Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

Valon Transforms Mortgage Servicing with Efficient, Programmatic Money Movement

Valon is a mortgage servicing technology company on a mission to empower every homeowner. The Valon team uses Modern Treasury’s UI and suite of APIs to oversee and automate complex payment flows at high volume across multiple banks and payment rails. Using Modern Treasury helps Valon improve efficiency and visibility, improve speed to market, and execute its mission.

Mortgage Servicing

ACH

Wire

Check

Book transfer

United States

to go live with Modern Treasury

moved per day

saved per new bank integration

At a Glance

- Because Valon’s product supports all stages of the end-to-end mortgage servicing process, the company manages a variety of complex fund flows at scale, requiring intricate, robust payments infrastructure.

- With Modern Treasury, Valon processes over $2 billion in monthly money movement, including hundreds of accounts at seven partner banks using four payment rails. Onboarding was easy, with Valon’s first bank connection live in ten weeks. Valon estimates that using Modern Treasury saves over three months in developer time per new bank integration compared to an in-house build.

- 65 Valon team members across technical and operations-focused departments use Modern Treasury’s APIs and dashboards to execute fund flows with standardized, transparent, and real-time transaction data. As the team looks to expand its offerings, the partnership with Modern Treasury holds even greater value.

About Valon

Founded in 2019, Valon brings simplicity, dependability, and humanity to homeownership. Valon reimagines the servicing industry’s antiquated technology and practices to empower homeowners and save them money, time, and energy.

Nuanced Payment Needs for Transactions at Scale

Valon executes an average of 800-1,000 payment orders per day, accounting for roughly $50-100 million in money movement. Transactions involve hundreds of bank accounts across seven banks, supporting four rails.

As Product Manager Dan Chen shares, this complexity isn’t exclusive to the product's backend. “We’re also interfacing with our customers, receiving and sending payments at scale across different payment methods, including checks—the money movement infrastructure required is complicated.”

Valon also operates in a strict regulatory environment. “Having real-time bank transaction data available and being able to programmatically move money is critical,” Chen says.

From a Swift Launch to Faster Integrations

Seeking to maximize available resources and increase speed to market, Valon’s founders sought out Modern Treasury as they prepared to launch. They wanted to set up an initial bank integration to serve their operational needs, with the ability to originate ACH and wires and receive checks via lockbox.

As Chen recalls, “In the beginning, we didn't fully appreciate the number of different types of banks Valon would be working with. But even leveraging Modern Treasury’s API to handle the integration for one bank was already something we felt was valuable.”

Valon’s first integration through Modern Treasury was up and running in under three months, setting the stage for five years of meaningful partnership and the movement of over $40 billion.

“Now, we work with multiple banks and multiple different types of accounts. Modern Treasury’s infrastructure allows us to scale how we connect to those different types of banks without worrying about the bank-specific integration details, ” says Chen.

Since launch, the team at Valon estimates developer time-savings of over three months per new bank connection by using Modern Treasury instead of a proprietary build. Considering the six additional banks Valon has onboarded with since launch, this amounts to a potential savings of roughly 21 months (over 15,000 hours).

One Central Source of Truth, with Robust Controls

Today, Valon has 65 Modern Treasury user accounts across two primary use cases. Chen says, “Our development team and engineers interact with the APIs and the Modern Treasury documentation and then build out how we use the APIs. The other users are mainly from our operations team who need transaction information to handle the complex and operationally intensive processes.”

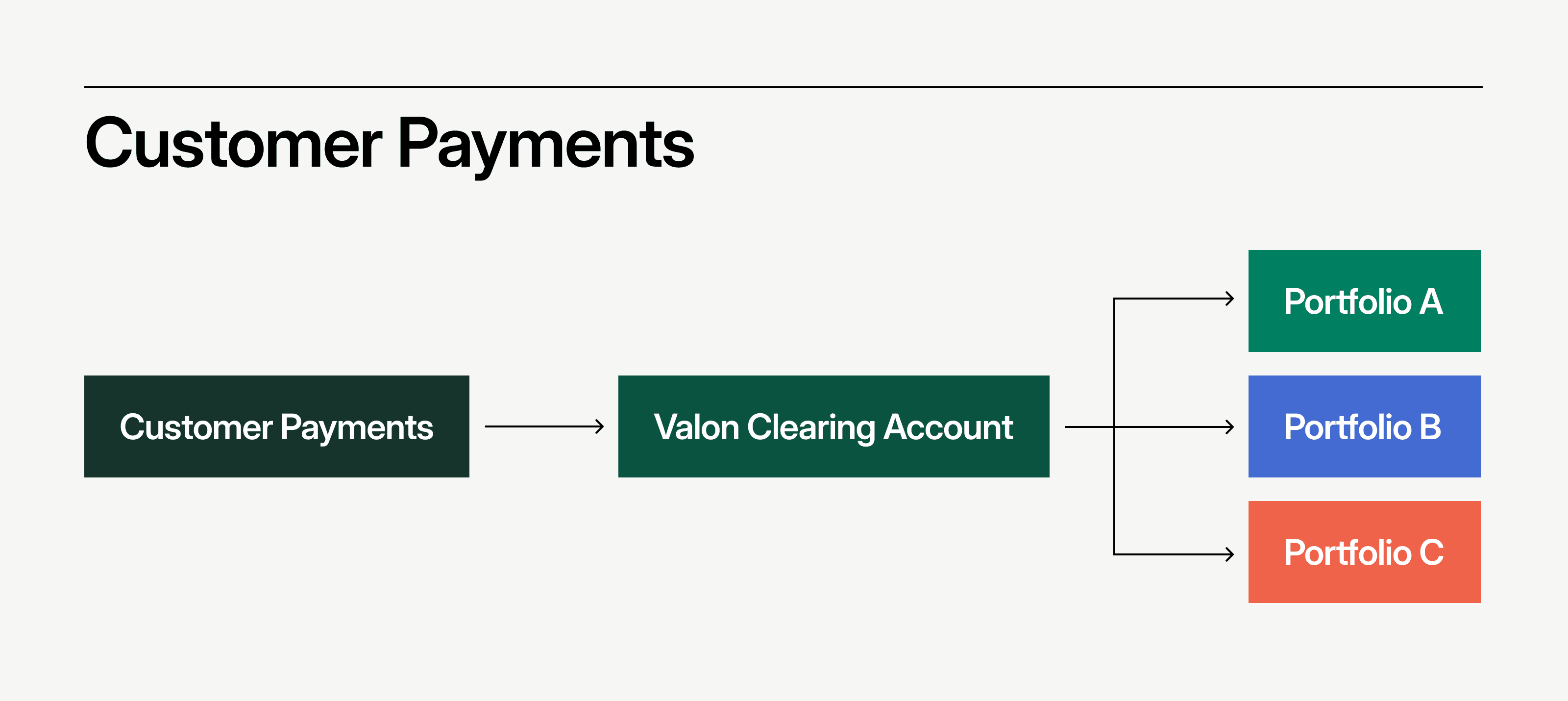

A closer look at the payment flows managed by the operations team demonstrates the complexity of money movement at Valon. The payments team manages customer payments. Once customer funds settle at Valon, they are identified and moved into accounts that correspond to the various portfolios that the loan is associated with.

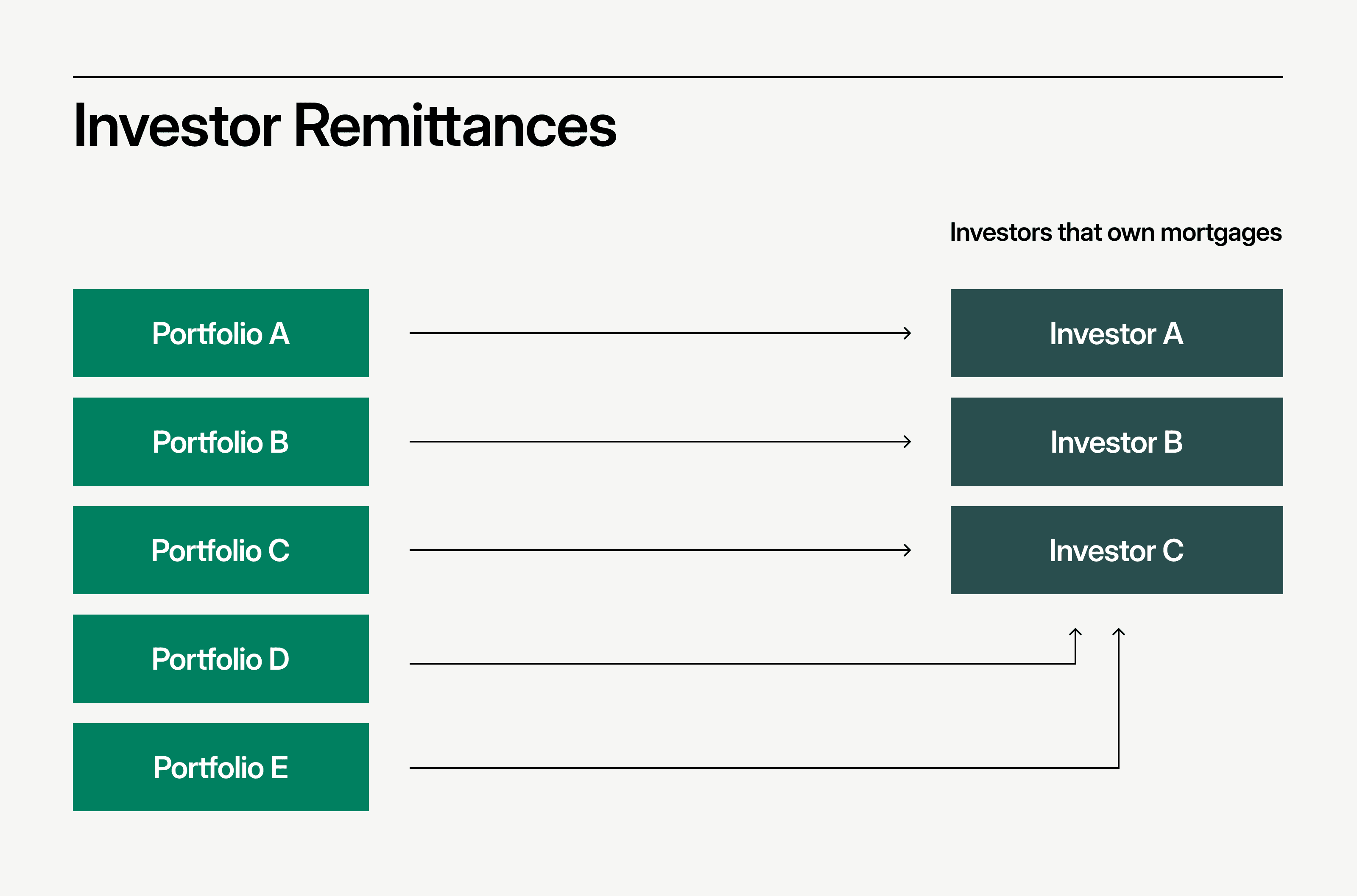

The investor reporting team manages investor remittances, wherein funds are remitted to investor accounts.

Valon also manages escrow accounts on behalf of homeowners, with payments that flow to homeowner accounts and payouts designated for insurance providers and tax authorities.

As Chen puts it, “There’s a lot of money coming in and a lot of money going out. By leveraging Modern Treasury, we have one place where all that money movement is tracked. Our operations team can use Modern Treasury to see the status of all the fund flows they handle.”

“There’s a lot of money coming in and a lot of money going out. By leveraging Modern Treasury, we have one place where all that money movement is tracked. Our operations team can use Modern Treasury to see the status of all the fund flows they handle.” -Dan Chen, Product Manager, Valon

For Valon, the scale and complexity of this money movement warrants a robust set of rules and approvals.

“With so much money going out across these different processes, we need to ensure that disbursements are properly reviewed and go to the right places in the right amounts,” says Chen.

Valon has a team exclusively responsible for this process. They make sure approvals are in place, review the transactions that need to be reviewed, approve them, and then make sure things go out on time.

Notable Business Gains for Efficiency, Robustness, and Speed

Valon's single most significant business outcome of using Modern Treasury is greater efficiency.

Chen shares, “Because of this partnership, we can manage programmatic money movement across all our banks. Given the number of banks we work with and the number of payments we make, it would be incredibly difficult to do this without Modern Treasury."

Another significant business outcome for the Valon team is the transparency and availability of data.

“We appreciate having standardized transaction data across all our partner banks through Modern Treasury, which allows us to ingest data in a standardized way,” says Chen.

With Modern Treasury, Valon can process money movement in real time. Chen observes that the resulting granular, real-time data helps Valon guarantee robustness.

“Being able to ensure accurate reconciliation is essential. For example, tracking money movement from payment orders we send to when those transactions settle at the bank and funds come through to us is important,” says Chen.

Singular Expertise that Boosts Speed to Market

The technical expertise of Modern Treasury’s team is another value-add for Valon.

“As a technology company ourselves, working with another technology company is refreshing,” Chen says. “The team at Modern Treasury has great technical understanding, which comes through in how the product was designed and allows us to work together whenever we have a situation requiring a closer partnership to figure out. Our team values that we can lean on Modern Treasury in those types of discussions because it's not something we see from other vendors, especially one that’s so critical to how we operate our payments processes and infrastructure.”

Modern Treasury is a major support in speed to market. Valon appreciates the ability to set up new bank account connections significantly faster. “If we built a new integration ourselves, it would take several months of developer time. In terms of allowing Valon to get bank connections online for any new bank we weren't previously integrated with, Modern Treasury has helped us go to market there. Not to mention, being able to access new types of banks in a relatively quick timeline allows us to move faster and get new customers on board,” says Chen.

Valon also needs to take on new portfolios with existing customers, which requires setting up bank accounts through existing bank connections and allowing integration through Modern Treasury.

As Chen observes, “Using Modern Treasury saves us time, which allows us to focus on building or launching other types of products.”

Mission-forward into the Future

Valon’s mission is to empower users with modern technology that puts homeowners first. Modern Treasury is an essential part of this pursuit.

The Valon team sees many parallels with Modern Treasury in that Valon is also leveraging technology to operate in a more regulated, legacy space.“Using the best in modern products and technology—in the best way possible—unlocks Valon’s ability to achieve our mission. Using Modern Treasury is one of the best ways to leverage technology to achieve that mission,” says Chen.

Looking forward, Valon is excited to continue growing their existing business—and they anticipate that the scale of money movement will grow dramatically.

As Chen shared, “Leveraging Modern Treasury through all that growth is exciting for us because we’re able to take advantage of the benefits at an even greater scale, perhaps our greatest scale as a business.”

Valon is also looking to explore new loan products that will warrant different types of payments, as well as new bank accounts and, potentially, new banks.

“As Valon continues to grow, we’re excited about building our technology and platform to handle new products. We’re excited to continue partnering with Modern Treasury in this journey,” says Chen.