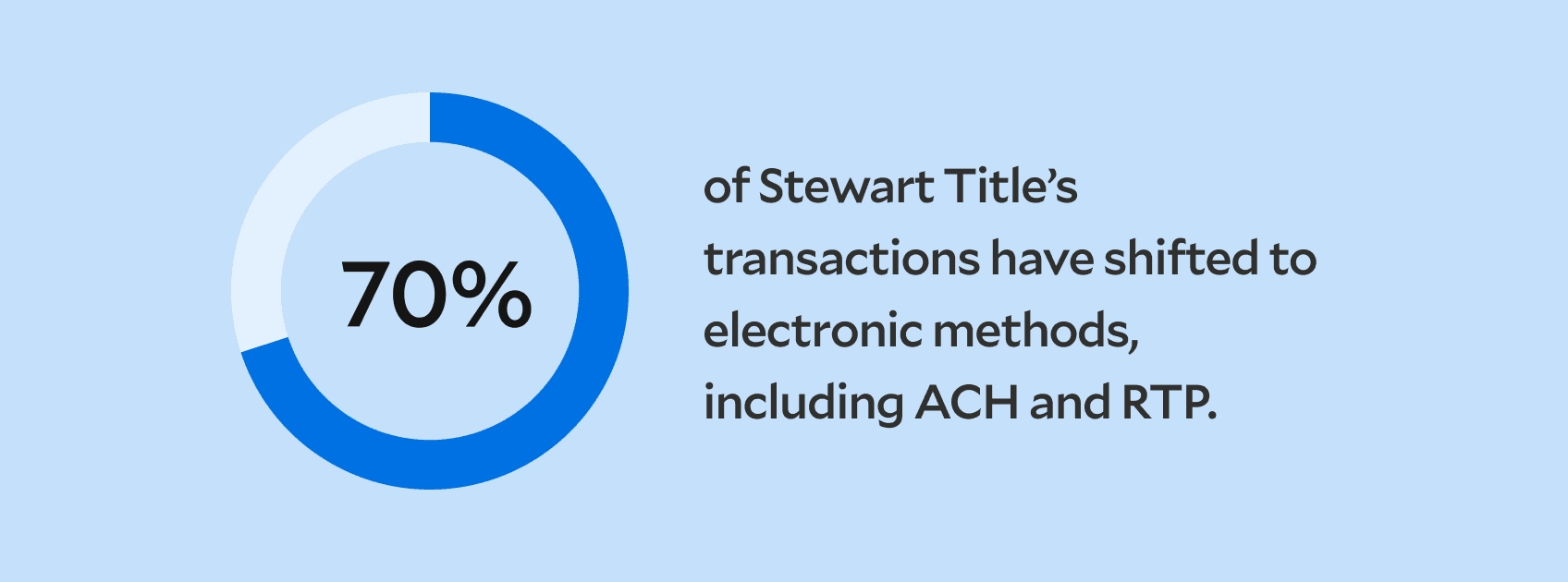

Stewart Title, a leading title insurance and real estate services company, faced significant operational challenges from outdated systems and heavy reliance on checks and wires. Their strategic initiative to transition 70% of transactions to electronic methods like ACH and RTP aims to reduce costs, mitigate fraud risks, and enhance customer experiences.

Anticipated benefits for Stewart include faster closing processes, more efficient electronic agent commission payments, and the potential for weekend closings—a significant competitive advantage in real estate. By implementing a unified platform for payment operations, Stewart Title is positioning itself as an industry innovator while improving service efficiency and security.

Alegeus: Transforming Health Benefits Management

Alegeus, a leader in health benefits management handling high transaction volumes across multiple banks, faced challenges with manual, batch-based reconciliation processes that proved inefficient and error-prone.

By implementing an automated reconciliation platform, Alegeus streamlined workflows and enhanced accuracy across its financial operations. This automation has driven substantial efficiency improvements while unlocking new growth opportunities. The company continues to expand its capabilities with advanced automation and AI features that support comprehensive digital transformation and enhance customer experiences.

Accelerating Your Payment Operations Transformation

Modern Treasury's payment operations platform provides the foundation for financial transformation through unified bank connectivity, centralized transaction visibility, and intelligent automation. By abstracting away the complexity of diverse financial networks, the platform enables organizations to work seamlessly across payment rails while maintaining complete visibility into transaction statuses.

For organizations embracing faster payment methods, Modern Treasury delivers the infrastructure needed to support real-time processing and monitoring, enabling immediate payment confirmation, accelerated reconciliation, and enhanced cash flow management—essential capabilities in today's evolving payment landscape.

To learn more about modernizing your payment operations and implementing real-time capabilities for your organization, get in touch.