Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

Pix is Brazil’s instant payment platform that launched on November 16, 2020. Created and managed by the Central Bank of Brazil, Pix enables fast payments and transfers at any time, year-round.

Brazil's central bank created the instant payment platform to diversify the country’s banking industry and foster healthy competition. Pix payments became ubiquitous in Brazil by October 2021, just a year after the system launched. In just over two years, Pix has been used by 122 million customers (just over half of the population).

With Pix payments, users can execute transactions in under 10 seconds (2.5 seconds, on average), even on weekends and holidays. The goal of the Pix payments system is to reduce cash transactions while providing alternative payment options to boletos, ATMs, and bank slips. Pix also enables faster payments that are more convenient, affordable, and secure than traditional payment methods.

Pix is unique because it doesn’t require acquirers, card schemes, or issuers. As an interoperable instant payments system, it works with all digital wallets. That means two people using digital wallets from different service providers can still transact in real time using Pix.

Pix uses a database called the Transaction Accounts Identifier Directory (DICT) to link Pix keys with each user's transactional account information. Pix relies on the Instant Payment System (SPI), which is the centralized infrastructure to settle instant payments between various payment service providers in Brazil.

How do Pix Payments work?

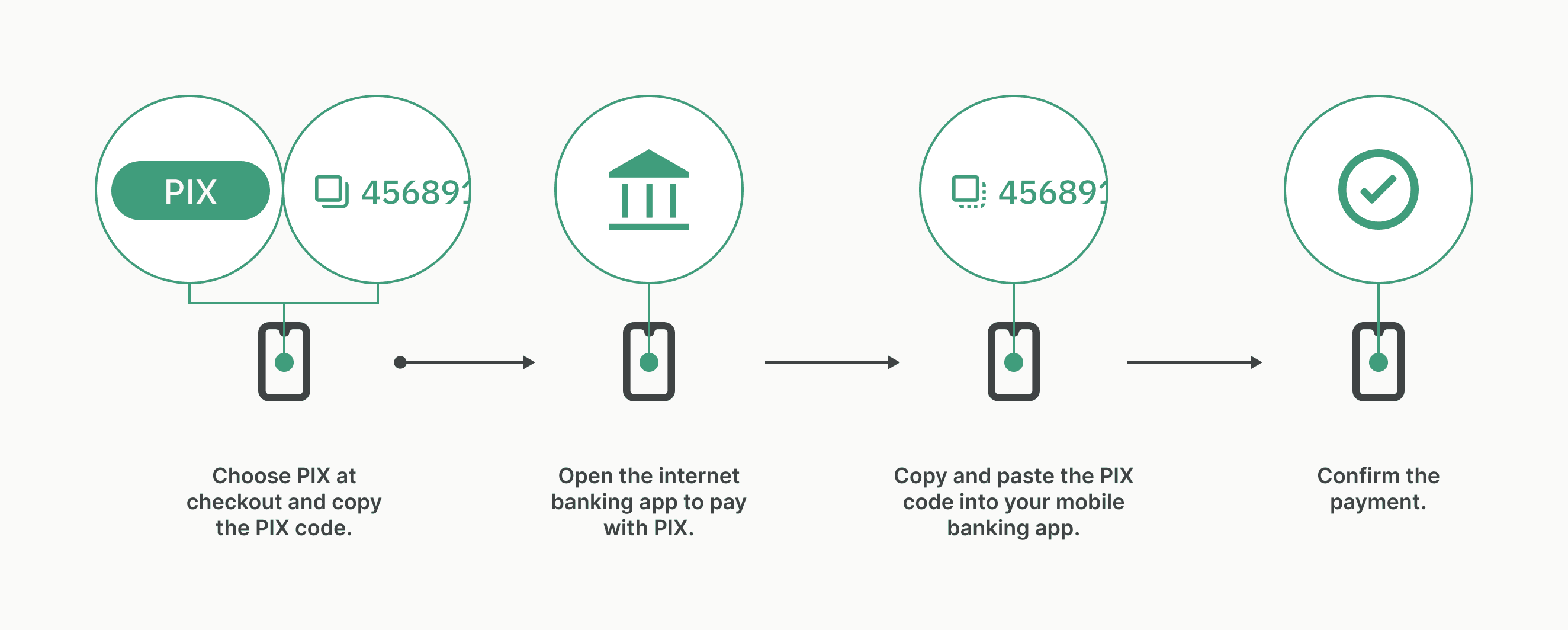

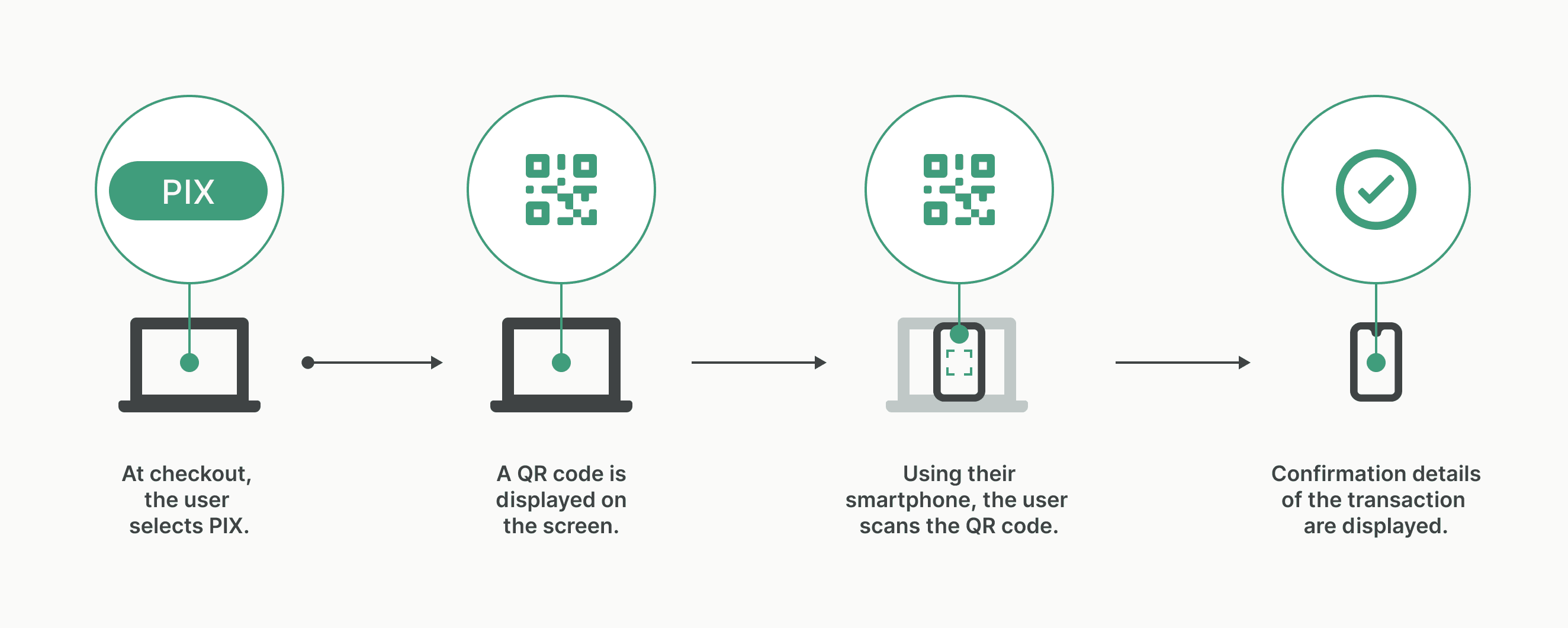

Pix makes it easy for consumers to send payments. Users simply select Pix on the checkout page, then scan, copy, and paste a Pix code into their digital wallets or use a smartphone to scan a QR code. Once a recipient’s information is confirmed, the user can complete the transaction.

To receive payments with Pix, users can generate a QR code or provide the payee with their address key. If a user (recipient) generates a static QR code, the recipient doesn’t need to include the transaction amount, but the payee must manually include the payment amount. With dynamic QR codes, the recipient must include the amount to be paid.

Pix is cheaper for businesses to use and widely available to users who do not need a bank account to initiate Pix payments. Users just need a digital wallet or similar service from a participating institution.

Since Pix payments are real-time payments, they can’t be canceled, but payees can request a refund from recipients. Transaction amounts can be changed, and transactions can be canceled if the payment has not yet been confirmed. The Central Bank developed a Special Return Mechanism to be used in special cases where fraud may have occurred.

What are the Benefits of Pix Payments?

Pix allows online merchants to collect funds in real time without the need for intermediaries. Instant payments also foster improved business relationships with suppliers, vendors, and contractors who also get paid instantly. Faster payments mean better cash flow, which improves operations for business owners.

Consumers can enjoy Pix at no cost to send and receive payments in real time. This has bolstered financial inclusion and access. The system’s full availability means transfers can occur at any time, regardless of whether banks are open.

Learn

Dive deep into Global ACH, SWIFT, and other international bank rails.

A Canadian EFT (or Electronic Funds Transfer) is a bank-to-bank transfer in Canada, similar to ACH in the US.

US companies moving money internationally will likely weigh the pros and cons of SWIFT vs. Global ACH when it comes to attributes like speed and cost.

ACH (Automated Clearing House) is a payment processing network that facilitates electronic transfers between banks in the United States. It enables automated electronic debiting and crediting of checking and savings accounts. ACH payments work by batching transactions together, which are then processed at scheduled daily intervals.

Pix is Brazil’s instant payment platform that launched on November 16, 2020. Created and managed by the Central Bank of Brazil, Pix enables fast payments and transfers at any time, year-round.

A SWIFT code, also known as a SWIFT ID or Bank Identifier Code (BIC), is a unique 8-11 character code assigned to a bank for SWIFT wire transfers.

SWIFT payments or international wires are global payments made through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network.

Part of the FedACH system, FedGlobal ACH offers low-cost and efficient cross-border ACH payments.

Global ACH can help companies move money from US-domiciled accounts across borders using local rails. Learn how and when to use this payment rail.

The Office of Foreign Assets Control (OFAC) is a financial intelligence and enforcement agency under the jurisdiction of the US Treasury Department.

TARGET Instant Payment Settlement (TIPS) was launched by the Eurosystem in November 2018 as a market infrastructure service that settles instant payments.

A stablecoin is a form of cryptocurrency created to maintain a consistent value by being linked to a reserve asset, such as a fiat currency (e.g., USD, EUR), a commodity (e.g., gold), or other digital currencies.

An International ACH Transfer—also known as Global ACH—is an ACH payment made cross-border from a US-domiciled account.

Originally known as Bankers’ Automated Clearing System (BACS), BACS Payment Schemes Limited clears and settles direct debit, BACS direct credit, and current account switch service in the United Kingdom.

The Bulk Electronic Clearing System (BECS) is a streamlined electronic payment method used to process low-value, bulk transactions in Australia and New Zealand.

The European Payments Council (EPC) is a not-for-profit organization that standardizes payments in the Single Euro Payments Area (SEPA). Through credit transfer, direct debit, card, and mobile payment schemas, the EPC aims to integrate electronic payments across Europe.

The Faster Payments Service (FPS) is a banking service in the United Kingdom. The FPS was instituted in order to reduce payment times between accounts held by different customers.

The Single Euro Payments Area (SEPA) is a system of payment schemas that standardizes cashless transactions in euros.

Unified Payments Interface (UPI) is a real-time payments system for mobile applications designed and launched by the National Payments Corporation of India.